Backstory

Today is my birthday. I am a few years away from 40. Recently I am experiencing high levels of stress at work. It has been taking a toll on my physical and emotional health. This might be a great time to get my retirement finances in order. Early retirement became an obsession, and I am counting down the days until we reach financial independence.

Keep Track of Spending

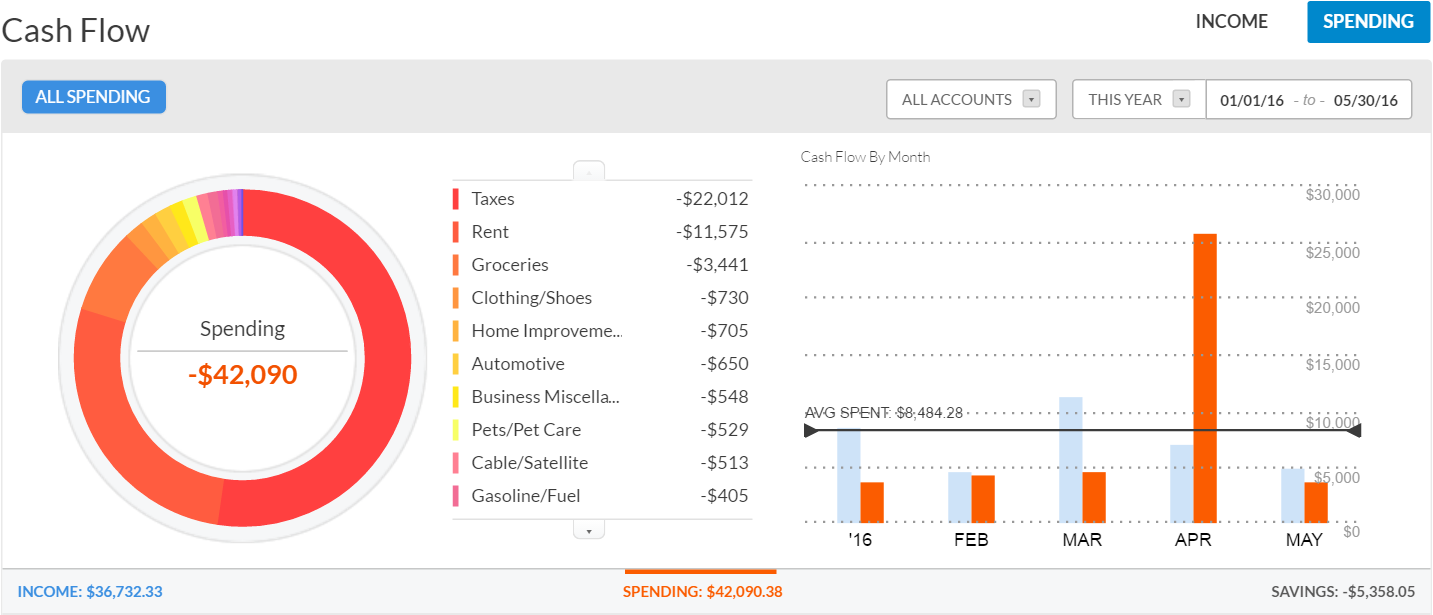

I started tracking our actual spending using Personal Capital. Here is a screenshot of my spending page.

The monthly spending amounts match our average monthly expense of last few years. I am going use this number as a practical monthly budget and find the realistic retirement savings goals.

Retirement Options

I analyzed different plans to illustrate the costs and income requirements of each retirement strategy. Various options were reviewed, and 4 key milestones came out.

Housing Expense

- 1 Bedroom Apartment: $2,000 – $2,500

- 2 Bedroom Apartment: $3,000 – $3,500

- 3 Bedroom Apartment: $3,500 – $4,000

Passive Income

- DLI Fund: 8%

Option 1: A Happy Marriage Without Kids (Target $0.83 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $2,500 | $30,000 |

| Food + Gas | $1,000 | $12,000 |

| Miscellaneous Expenses | $1,000 | $12,000 |

| Total Expenses | $4,500 | $54,000 |

| Retirement Target | ||

| Retirement Income Needs @17% Effective Tax Rate | $66,452 | |

| Retirement Asset Needs @8% Return | $830,650 | |

Option 2: A Happy Marriage With 1 Kid (Target $1.2 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $3,500 | $42,000 |

| Food + Gas | $1,500 | $18,000 |

| Miscellaneous Expenses | $1,250 | $15,000 |

| Total Expenses | $6,250 | $75,000 |

| Retirement Target | ||

| Retirement Income Needs @19% Effective Tax Rate | $96,064 | |

| Retirement Asset Needs @8% Return | $1,200,800 | |

Option 3: A Happy Marriage With 2 Kids (Target $1.5 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $4,000 | $48,000 |

| Food + Gas | $2,000 | $24,000 |

| Miscellaneous Expenses | $1,500 | $18,000 |

| Total Expenses | $7,500 | $90,000 |

| Retirement Target | ||

| Retirement Income Needs @22% Effective Tax Rate | $121,269 | |

| Retirement Asset Needs @8% Return | $1,515,862 | |

Option 4: A Happy Marriage With 2 Kids & Luxury Life (Target $4 million)

| Expenses | Monthly | Yearly |

|---|---|---|

| Rent + Utilities | $4,000 | $48,000 |

| Food + Gas | $2,000 | $24,000 |

| Miscellaneous Expenses | $1,500 | $18,000 |

| Luxury Expenses | $10,000 | $120,000 |

| Total Expenses | $17,500 | $210,000 |

| Retirement Target | ||

| Retirement Income Needs @33% Effective Tax Rate | $320,391 | |

| Retirement Asset Needs @8% Return | $4,004,887 | |