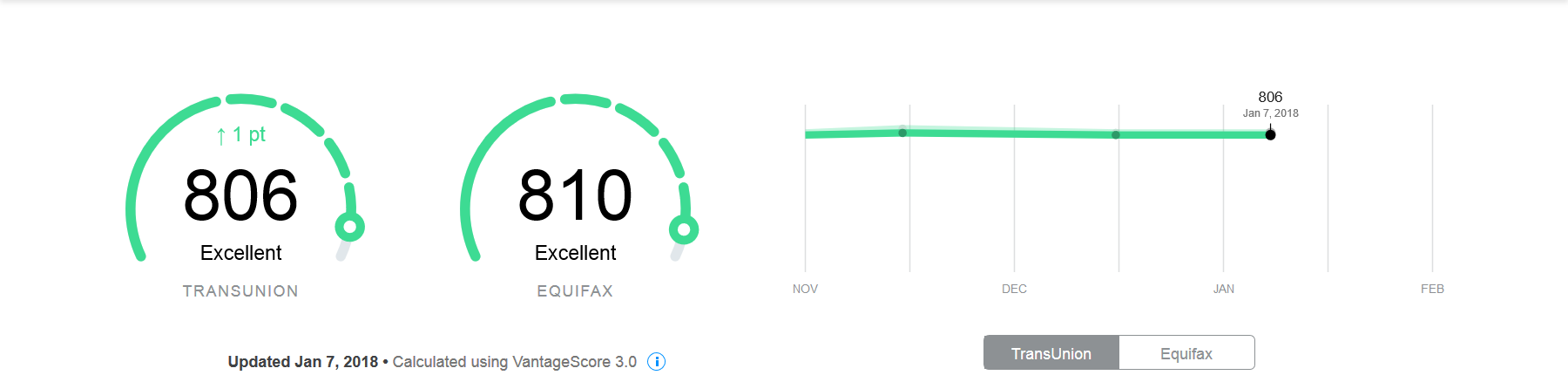

Credit Score

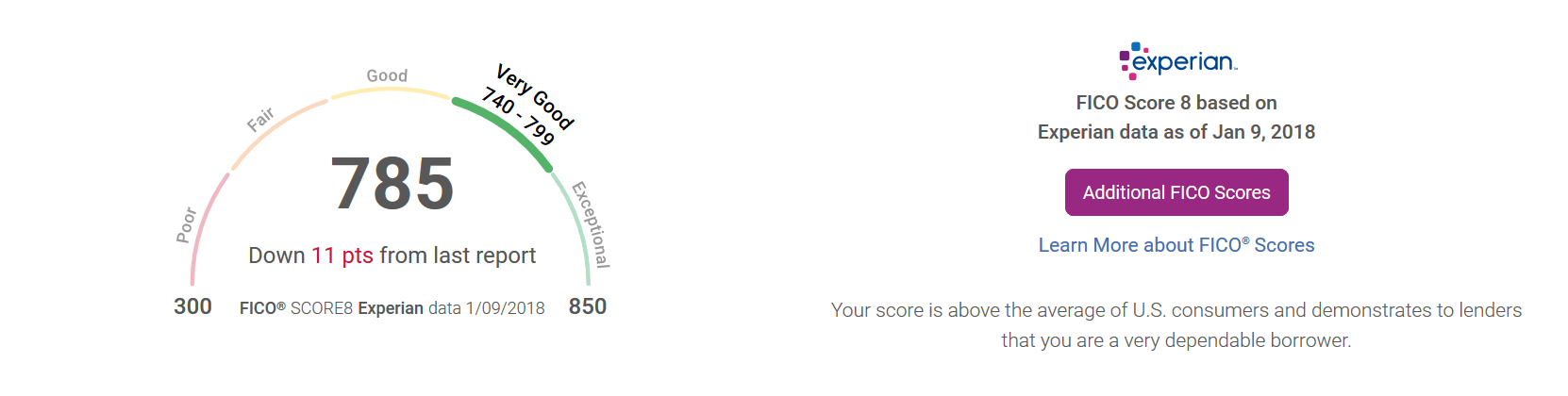

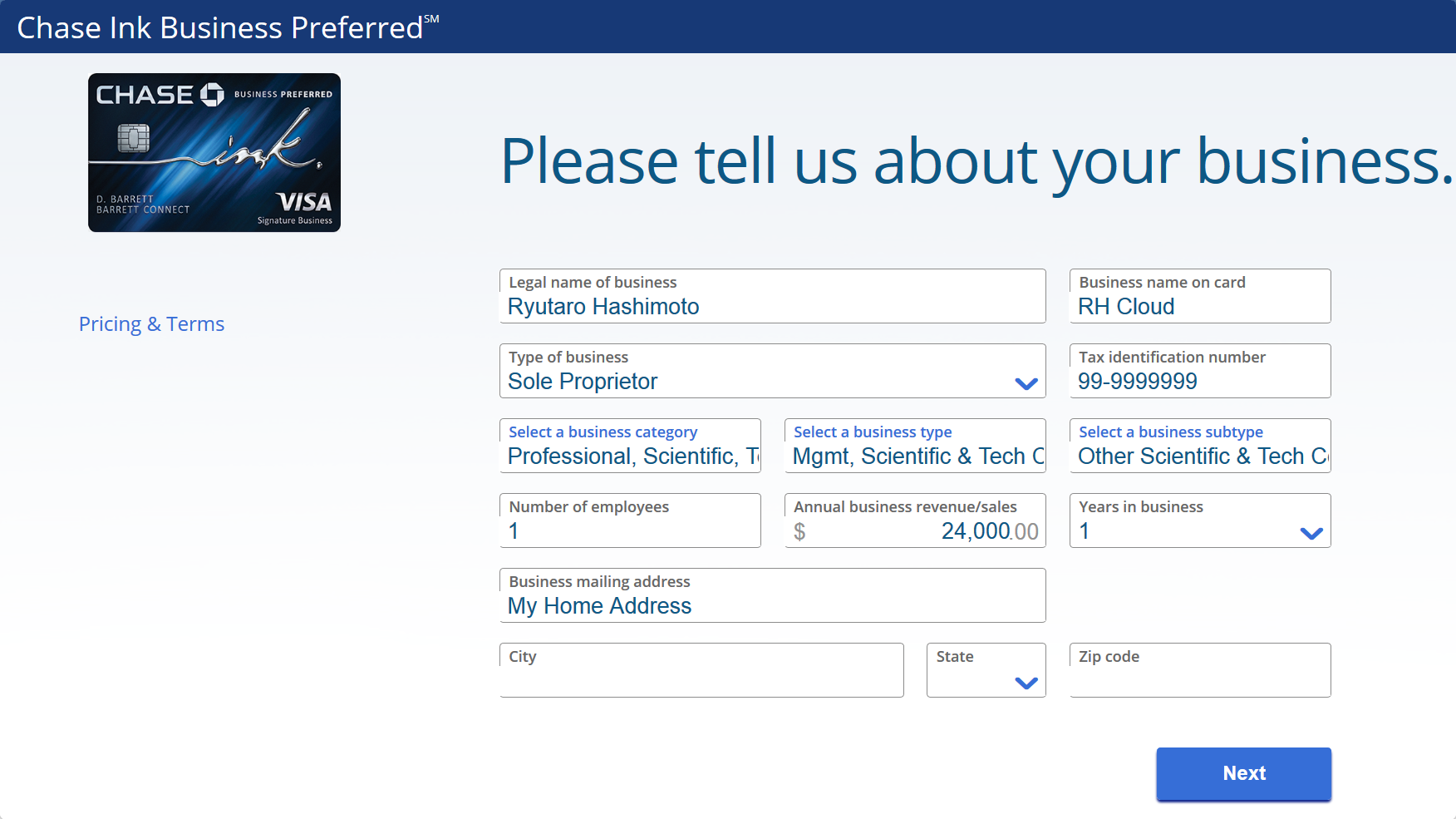

Chase Ink Business Preferred

- 80,000 bonus points after you spend $5,000 on purchases in the first 3 months after account opening.

- $95 Annual Fee

Steps

- Applied online (used my full name as Legal name of business and SSN as Tax identification number)

- Application was not instantly approved.

- Immediately called the reconsideration line (800-453-9719) listed on Doctor Of Credit.

- Provided following information to verify my identity:

- Name

- SSN

- DOB

- Account with Chase (Credit Limit)

