The Complete Guide to Credit Card Arbitrage

How to borrow at 0-3% and invest for double-digit returns using credit card balance transfers

Introduction

Recently, a reader named Evan asked the following question:

Can you talk a little more about how to get started doing credit card arbitrage, like the basics? I just discovered this and am still trying to get my head around how you get the cash from the cards to invest. I think you are supposed to charge your monthly expenses and then take that money you saved and invest it? Is that correct? Also, how does one go about getting all these credit cards without tanking your credit score and then getting denied by any more cards in the future? I have 2 credit cards with low limits, each around $2,500. Those won’t work. And do you need to get the checks from the card companies for this to work? Impressed by what you’ve done here, just want to know the initial details on how to get started. Thanks!

The fundamental principle of credit card arbitrage is simple: make money by using someone else’s money. You borrow at low promotional rates (0-3%) and invest in assets yielding higher returns (10%+). The spread is your profit.

Minimum Requirements

To begin effectively, I recommend having a cashable credit limit of at least $100,000. Below this threshold, the strategy may not make financial sense—you would invest too much time and effort for minimal returns.

Here’s the math: To generate $7,000 in profit from a $100,000 balance transfer, you need to earn a 10% return while paying 3% in borrowing costs. With smaller amounts, the absolute dollar returns diminish while the administrative overhead remains constant.

Part 1: How to Get Cash from Credit Cards

There are four primary methods to access cash from credit cards:

- Direct Deposit — Transfer funds electronically to your bank account

- Balance Transfer Checks — Write a check to yourself and deposit it

- Credit Balance Refunds — Overpay your card, then request a refund

- Balance Carry Over — Preserve cash by carrying a balance on purchases

Method 1: Direct Deposit

Request a direct deposit from your credit card to a bank account up to your total available credit. This is the most efficient method when available. The following banks offer this option:

Barclaycard

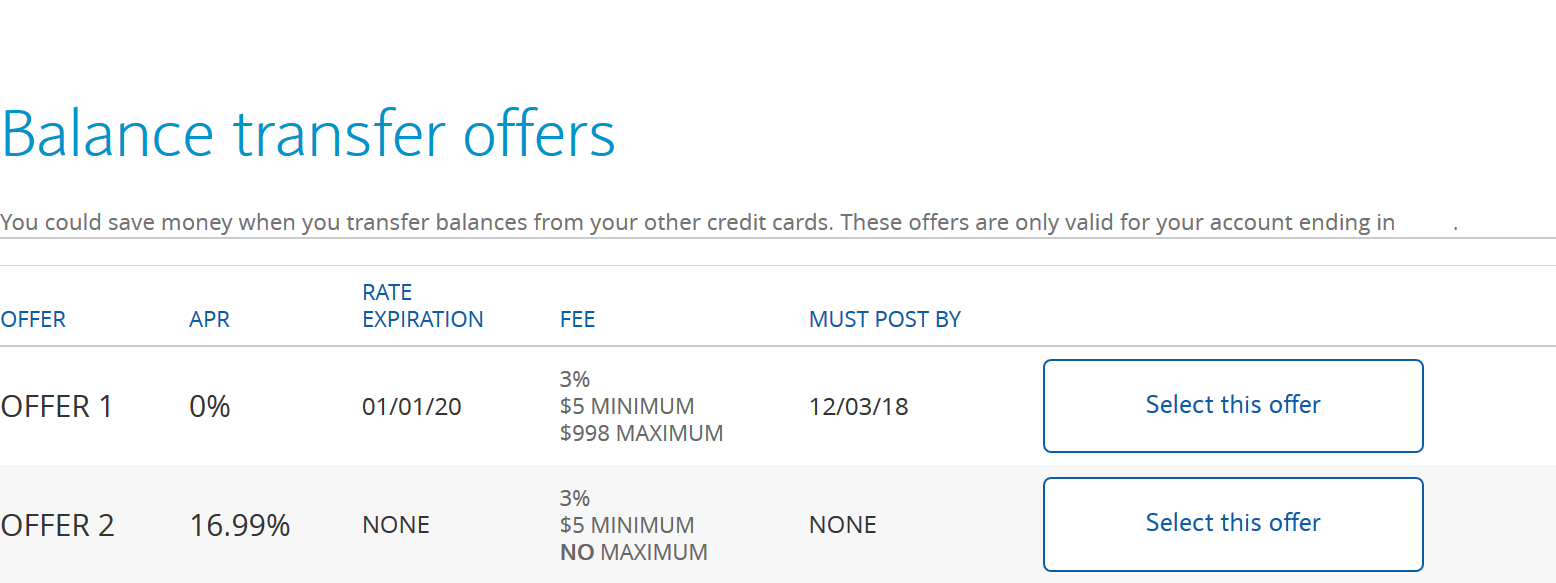

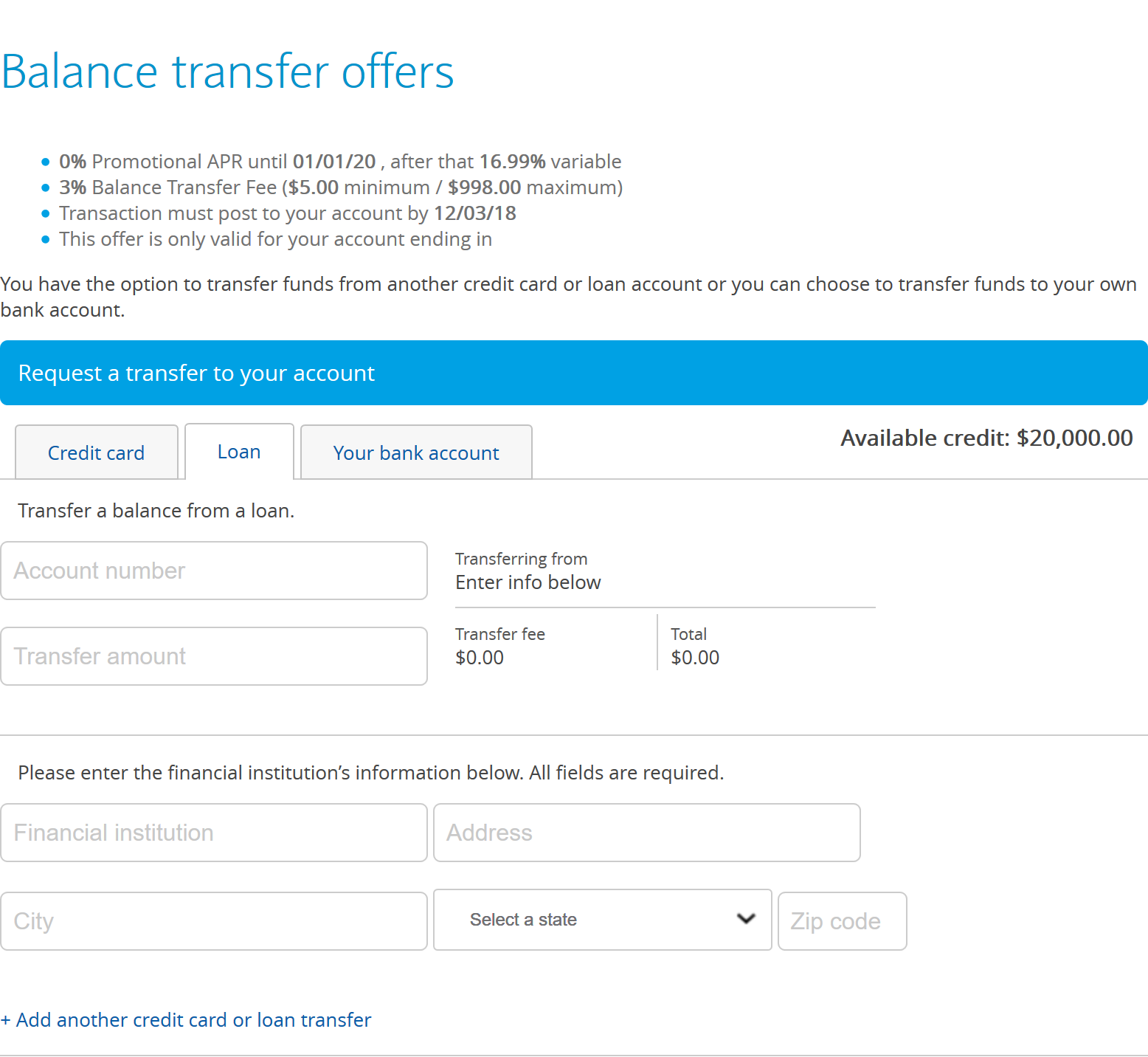

Navigate to Services → Balance transfer offers → Select this offer

Under the Loan tab, enter your bank account information. You can direct deposit to any bank account—you’ll need your bank’s deposit mailing address (e.g., PO Box 105576, Atlanta, GA 30348-5576 for Bank of America). Do not perform balance transfers to credit cards.

