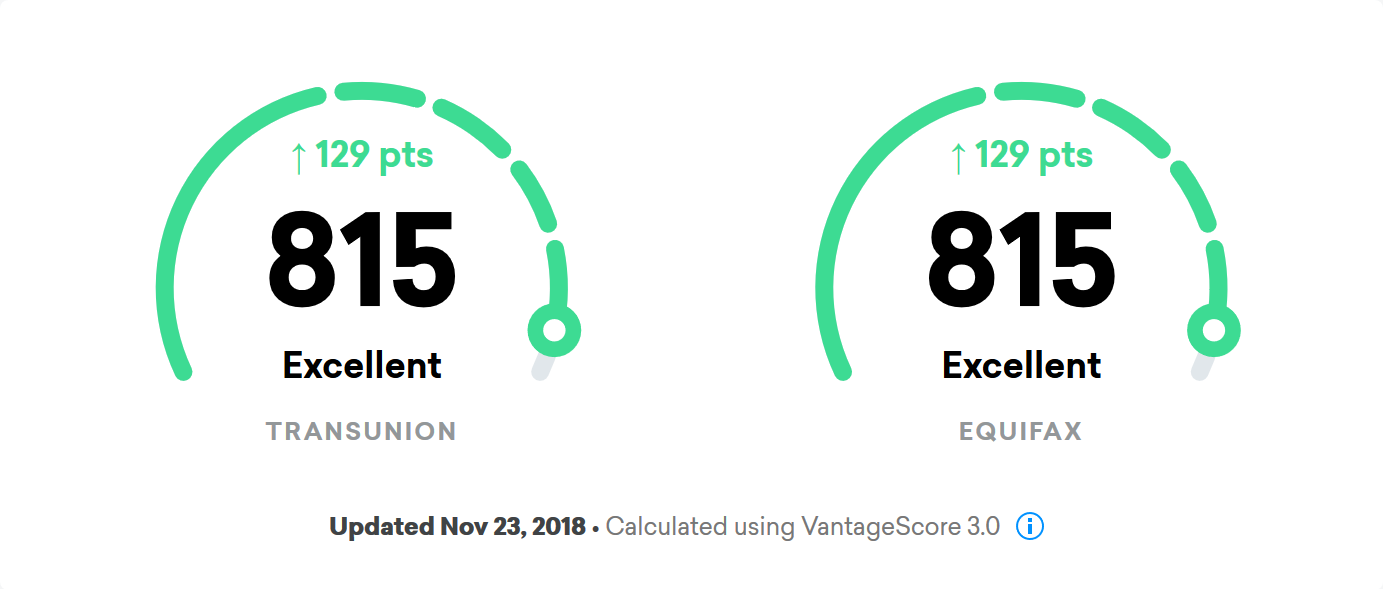

Credit Score

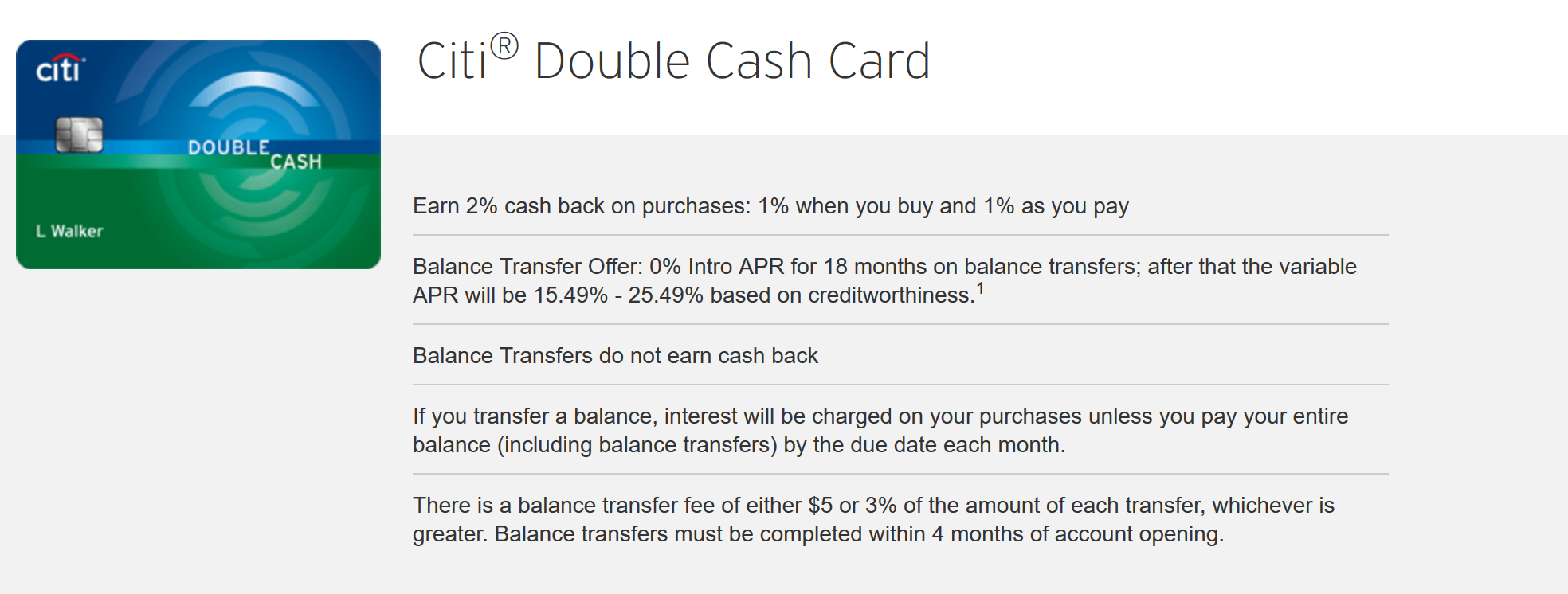

Citi Double Cash

- 0% Intro APR for 18 months on balance transfers

Steps

RESULT: Declined

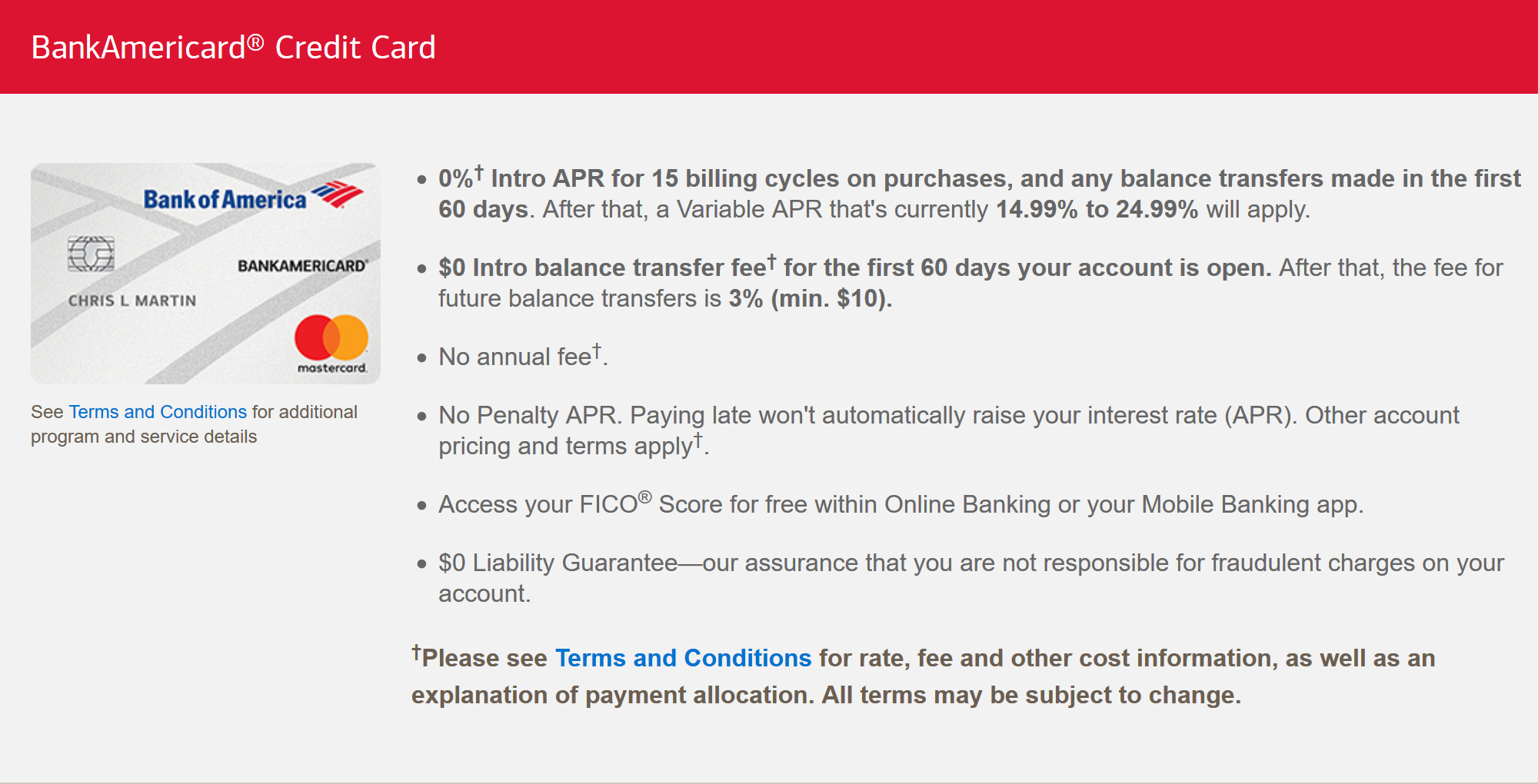