- Waited on hold for 3 minutes, then it was approved for $12,000

- Received the card after 4 business days

RESULT: Approved after follow up

CREDIT LIMIT: $12,000

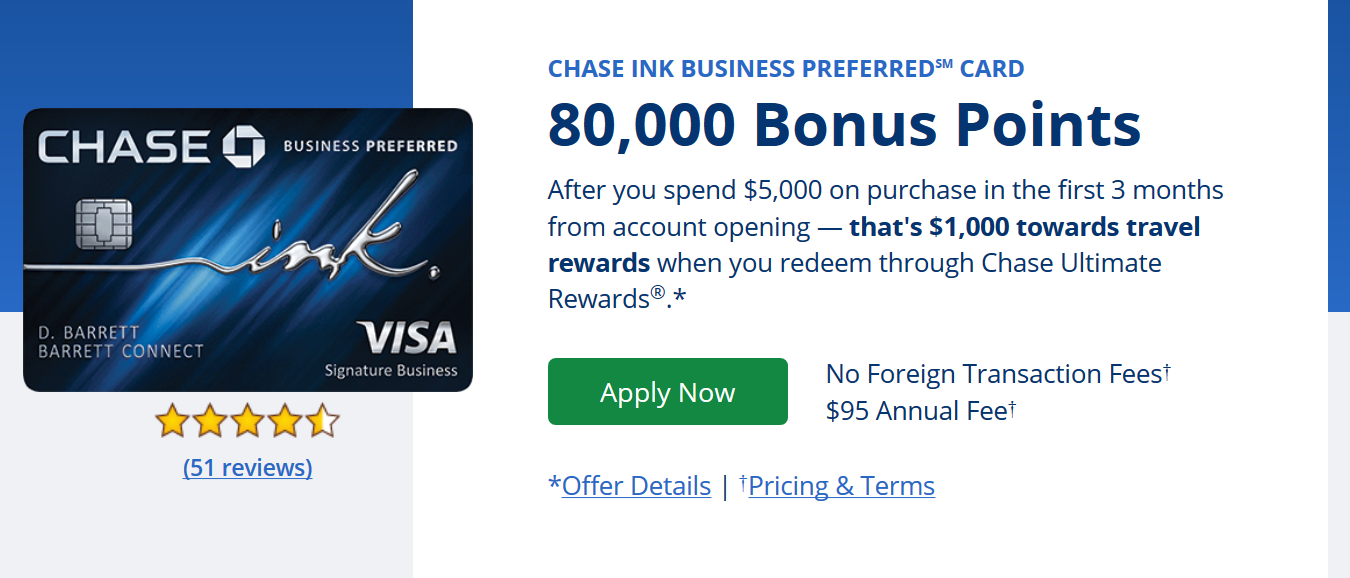

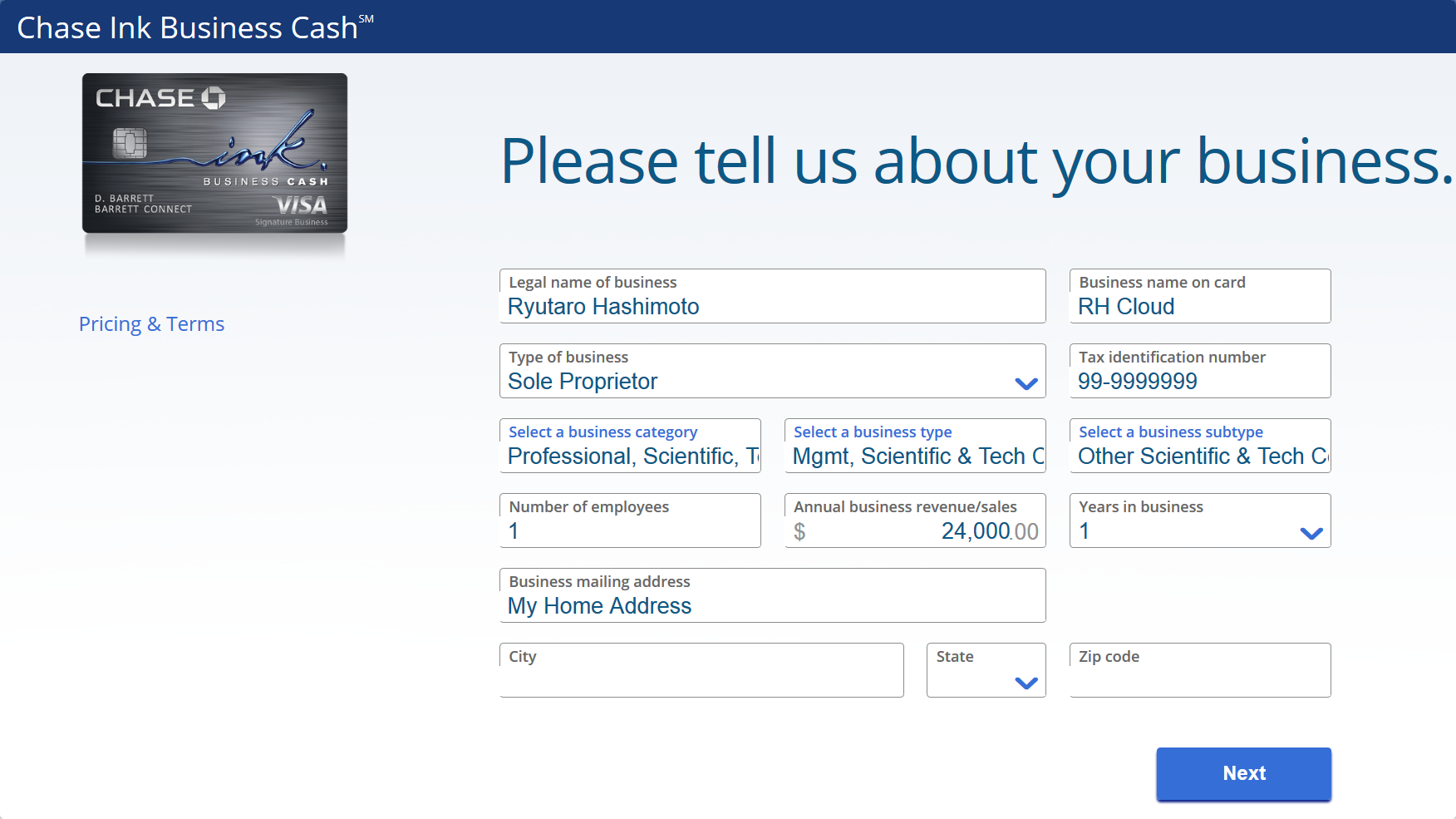

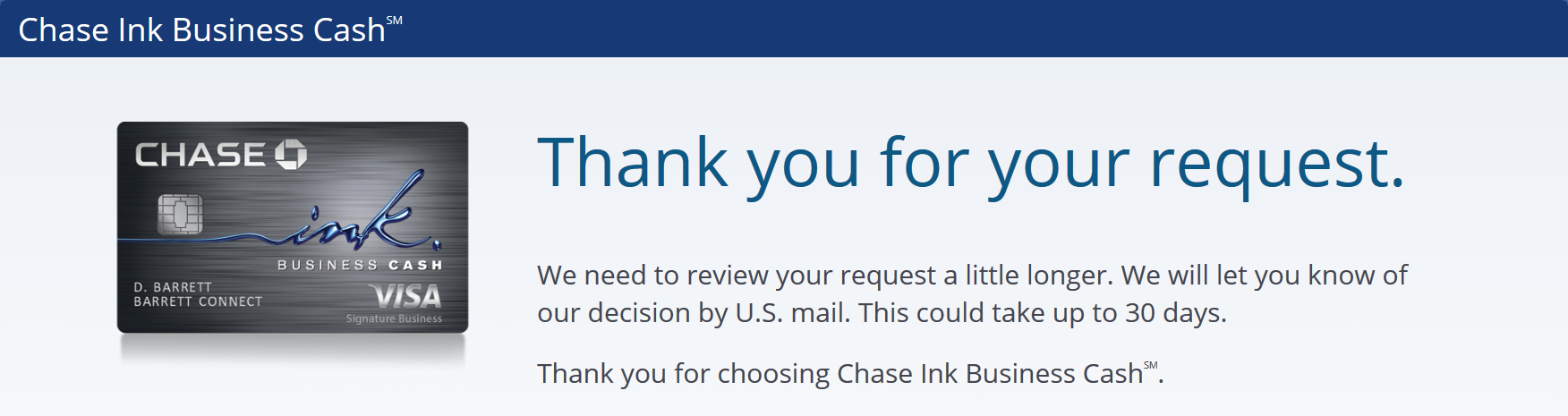

Chase Ink Business Cash

- $300 Bonus Cash Back after you spend $3,000 on purchases in the first 3 months after account opening.

- 0% intro APR on purchases and balance transfers for the first 12 months

- No Annual Fee

Steps

- Applied online (used my full name as Legal name of business and SSN as Tax identification number)

- Application was not instantly approved.

- Immediately called the reconsideration line (888-270-2127) listed on Doctor Of Credit.

- Provided following information to verify my identity:

- Name

- SSN

- DOB

- Account with Chase (Balance or Credit Limit)

- Agent – She mentioned my previous application. I told her that I just got approved for a Chase Ink Business Preferred card today, and I also want a Chase Ink Business Cash card because it has a different reward structure.