Processing time: 7-8 business days

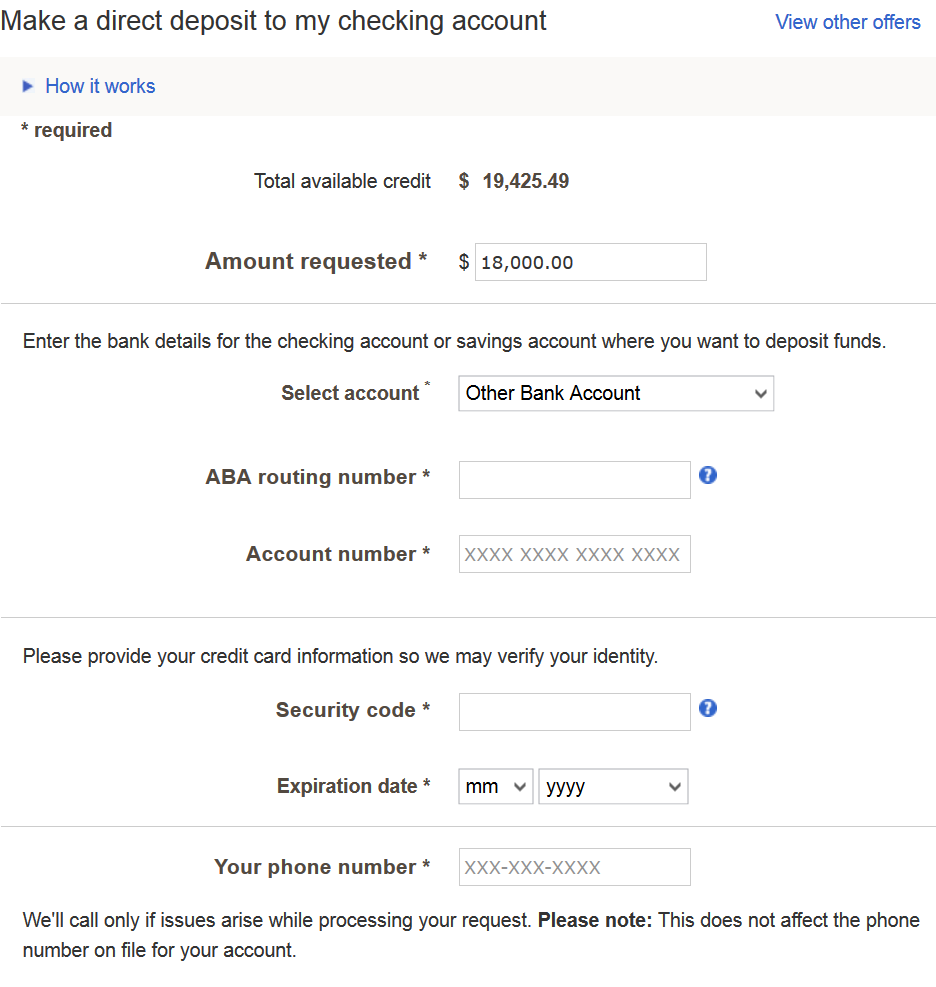

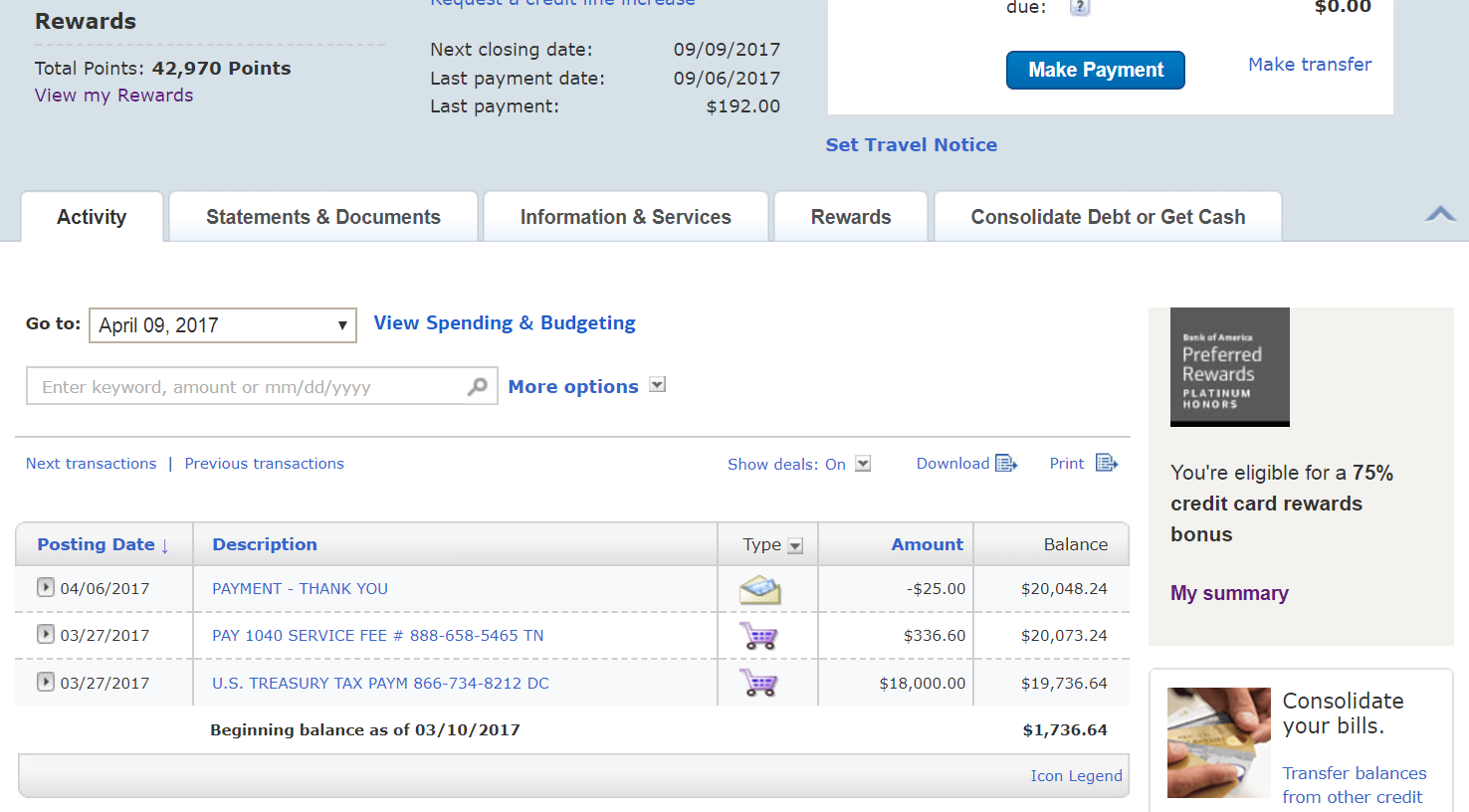

Bank of America

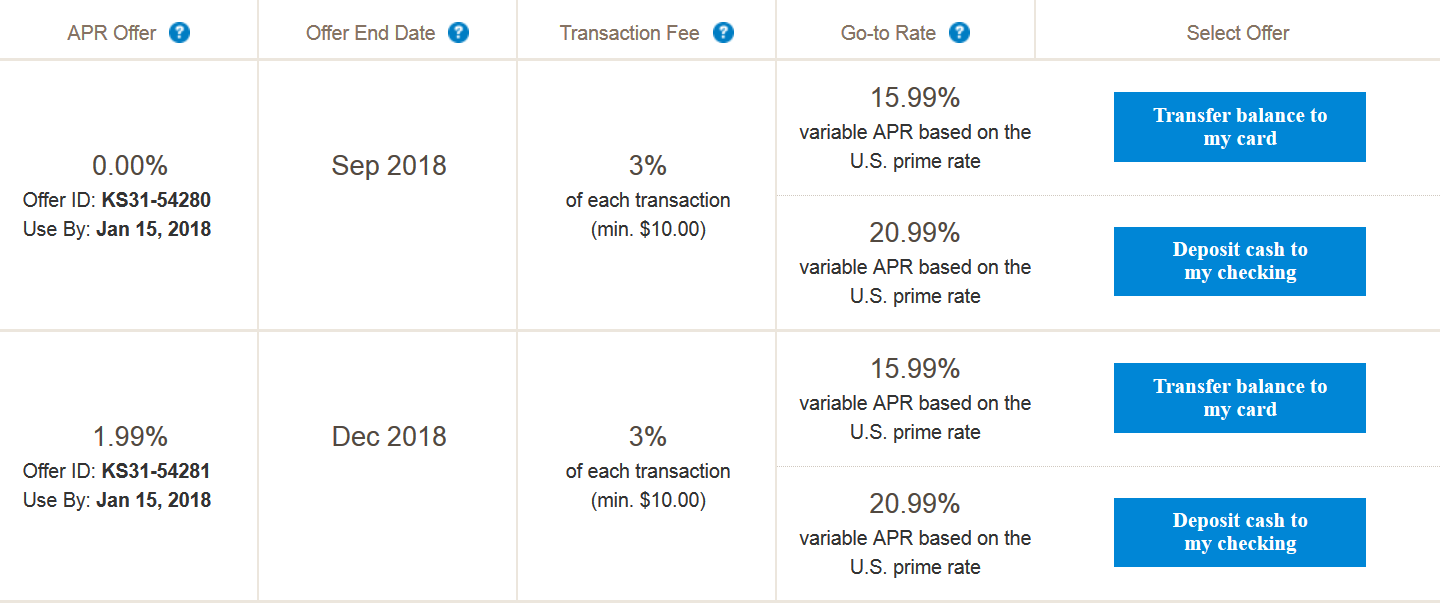

Navigate to Accounts → Credit Card account → Consolidate Debt or Get Cash → Deposit cash to my checking

Select Other Bank Account to direct deposit to an external bank account.

Important: Make sure you select a promotional offer, or the standard APR will apply to your balance.