BankAmericard

- 0% Intro APR for 15 billing cycles for purchases, and any balance transfers made in the first 60 days of opening your account.

- $0 Intro balance transfer fee for the first 60 days your account is open.

Steps

RESULT: Declined

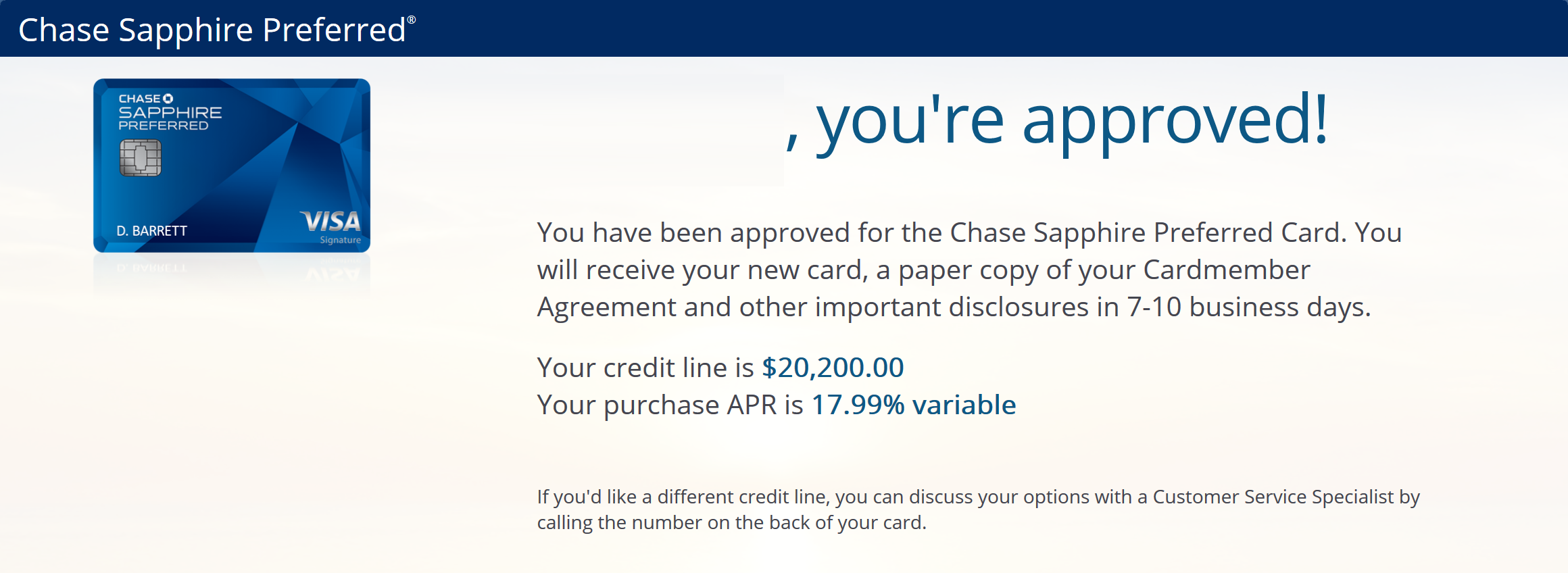

Chase Sapphire Preferred

- 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- $0 intro annual fee for the first year, after that $95.