- Waited on hold for 3 minutes, then it was approved for $12,000

- Received the card after 4 business days

RESULT: Approved after follow up

CREDIT LIMIT: $12,000

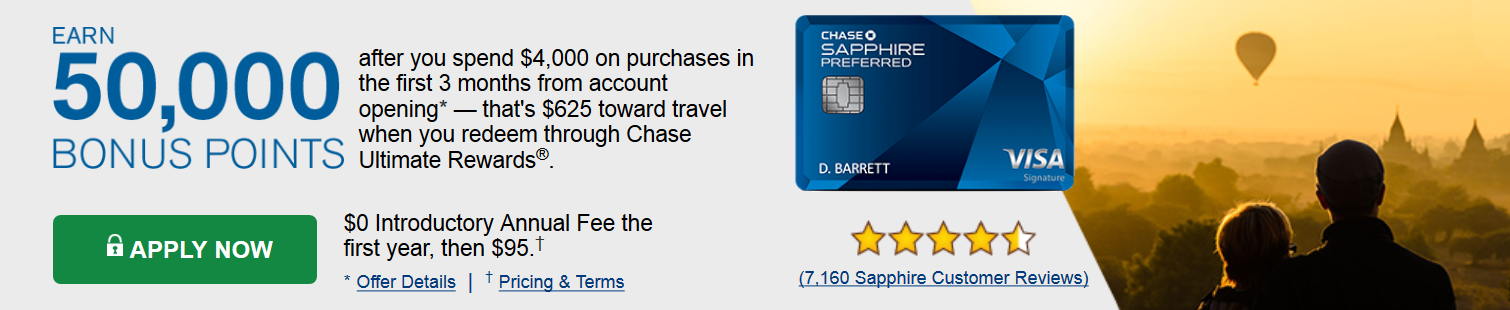

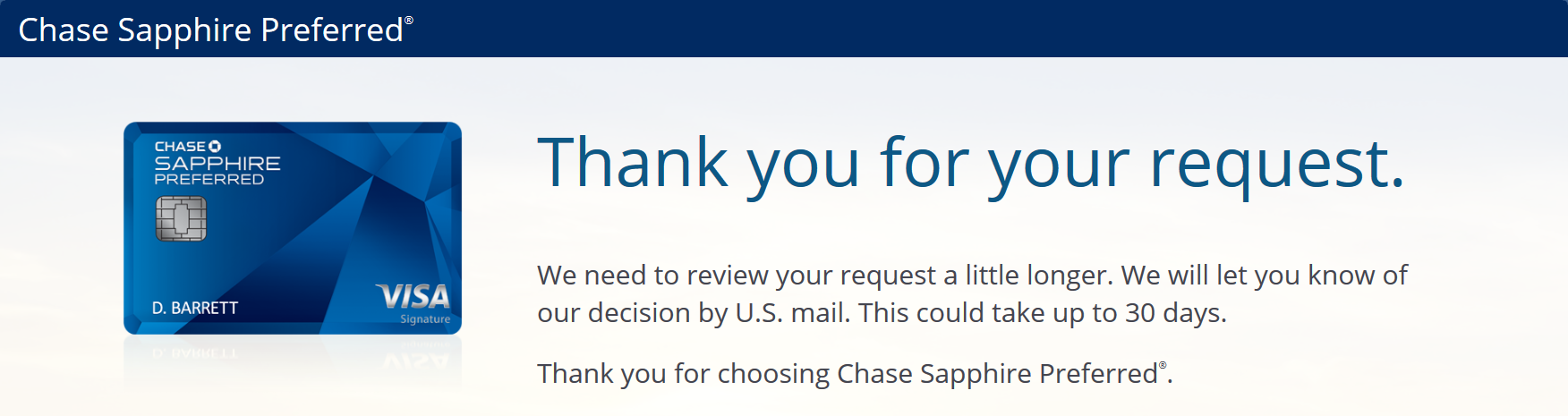

Chase Sapphire Preferred

- 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- $0 intro annual fee for the first year, after that $95.

Steps

- Applied online

- Application was not instantly approved.

- Immediately called the reconsideration line (888-270-2127).

- Provided following information to verify my identity:

- Name

- SSN

- DOB

- 2 credit cards that are NOT with Chase

- Agent – She said my application was declined due to: 1) too many recent inquiries, 2) just opened 2 accounts with Chase and extended new credit line. Chase needs to see how I handle new credit cards. I asked what if I cancel other Chase credit card so that my credit line remains same. She said I had to call another department because she can’t close. Even so, there is no guarantee that I get Chase Sapphire Preferred. I gave up.

- Receive a rejection letter after 4 business days. Chase was unable to approve my request for a CHASE SAPPHIRE Visa Signature account at this time due to: Too many requests for credit or opened accounts with Chase.