Processing time: Next business day

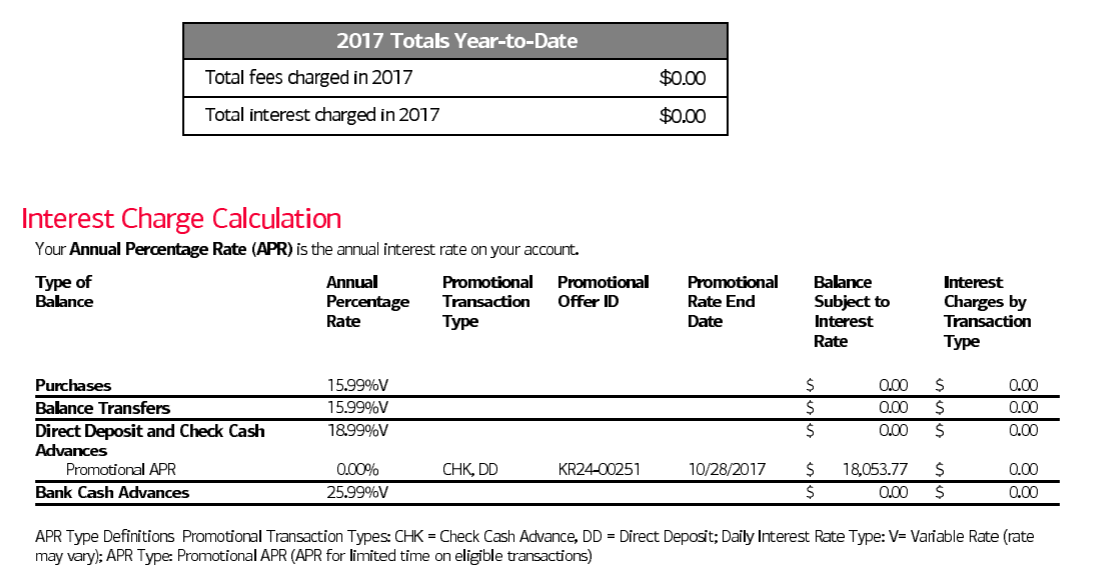

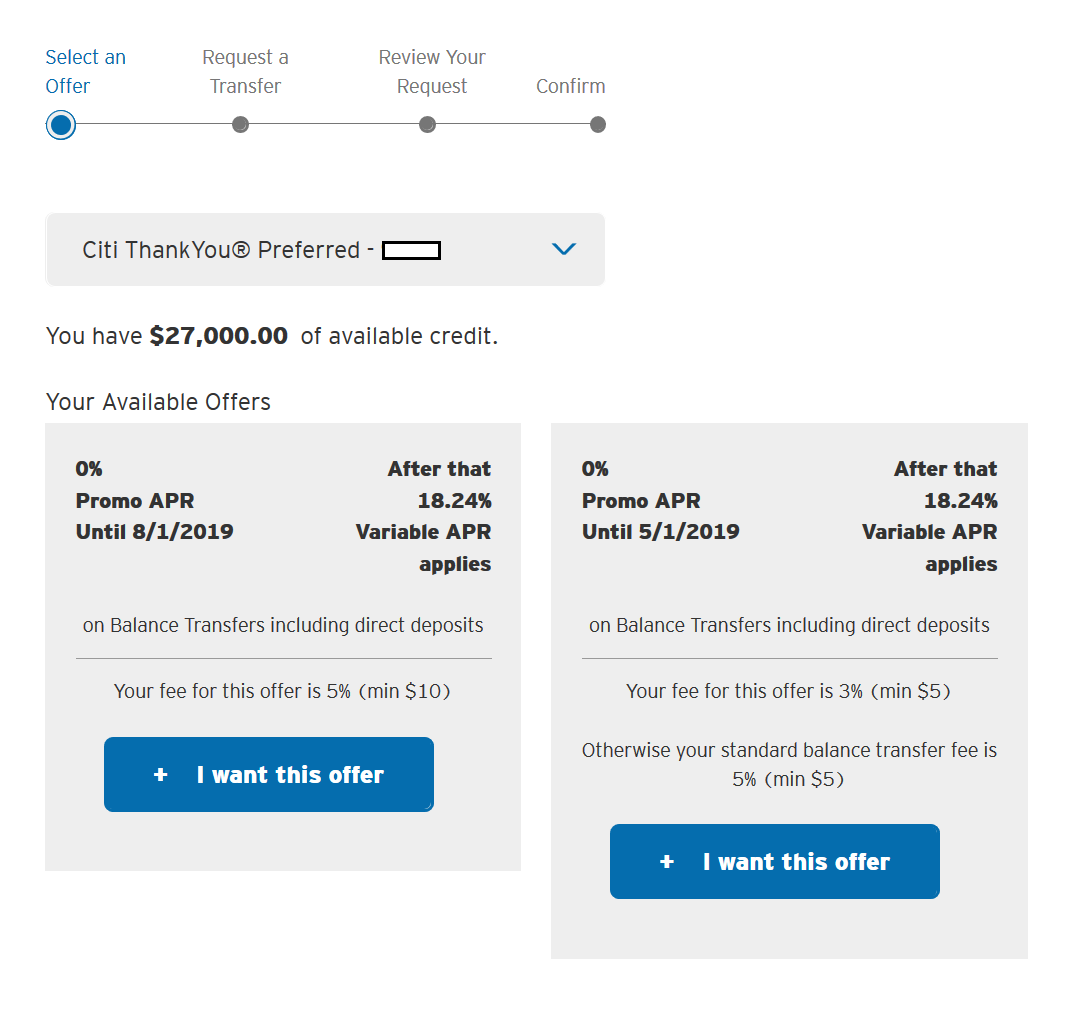

Citi

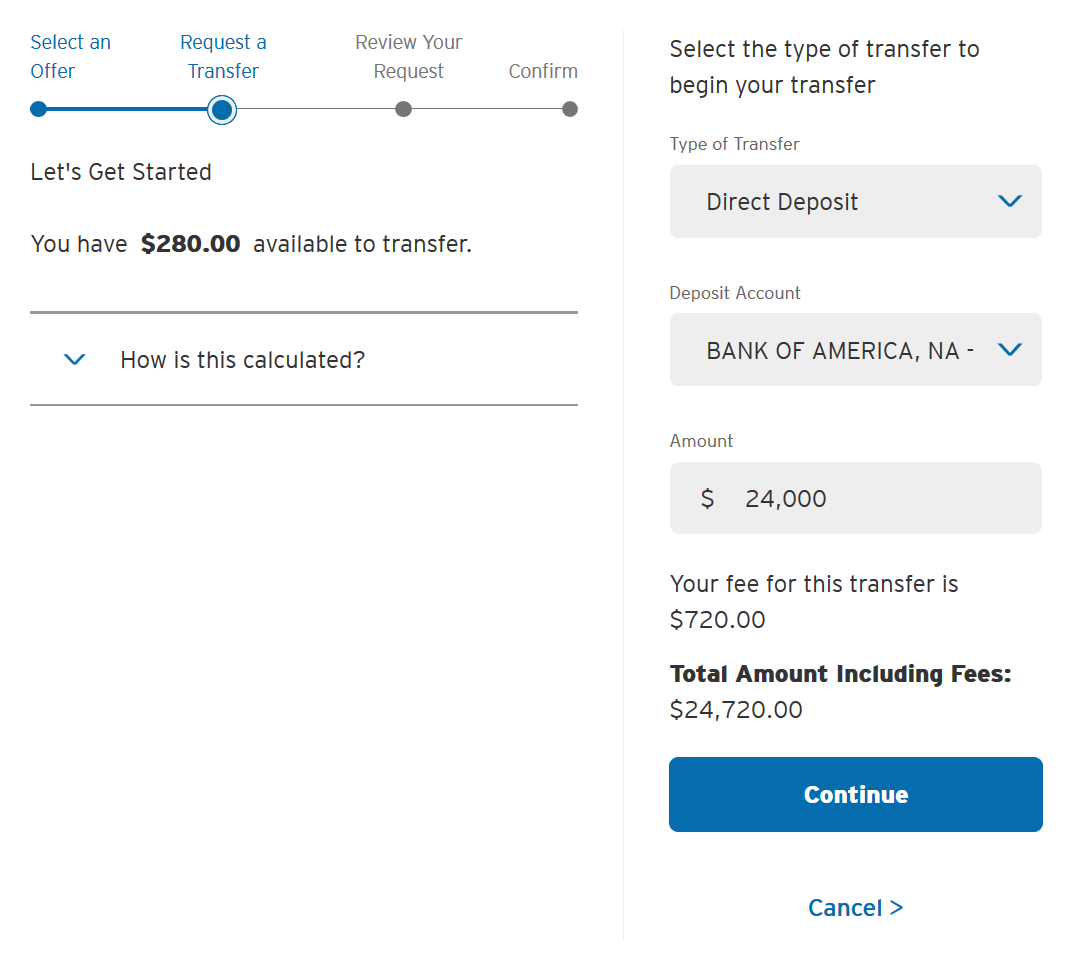