Steps

RESULT: Instant Approval

CREDIT LIMIT: $20,200 -> $9,800 -> Closed (see Chase Freedom Unlimited for more detail)

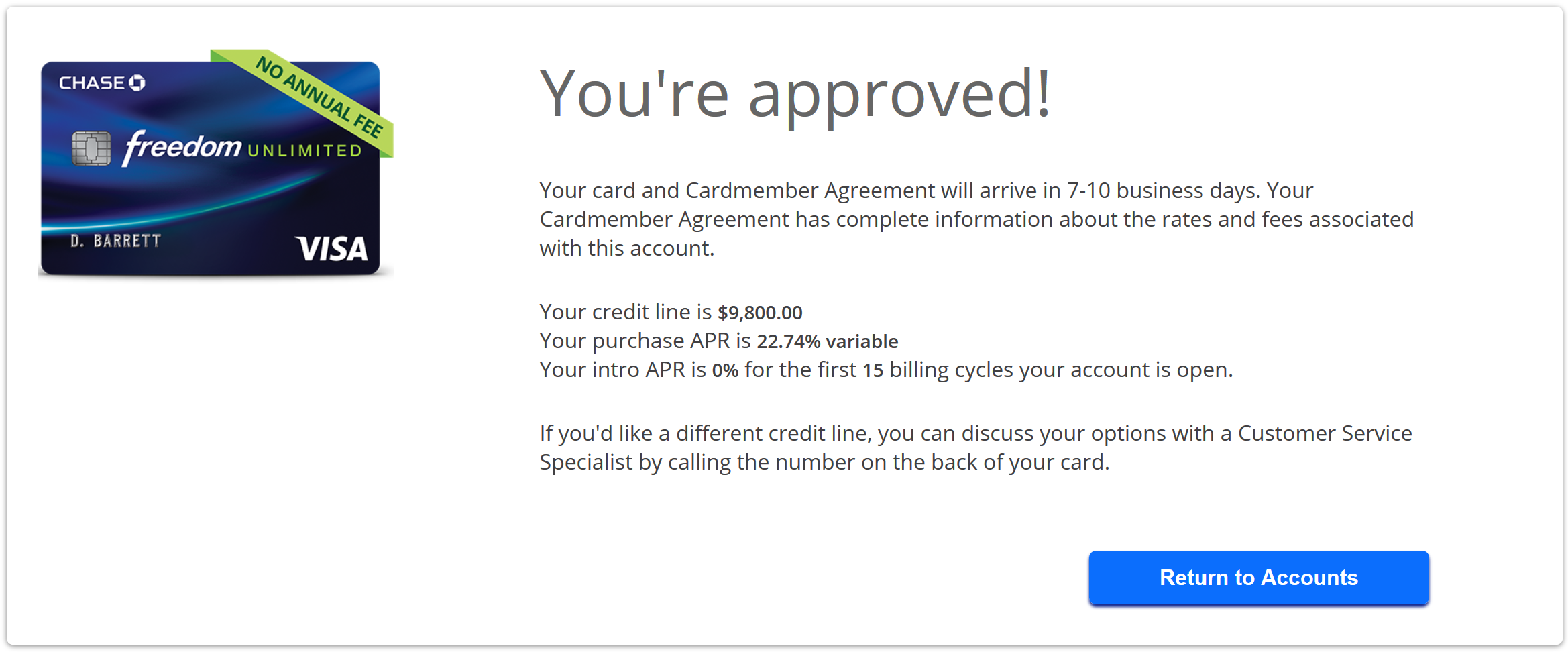

Chase Freedom Unlimited

- $150 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 0% intro APR for 15 months from account opening on purchases and balance transfers.

Steps

- Applied online

- Application was instantly approved for $9,800.