RESULT: Declined

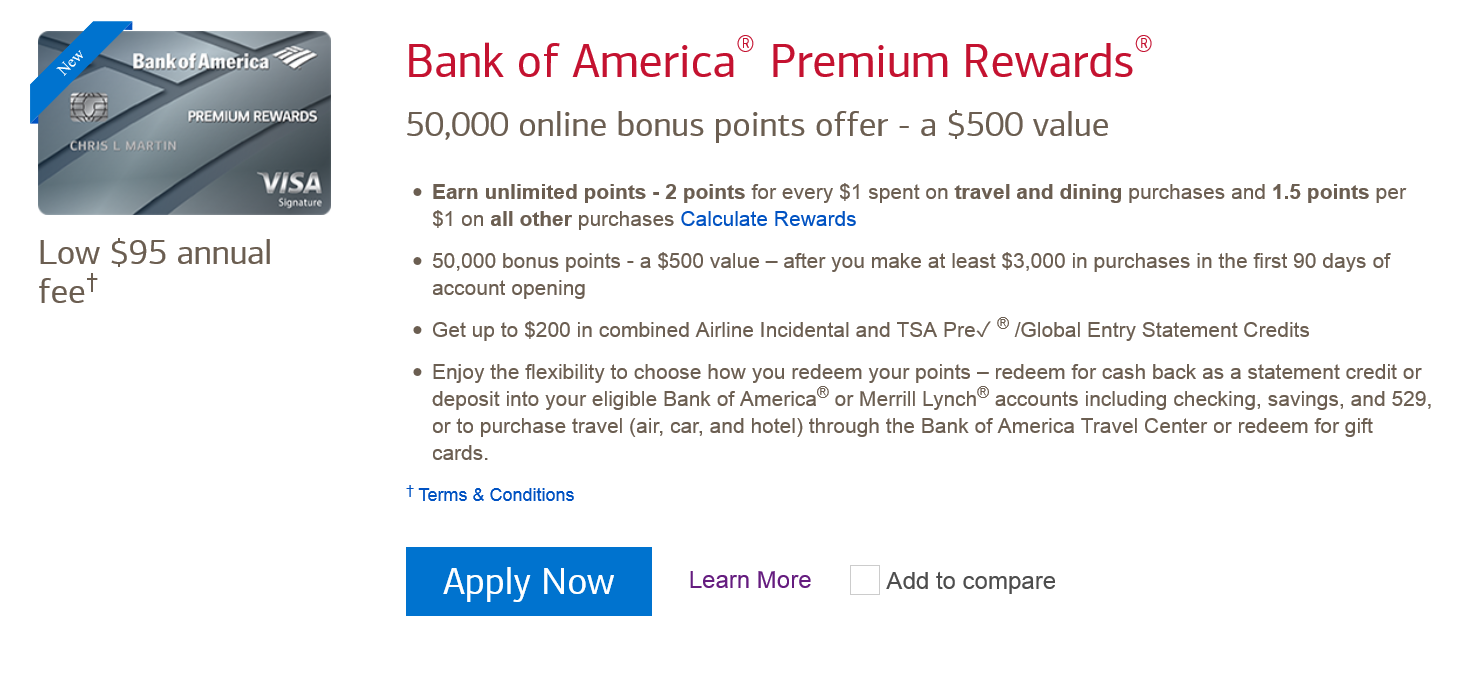

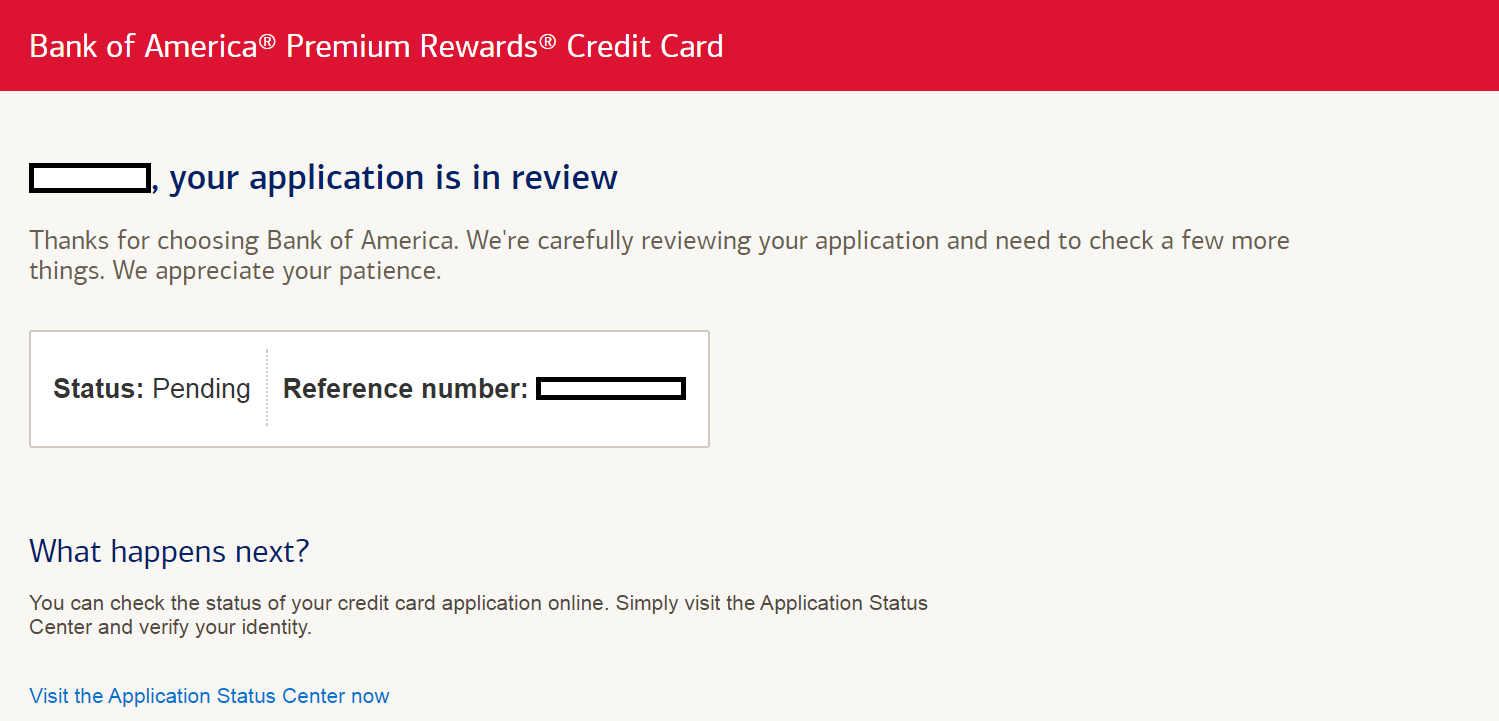

Bank of America Premium Rewards

- 50,000 bonus points – a $500 value – after you make at least $3,000 in purchases in the first 90 days of account opening

- Get up to a $100 Airline Incidental Statement Credit annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees

- $95 Annual Fee

Steps

- Applied online

- Application was not instantly approved.

- Immediately called the reconsideration line listed on Doctor Of Credit.

- 866-224-8555 didn’t work

- 866-224-7803 didn’t work

- 800-354-0401 worked

- Provided following information to verify my identity:

- Name

- Reference number

- DOB

- Last 4 digits of SSN

- Agent #1 – She said it’s already approved for $21,000. She checked few things and transferred me to another agent to confirm approval.

- Agent #2 – He confirmed that my application was approved. The card was approved with a total credit line of $19,000. Bank of America reduced the credit line on my MLB Cash Rewards Mastercard so that my overall available credit line remains the same.

- 4 business days later, I received an approval letter and Activity Alert email. My credit card was just mailed.

- Received the card after 7 business days

RESULT: Instant Approval

CREDIT LIMIT: $19,000 (moved the credit line from my existing card)