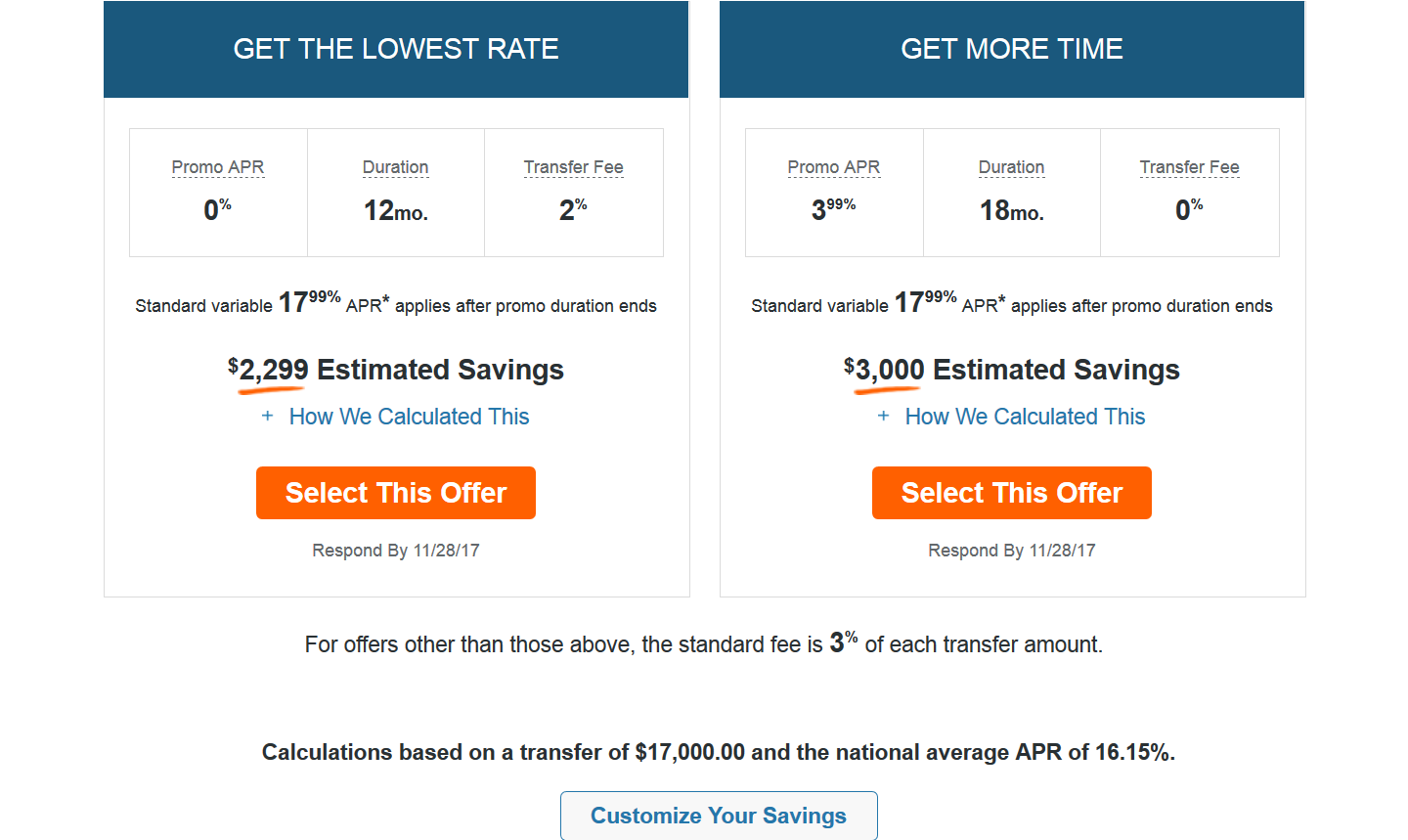

Navigate to Services → Credit Card Services → View Available Balance Transfer Offers. Select your desired offer and click Start your Transfer.

