Backstory

Today is my birthday, and I’m approaching my 40s. Recently, I’ve been experiencing high levels of stress at work that have been taking a toll on my physical and emotional health. This seems like an ideal time to get my retirement finances in order. Early retirement has become an obsession, and I’m counting down the days until we reach financial independence.

Keep Track of Spending

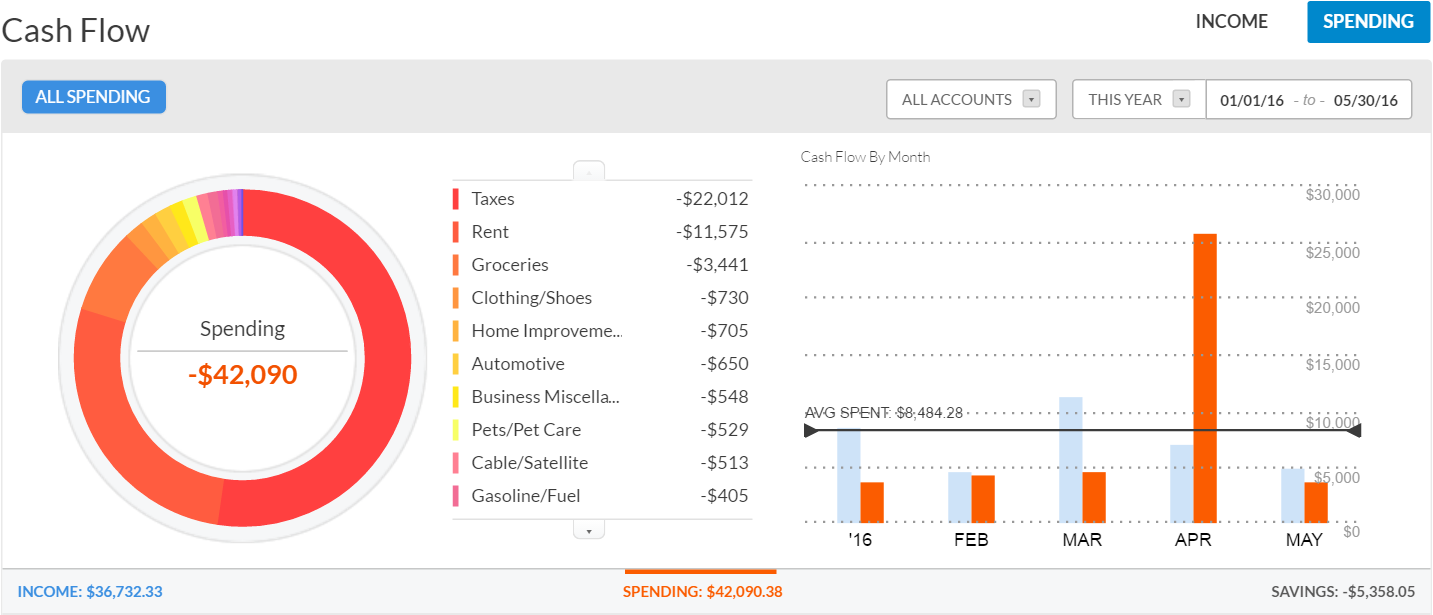

I started tracking our actual spending using Personal Capital. Here is a screenshot of my spending page.

The monthly spending amounts align with our average monthly expenses over the past few years. I’m going to use this number as a practical monthly budget to determine realistic retirement savings goals.

Retirement Options

I analyzed different plans to illustrate the costs and income requirements of each retirement strategy. After reviewing various options, four key milestones emerged.

Housing Expense

- 1 Bedroom Apartment: $2,000 – $2,500

- 2 Bedroom Apartment: $3,000 – $3,500

- 3 Bedroom Apartment: $3,500 – $4,000

Passive Income

- DLI Fund: 8%

Option 1: A Happy Marriage Without Kids (Target $0.83 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $2,500 | $30,000 |

| Food + Gas | $1,000 | $12,000 |

| Miscellaneous Expenses | $1,000 | $12,000 |

| Total Expenses | $4,500 | $54,000 |

| Retirement Target | ||

| Retirement Income Needs @17% Effective Tax Rate | $66,452 | |

| Retirement Asset Needs @8% Return | $830,650 | |

Option 2: A Happy Marriage With 1 Kid (Target $1.2 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $3,500 | $42,000 |

| Food + Gas | $1,500 | $18,000 |

| Miscellaneous Expenses | $1,250 | $15,000 |

| Total Expenses | $6,250 | $75,000 |

| Retirement Target | ||

| Retirement Income Needs @19% Effective Tax Rate | $96,064 | |

| Retirement Asset Needs @8% Return | $1,200,800 | |

Option 3: A Happy Marriage With 2 Kids (Target $1.5 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $4,000 | $48,000 |

| Food + Gas | $2,000 | $24,000 |

| Miscellaneous Expenses | $1,500 | $18,000 |

| Total Expenses | $7,500 | $90,000 |

| Retirement Target | ||

| Retirement Income Needs @22% Effective Tax Rate | $121,269 | |

| Retirement Asset Needs @8% Return | $1,515,862 | |

Option 4: A Happy Marriage With 2 Kids & Luxury Life (Target $4 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $4,000 | $48,000 |

| Food + Gas | $2,000 | $24,000 |

| Miscellaneous Expenses | $1,500 | $18,000 |

| Luxury Expenses | $10,000 | $120,000 |

| Total Expenses | $17,500 | $210,000 |

| Retirement Target | ||

| Retirement Income Needs @33% Effective Tax Rate | $320,391 | |

| Retirement Asset Needs @8% Return | $4,004,887 | |