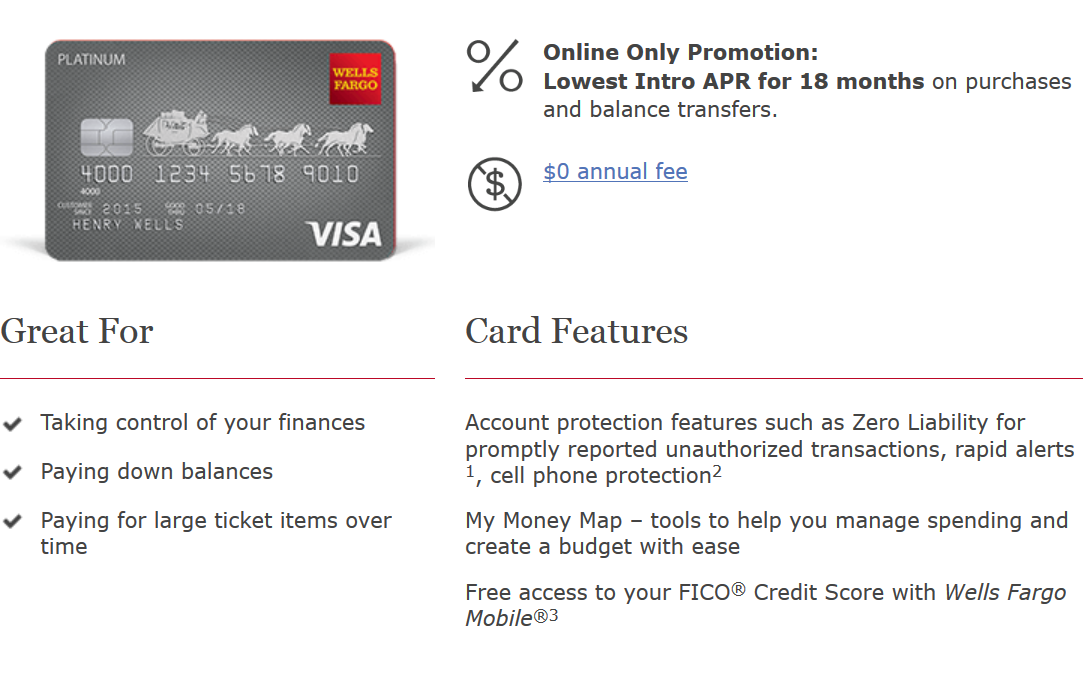

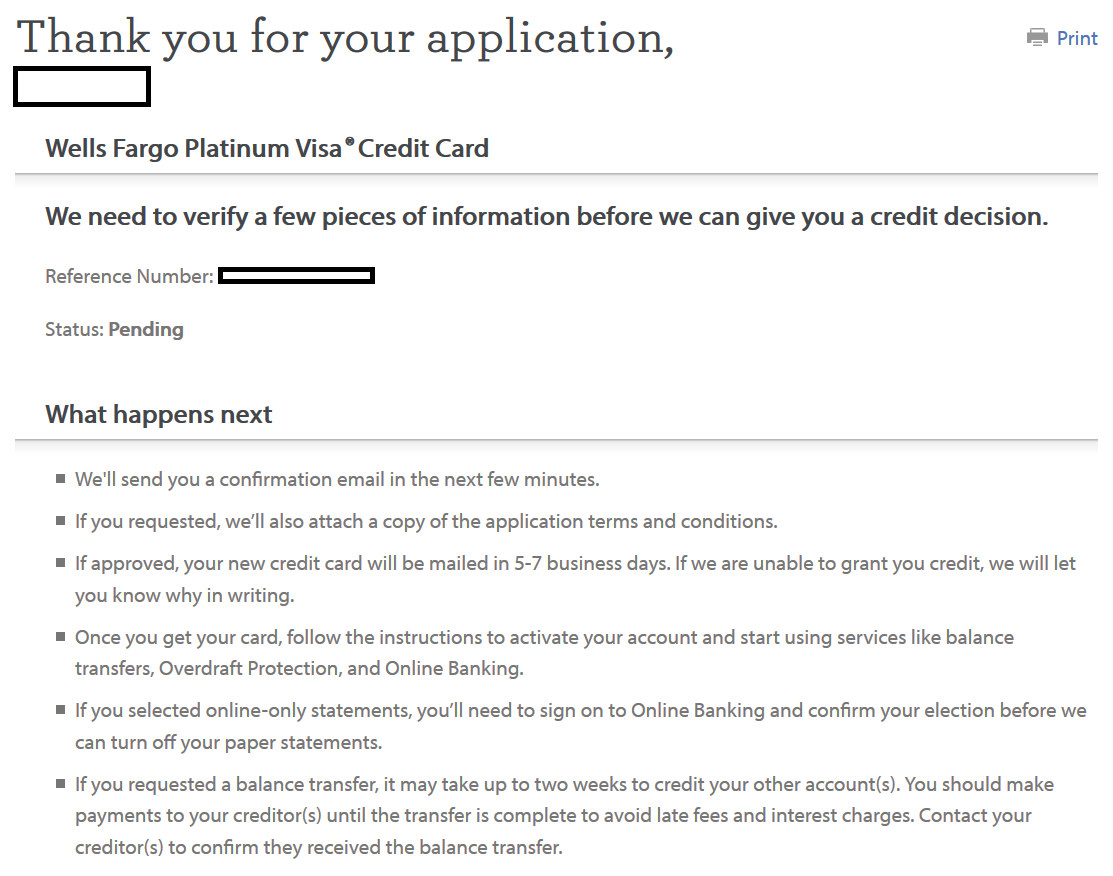

Wells Fargo Platinum Visa

- 0% introductory APR for 18 months on purchases and balance transfers.

- No Annual Fee

Steps

- Applied online

- Application was not instantly approved.

- Immediately called the reconsideration line (866-412-5956#1) listed on Doctor Of Credit.

- Provided following information to verify my identity:

- Name

- Reference Number

- DOB

- Mailing Address

- Agent – She said my application is still pending. I have to call back after 48 hours to check my application status.

- Receive a rejection letter after 4 business days. Wells Fargo was unable to offer me a credit card account because: Identity can’t be verified.

- Called the reconsideration line next day.

- Provided following information to verify my identity:

- Reference Number

- Name

- Mailing Address

- DOB

- Agent – He needs to send a code to my phone to verify my identity, but their system was unable to verify my phone number for some unknown reason (because I recently changed my number?). I asked him to try my Google Voice number, but no luck. Because he was not able to verify online, I had to bring government-issued photo ID and 2 forms of documents to validate address to a local Wells Fargo branch. I’m done.