Choose Direct Deposit as the transfer option. You can direct deposit to a bank account that is set up for automatic payments. Select Continue to finalize the transfer.

Processing time: 1-2 business days (may extend if fraud alert is triggered)

Discover

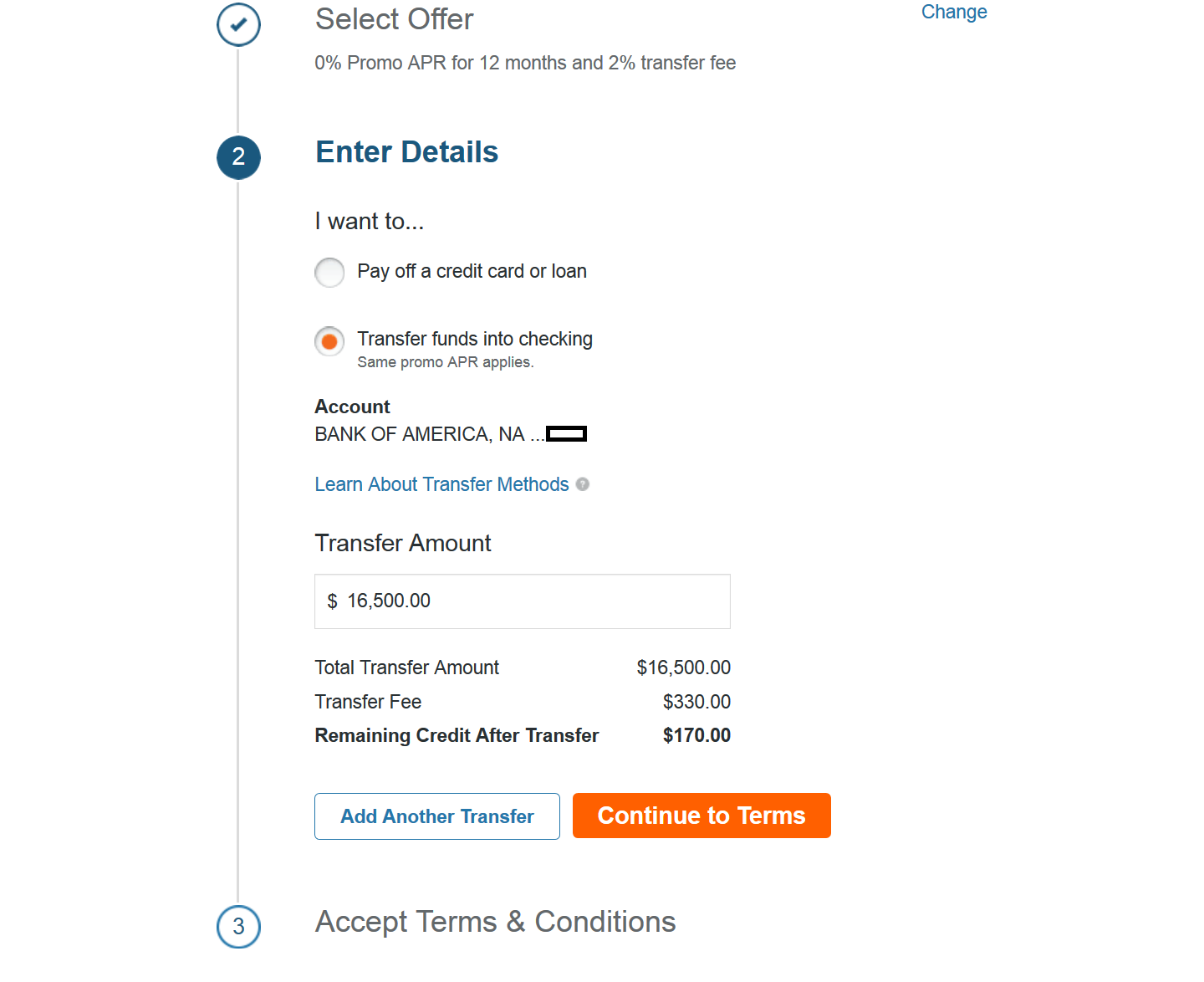

Navigate to Manage → Balance Transfer → Select This Offer

Select Transfer funds into checking. You can direct deposit to a bank account that is set up for automatic payments.

Processing time: 4 business days

Method 2: Balance Transfer Checks

You likely receive convenience checks from credit card companies regularly in the mail. Simply write a balance transfer check payable to yourself and deposit it into your bank account.

Chase

Chase rarely sends balance transfer checks. If you receive one, keep it for future use—they’re valuable.

U.S. Bank

Unlike Chase, U.S. Bank sends balance transfer checks frequently. Save them all.

Other Banks

Bank of America, Citi, and Discover also send balance transfer checks regularly. Since these banks offer direct deposit, the checks typically go straight to the shredder. Use direct deposit instead for faster processing and better tracking.

Method 3: Credit Balance Refunds

If direct deposit and balance transfer checks are unavailable, you can create a credit balance by overpaying your credit card using a balance transfer, then request a refund of the overpayment.

Warning: This approach is not recommended for large amounts. Requesting a large refund often raises suspicions of fraud. Banks may not release your funds immediately, and you may have to wait a month to receive a refund—this creates costly cash drag.

Zero-Fee Balance Transfer Refund Strategy

A better approach: Create a credit balance on your Citi or Discover credit card, then use no-fee balance transfer offers to direct deposit to your bank account. The transfer pays off your credit card balance before interest charges begin. I have successfully accessed over $100,000 using this method.

Citi Strategy

Discover Strategy

Method 4: Balance Carry Over

If your credit card is balance transfer unfriendly (e.g., American Express), the 0% Intro APR applies to purchases only (e.g., BankAmericard Travel Rewards), or the balance transfer fee exceeds 3% (e.g., Chase Ink Business Cash), it makes sense to spend and carry the balance to preserve cash rather than paying balance transfer fees upfront.

This strategy also works well when you expect sizable expenses in the near future (e.g., rent, federal tax). Sometimes you even earn a profit through rewards.

Part 2: Advanced Technique — Cross-Account Balance Transfers

For households with multiple credit profiles, cross-account balance transfers between partners can significantly expand your borrowing capacity and provide more flexibility in managing promotional periods.

How Cross-Account Transfers Work

Banks typically do not allow electronic funds transfers between different account owners, even among family members, unless the person is a joint account holder. However, they rarely verify the account owner of the target account. Most cross-account ACH transfers work without problems, except in rare cases where additional due diligence is conducted when transfer amounts exceed certain thresholds (e.g., $100,000).