- I received a call next day. She said Chase no longer allow 2 credit card approvals in a single day, so they closed the Freedom card. They called me to check if I want to close Sapphire instead. I requested to 1) exchange credit limit, then 2) close Sapphire and reopen Freedom.

- I received both Sapphire and Freedom cards 6 days later (on Saturday) along with a letter confirming above changes.

RESULT: Instant Approval

CREDIT LIMIT: $9,800 -> Closed -> Reopened with $20,200

Discover it

- 0% Intro APR for 14 months on purchases & balance transfers.

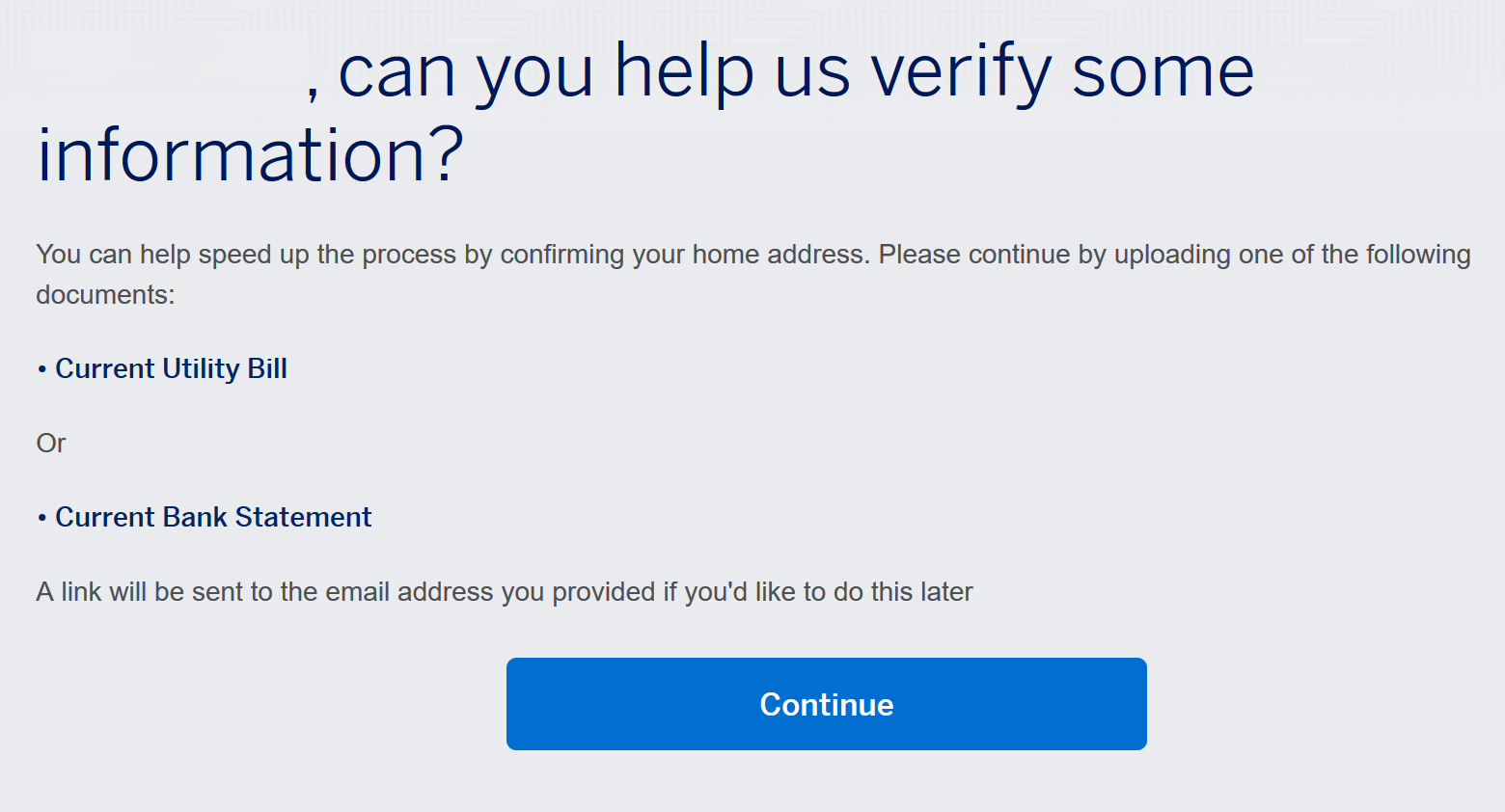

Steps

- Applied online

- I had to provide my previous address and a recent bank statement for address verification.