RESULT: Declined

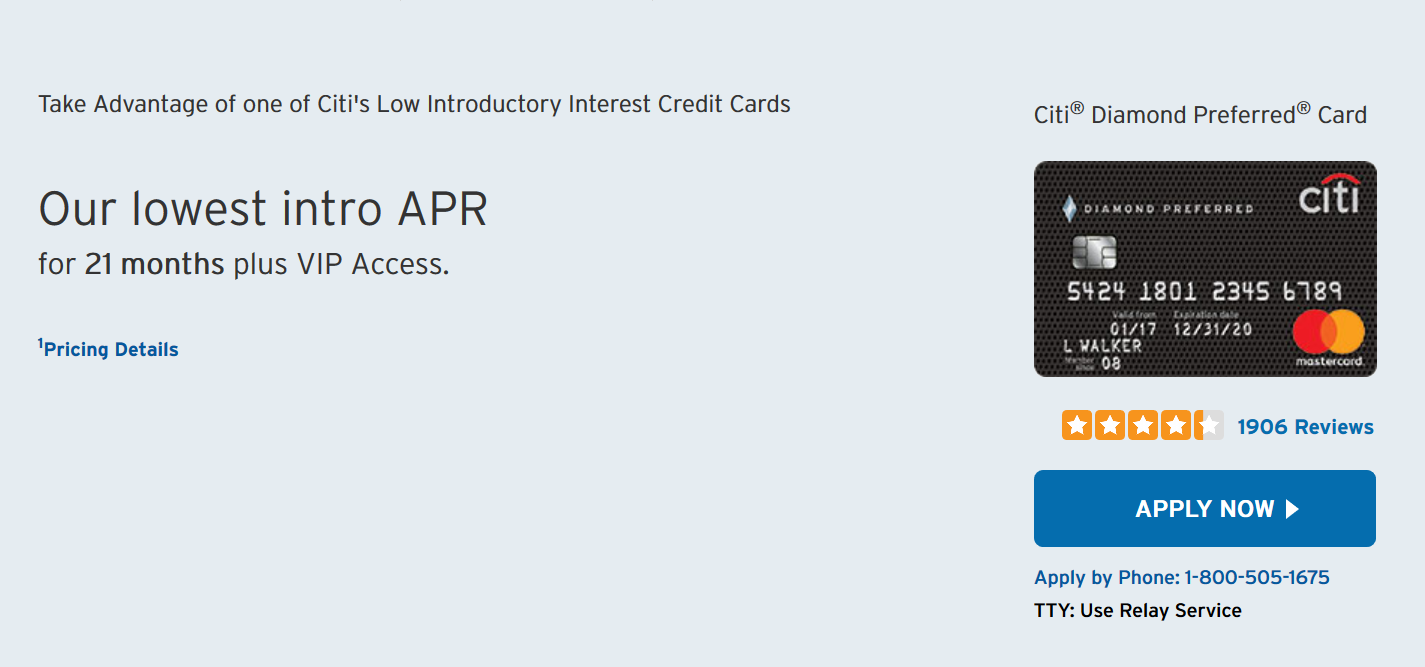

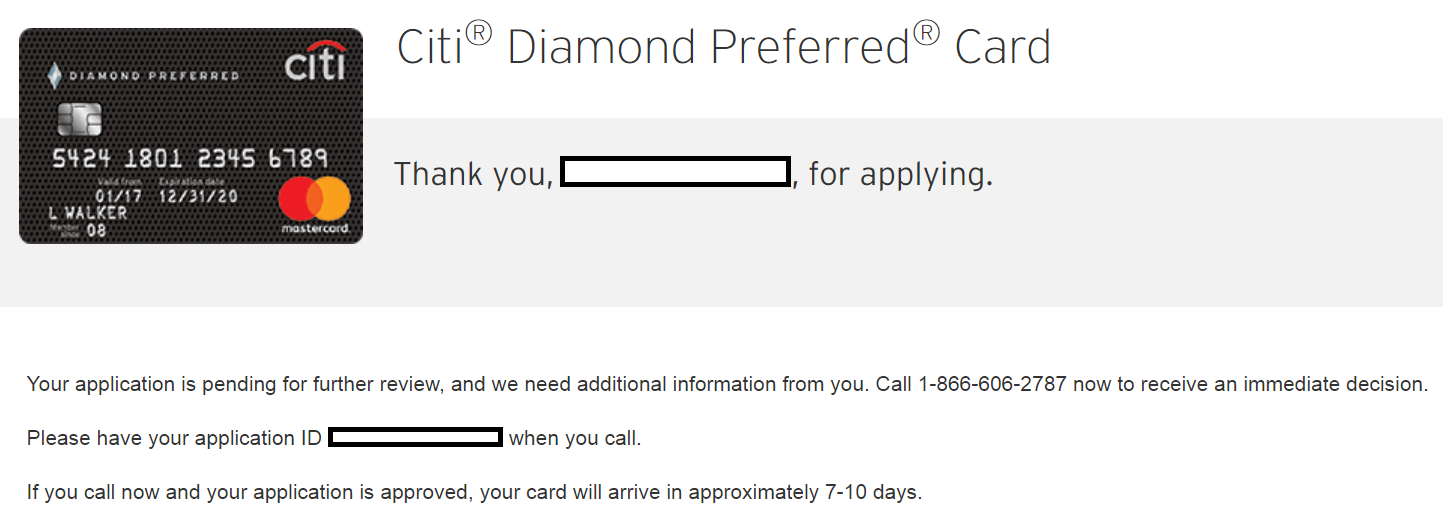

Citi Diamond Preferred

- 0% Intro APR for 21 months on purchases and balance transfers.

- No Annual Fee

Steps

- Applied online

- Application was not instantly approved.

- Citi called me after 3 days.

- Agent #1 – She asked to verify following information in my application. Then transferred me to another agent.

- Last 4 digits of SSN

- Income

- Rent

- Agent #2 – He said my application was declined due to too many recent inquiries. I asked how many is too many, and how recent is recent. He said Citi doesn’t want to see more than 2 inquiries in the last 6 months. I had 6 inquiries.

RESULT: Declined

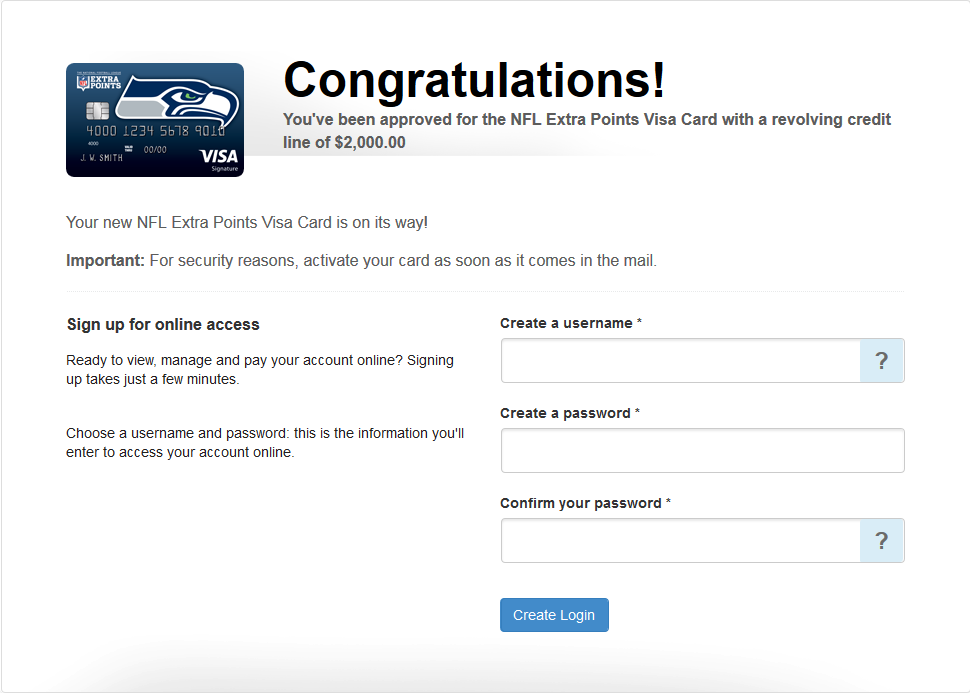

NFL Extra Points

- Earn 10,000 bonus points after $500 in purchases in the first 90 days, enough to redeem for $100 cash back

- 0% intro APR for 15 months on balance transfers made within 45 days of account opening.

- No Annual Fee

Steps

- Applied online

- Application was instantly approved for $2,000.