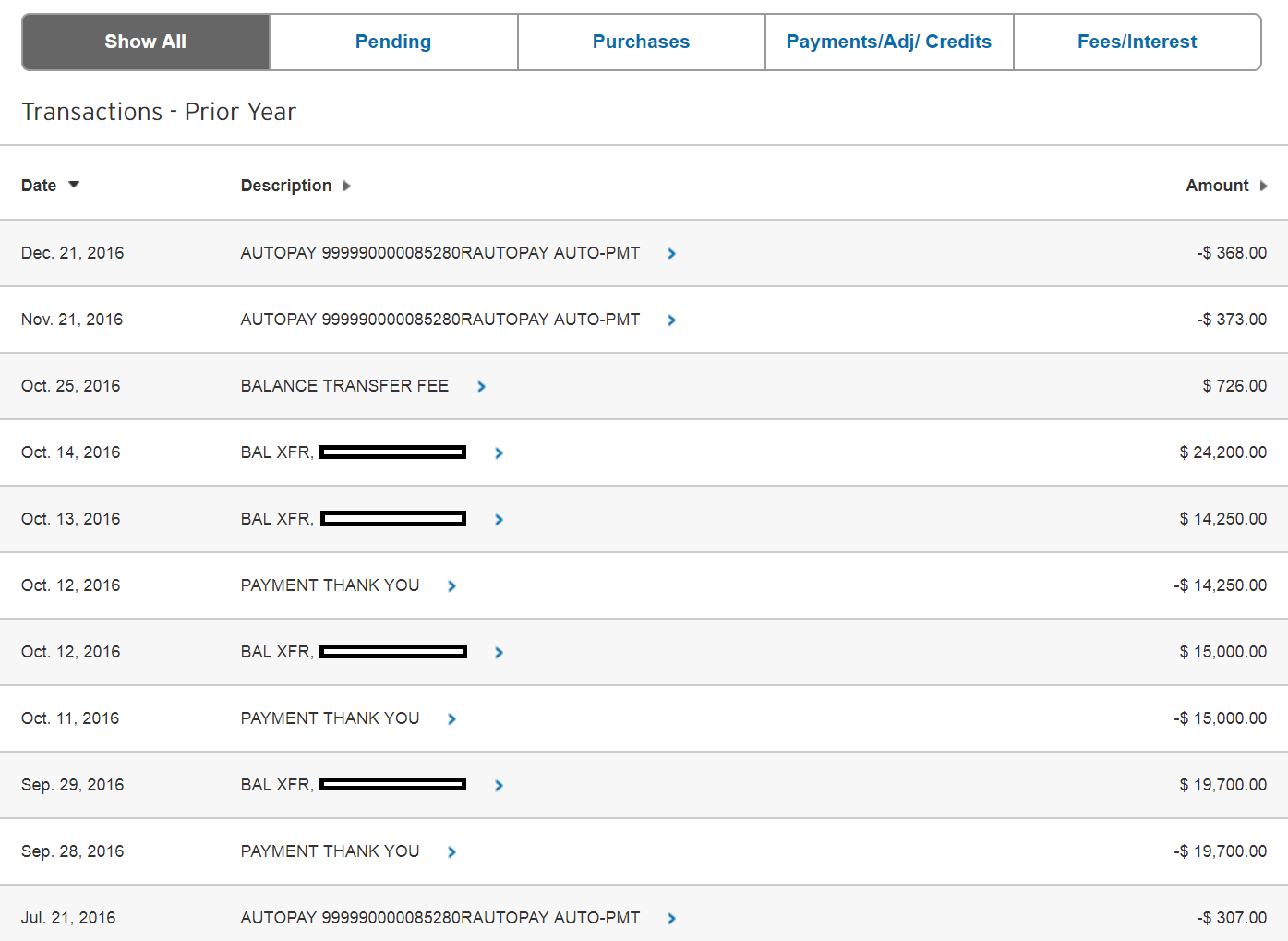

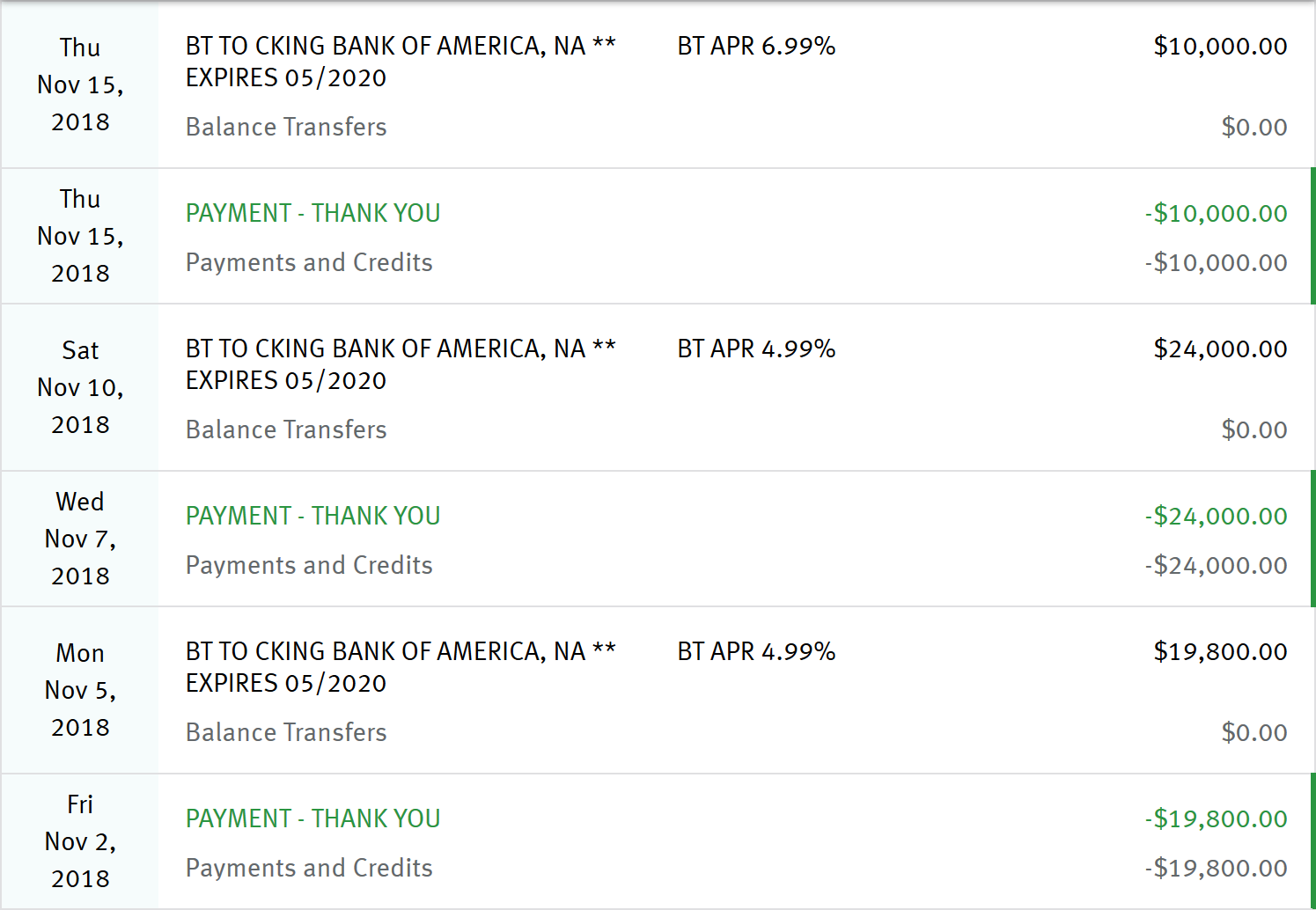

Verified Cross-Account Transfer Results

I have experimented with cross-account balance transfers between family members. Whether it was a balance transfer to another credit card, a direct deposit into a bank account, or a payment on a loan account, all transfers completed successfully:

| Source Card | Target Account | Amount | Method |

|---|---|---|---|

| Bank of America (Partner A) | Chase (Partner B) | $1,000 | Balance Transfer |

| Barclays (Partner A) | Chase (Partner B) | $1,500 | Balance Transfer |

| Chase (Partner B) | Citi (Partner A) | $14,250 | Balance Transfer |

| Chase (Partner B) | Citi (Partner A) | $15,000 | Balance Transfer |

| Discover (Partner C) | Bank of America (Partner B) | $18,000 | Direct Deposit |

| Chase (Partner C) | Bank of America (Partner A) | $11,400 | Balance Transfer |

| U.S. Bank (Partner A) | Bank of America (Partner B) | $17,000 | Balance Transfer |

| Alliant Credit Union (Partner A) | Bank of America (Partner B) | $16,000 | Balance Transfer |

| U.S. Bank (Partner C) | Alliant Credit Union (Partner A) | $16,541 | Balance Transfer |

| Discover (Partner C) | Bank of America (Partner B) | $23,700 | Direct Deposit |

Total verified cross-account transfers: $134,391

When to Use Cross-Account Transfers

This approach is recommended when both partners have $200,000+ credit limits and are investing in multi-year projects (e.g., commercial real estate, litigation finance). By swapping balances back and forth, you can extend promotional periods indefinitely and access higher total credit limits than either individual could achieve alone.