- Application was not instantly approved.

- Called the number 2 hours later. I provided my full name and DOB. She was able to locate my application without my reference number. It was already approved for $3,000.

- 6 days later (on Saturday), I received the card. I activated and requested credit line increase, but it was instantly delinted.

RESULT: Instant Approval

CREDIT LIMIT: $3,000

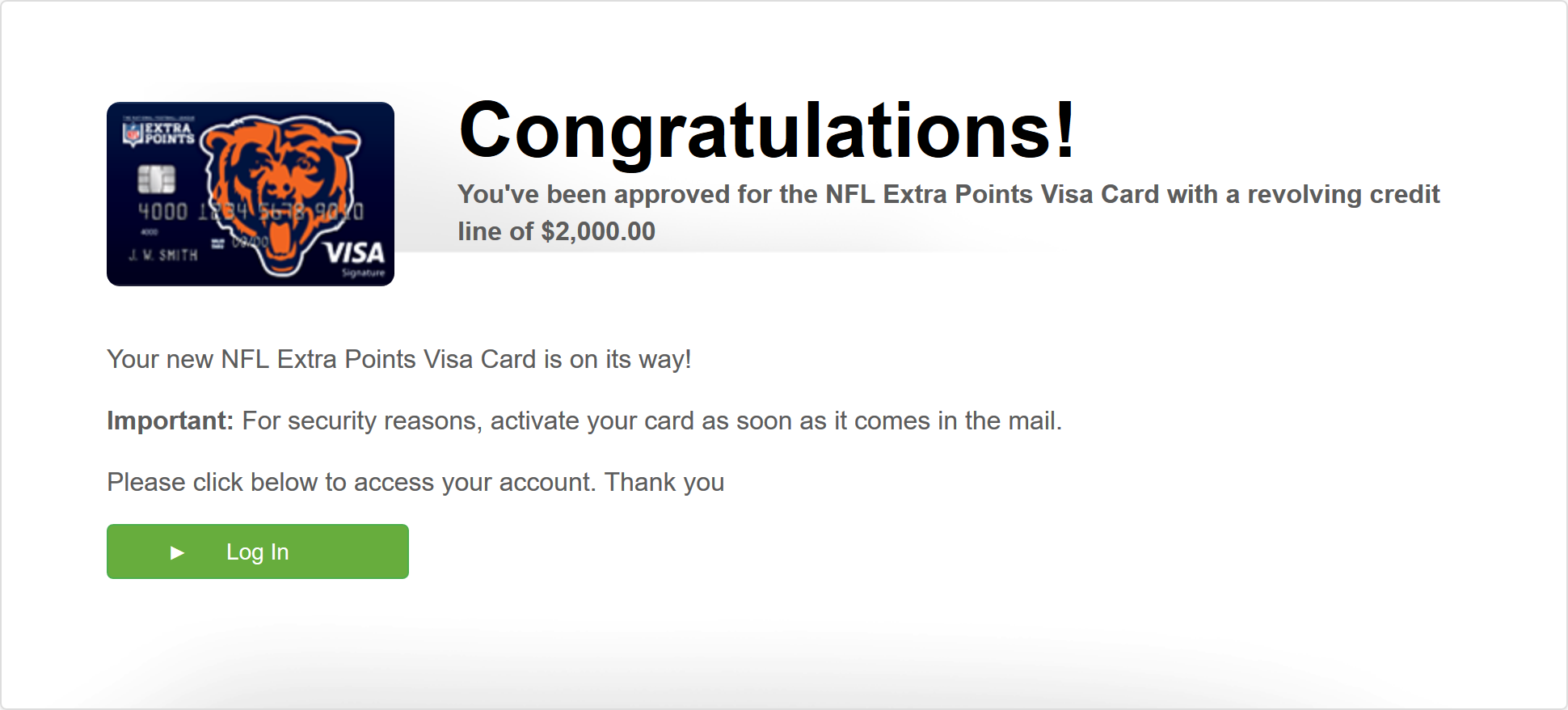

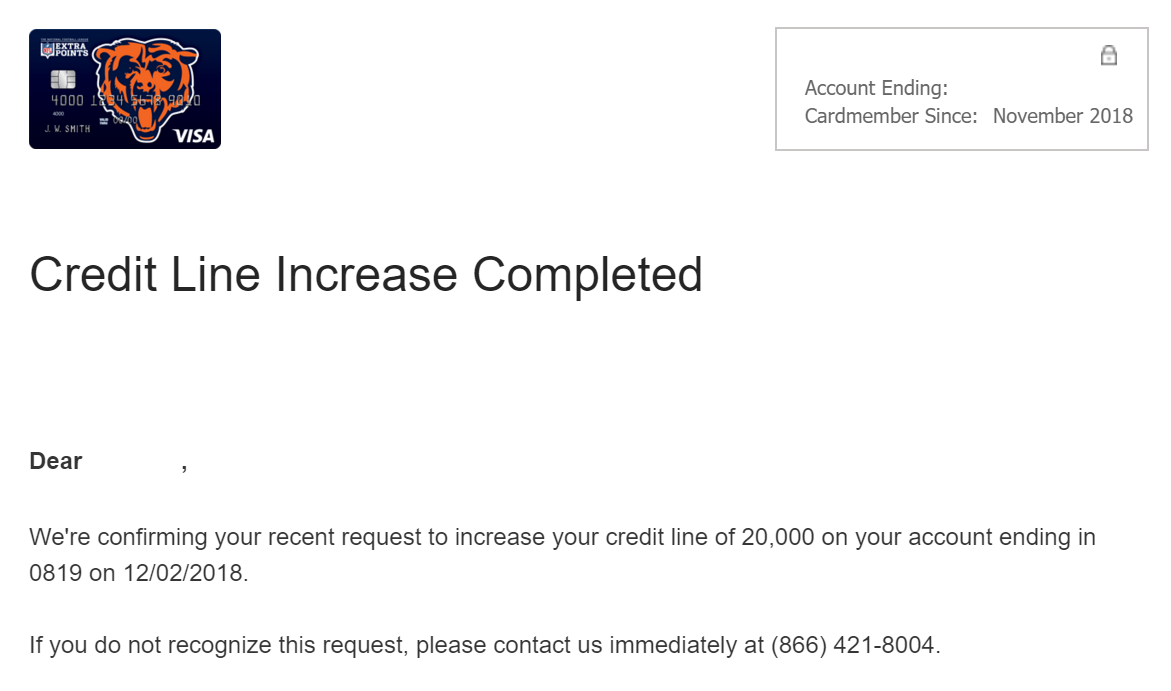

NFL Extra Points

- Earn 10,000 bonus points after $500 in purchases in the first 90 days.

- 0% intro APR for 15 months on balance transfers made within 45 days of account opening.

Steps

- Applied online

- Application was instantly approved for $2,000.

- 6 days later (on Saturday), I received the card. I activated and requested credit line increase to $20,000.

- Next day (on Sunday), Barclays increased my credit line to $20,000.

RESULT: Instant Approval

CREDIT LIMIT: $2,000 -> $20,000

U.S. Bank Cash 365 American Express

- $150 bonus after making $500 in eligible net purchases within the first 90 days of account opening.

- 0% introductory APR for the first 12 billing cycles for balances transferred within 60 days from account opening.

Steps

- Applied online

- Application was not instantly approved.

- 3 business days later, I called the reconsideration line for an automated status check (800-947-1444#1#1) listed on Doctor Of Credit. My application was already approved.

- 6 business days later, I received the card. Credit limit was $18,000.

RESULT: Approved after 3 days

CREDIT LIMIT: $18,000

Blue Cash Everyday from American Express

- $150 Back after you spend $1,000 in purchases on your new Card in your first 3 months.

- 0% intro APR on purchases and balance transfers for 15 months.

Steps

- Applied online

- Application was not instantly approved.

- 3 business days later, I received a letter saying that I needed to 1) provide a letter from my bank confirming my home address, and 2) complete the enclosed 4506-T form to confirm my total annual income.

- I will ignore this letter.

RESULT: Declined