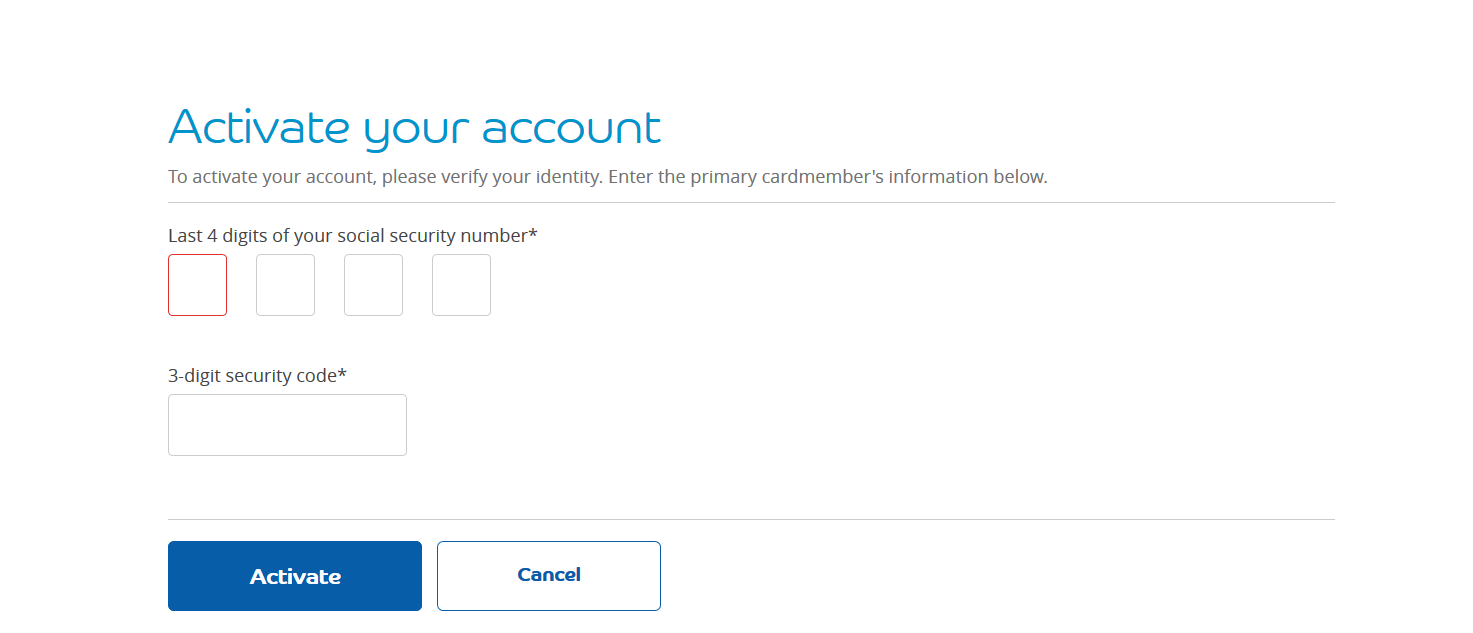

- 4 business days later, I received and activated the card (activation requires a security code).

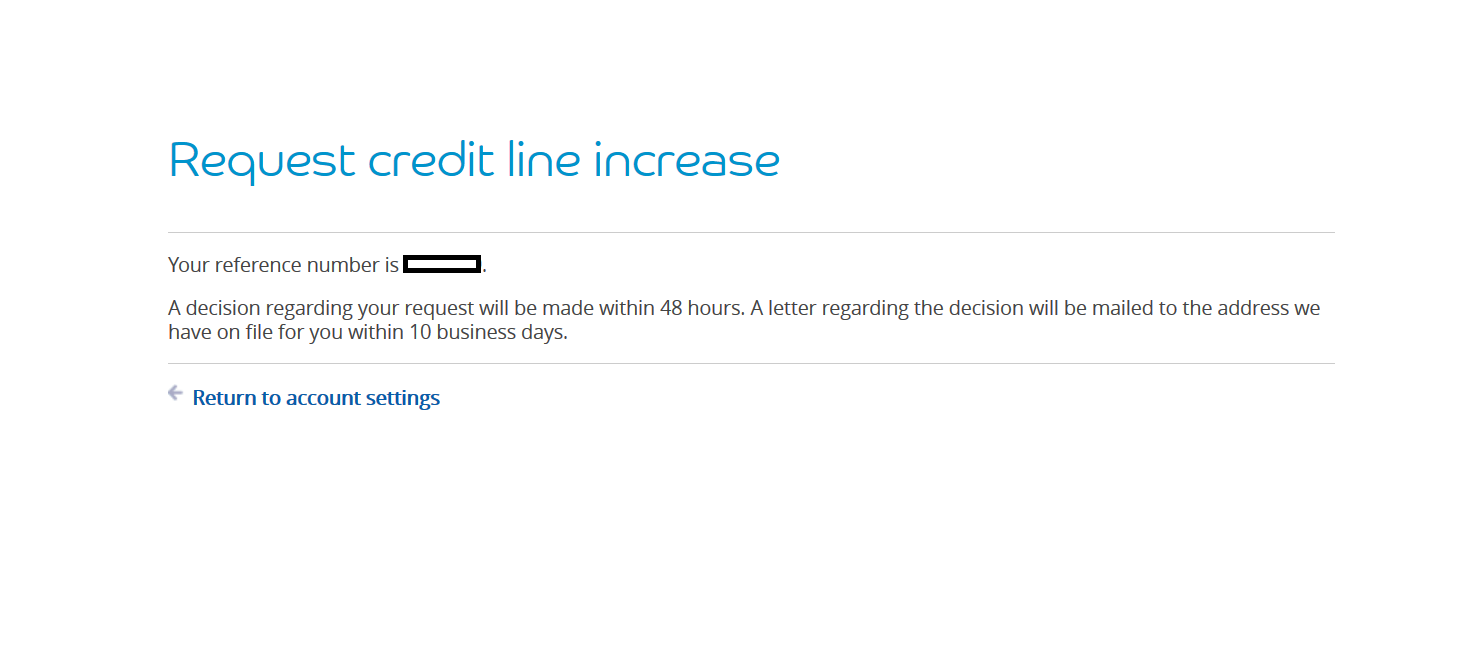

- Requested credit line increase to $15,000.

- Next day, Barclays increased my credit line to $10,000.

RESULT: Instant Approval

CREDIT LIMIT: $2,000 -> $10,000

U.S. Bank Cash 365 American Express

- $150 bonus after making $500 in eligible net purchases within the first 90 days of account opening.

- 0% INTRO APR for 15 billing cycles on purchases and balance transfers.

- No Annual Fee

Steps

- Applied online

- Application was not instantly approved.

- 2 business days later, I called the reconsideration line for an automated status check (800-947-1444#1#1) listed on Doctor Of Credit. My application was already approved for $25,000.

RESULT: Approved after 2 days

CREDIT LIMIT: $25,000

Alliant Credit Union Visa Platinum

- 0% introductory rate for 12 months

- No balance transfer fee

- No annual fee

Steps

- Applied online

- Application was not instantly approved.

- 2 business days later, I received an email saying that my credit card application has been approved for $20,000. They requested to provide a copy of my ID and two most recent paystubs to continue.

RESULT: Approved after 2 days

CREDIT LIMIT: $20,000