Part 3: How to Earn Double-Digit Returns

Once you successfully obtain capital from credit cards, there are several ways to generate double-digit returns with relatively manageable risk. The key is matching investment duration to your promotional period length.

Investment Options

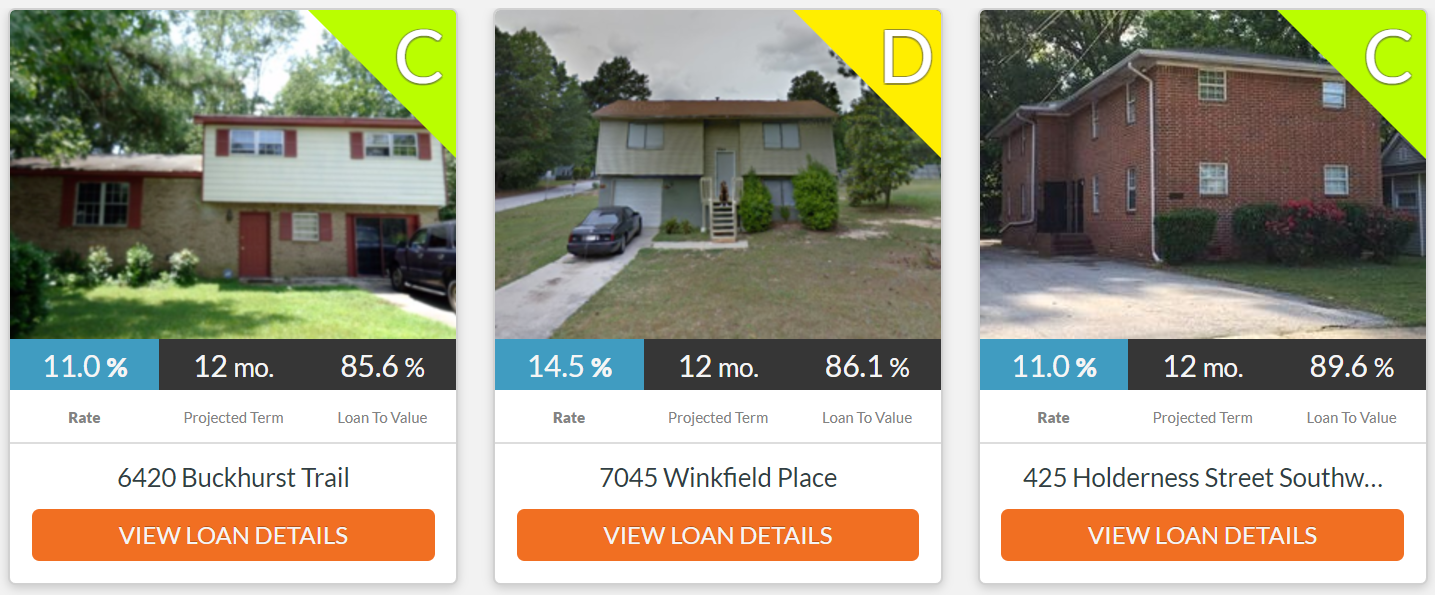

Groundfloor

Accreditation: Open to non-accredited investors

Minimum: $10 per loan

Terms: 6/9/12 months

Groundfloor is a real estate lending marketplace for fix-and-flip loans. Target Grade C (11%) or Grade D (14.5%) loans with terms that align with your promotional period.

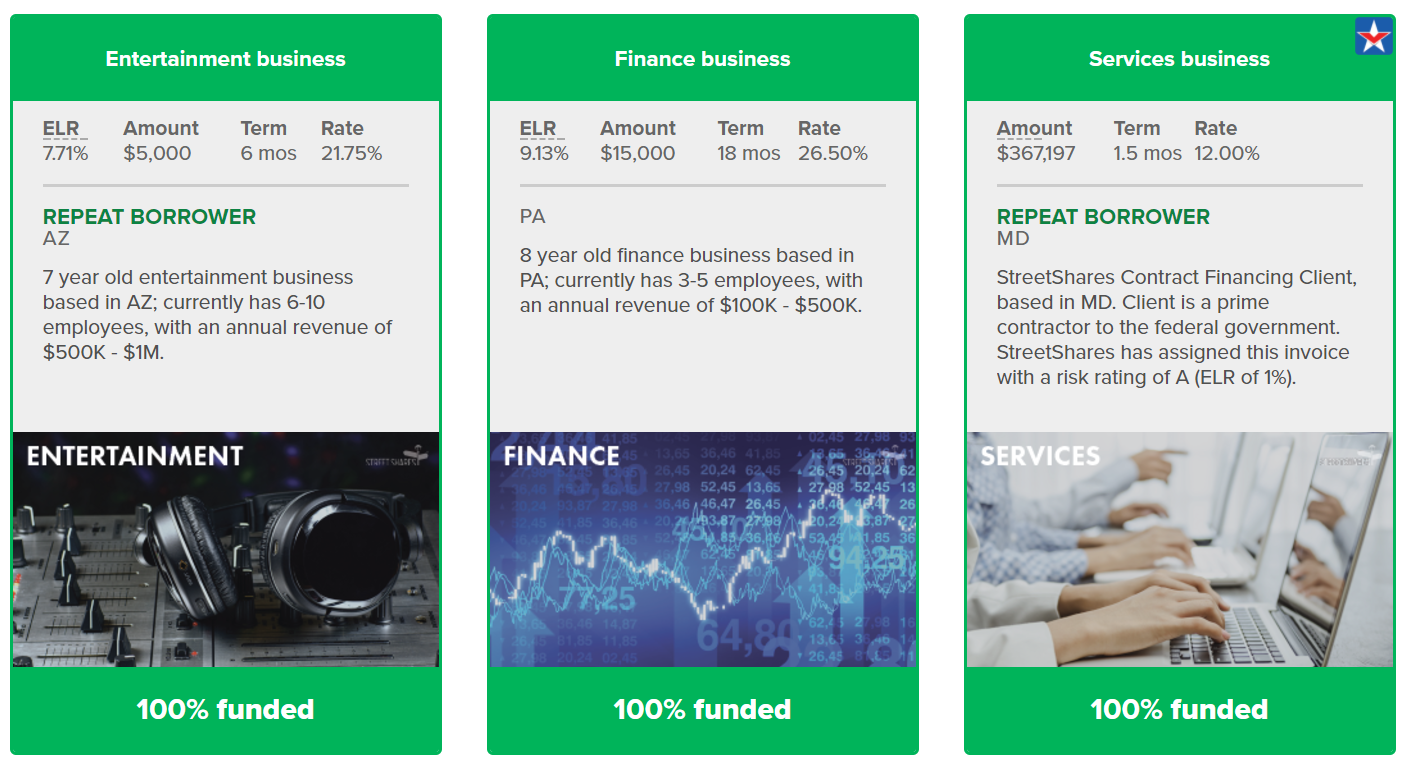

StreetShares

Accreditation: Self-accreditation (checking a box)

Minimum: $25 per loan

StreetShares offers term loans, lines of credit, and contract financing to veteran small-business owners. The government contract financing product is particularly attractive: short-term, high-yield, and secured by a government contract.

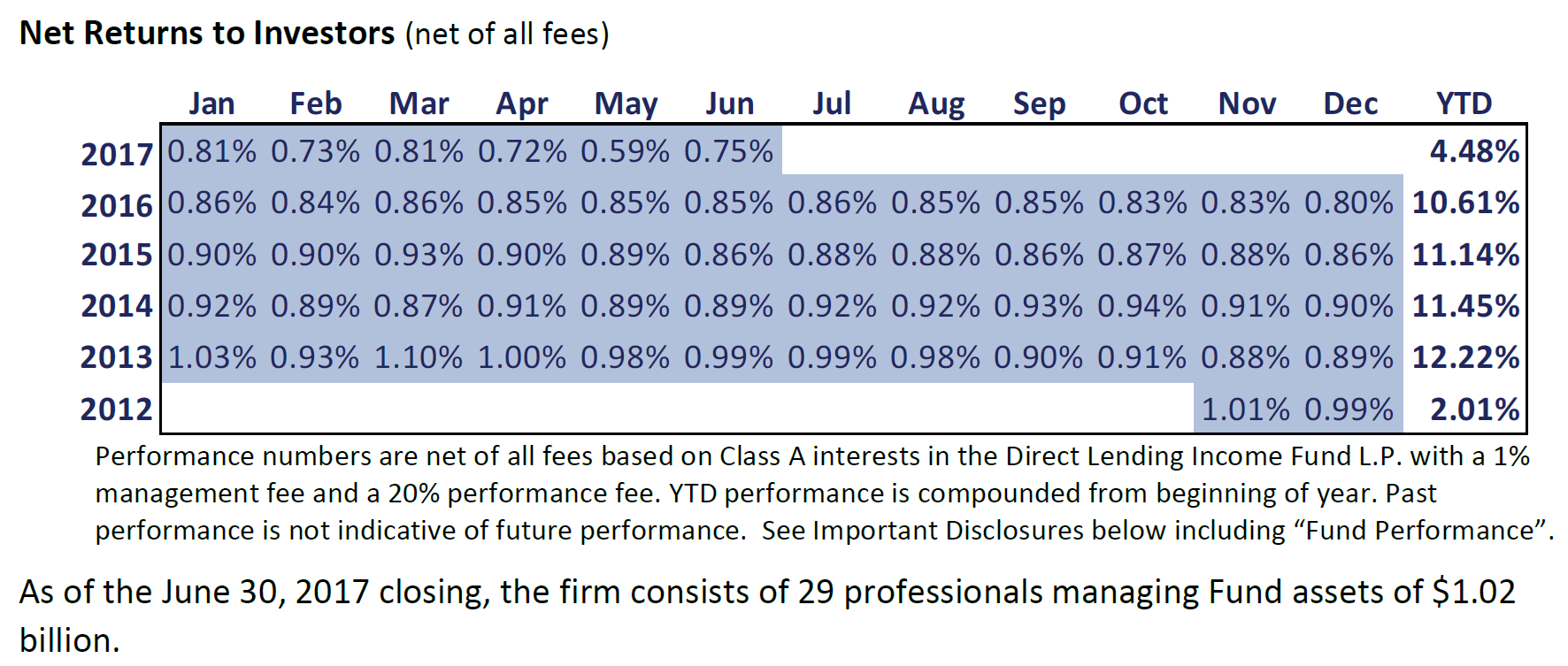

Direct Lending Income Fund

Accreditation: Self-accreditation (signing a document)

Minimum: $100,000

This fund serves as an excellent alternative to traditional savings accounts, delivering consistent returns over multiple years. It functions as my risk-free return benchmark.

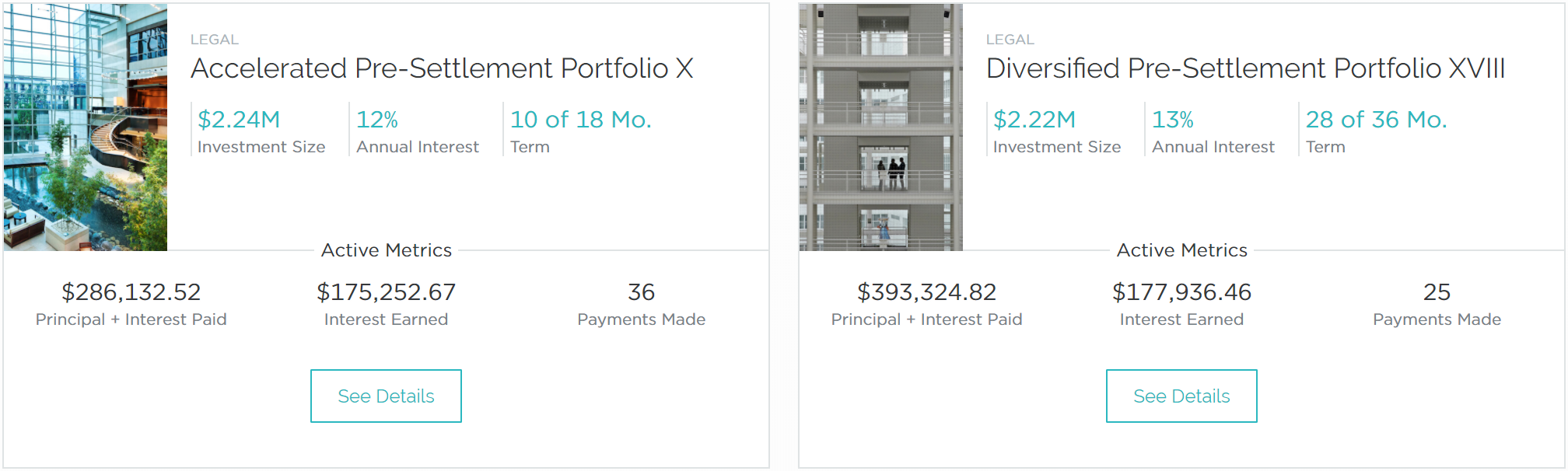

YieldStreet

Accreditation: Self-accreditation (request Third Party Verification and verify yourself)

Minimum: $5,000-$50,000+ depending on offering size

YieldStreet offers asset-backed investments across multiple categories. If you use cross-account balance transfers with your partner, multi-year litigation portfolios are ideal for maximizing the extended promotional periods.

Part 4: Leverage Everything

Credit card arbitrage is fundamentally about leveraging your credit. With this approach, 100% of your extra money goes toward investment and 0% goes toward debt repayment. No exceptions. This principle extends beyond credit cards:

Mortgage

If you are planning to buy a house, reconsider. If you absolutely must buy, ensure you put no more than the minimum down payment. With rates at historical lows, you should never prepay your mortgage—that capital is better deployed in higher-yielding investments.

Auto Loans

Zero-percent financing offers significant advantages. Avoid paying off your car loan early to maximize these benefits. Free leverage is valuable leverage.

Summary

| Component | Recommendation |

|---|---|

| Minimum Credit Limit | $100,000+ cashable |

| Best Cash Access Method | Direct deposit (fastest, most reliable) |

| Target Borrowing Cost | 0-3% (promotional rates only) |

| Target Investment Return | 10%+ (double-digit) |

| Advanced Strategy | Cross-account transfers with partner |

Last updated: January 2026

Wow, very helpful!! Thank you so much for taking the time and effort to explain some of the basics here. Obviously one must be EXTREMELY disciplined and ensure that you never miss one payment, as that will ruin your credit score, and eliminate your ability to keep building credit and getting more money. This is all very fascinating. Thank You!

Update: I have raised $55,000 in credit limits so far. I am however struggling with how to turn these credit limits into cash in my bank account. I don’t have a citi card yet, my application process has been delayed. I have: 3 BOA, 2 chase, 2 Barclaycard, 1 Discover, 1 Alliant, and 1 Capital One. BOA balance transfers seem easy to get into your checking account. Any suggestions for how to complete the rest? Thanks for any help!