A comprehensive guide to borrowing at 0-3% promotional rates and investing for double-digit returns using credit card balance transfers—including advanced techniques for accessing cash and maximizing capacity.

Introduction

Recently, a reader named Evan asked:

Can you talk a little more about how to get started doing credit card arbitrage, like the basics? I just discovered this and am still trying to get my head around how you get the cash from the cards to invest. I think you are supposed to charge your monthly expenses and then take that money you saved and invest it? Is that correct? Also, how does one go about getting all these credit cards without tanking your credit score and then getting denied by any more cards in the future? I have 2 credit cards with low limits, each around $2,500. Those won’t work. And do you need to get the checks from the card companies for this to work? Impressed by what you’ve done here, just want to know the initial details on how to get started. Thanks!

The fundamental principle of credit card arbitrage is simple: make money by using someone else’s money. You borrow at low promotional rates (0-3% APR) and invest in higher-yielding opportunities (10%+). The interest rate spread is your profit.

Minimum Requirements

To execute this strategy effectively, you need at minimum $100,000 in cashable credit. Below this threshold, the absolute dollar returns don’t justify the time investment and operational complexity.

The math: With a $100,000 balance transfer at 0% APR for 15 months, earning 10% annual returns generates approximately $12,500 in profit. With $25,000, you’d earn $3,125 for the same amount of work—tracking payments, managing investments, coordinating repayments. The overhead remains constant; the returns don’t scale down proportionally.

Building to $100K: If you currently have limited credit ($5,000-$10,000), see my guide From $5,000 to $300,000: A Credit Building Roadmap for strategies to expand your credit capacity over 2-3 years.

Part 1: How to Get Cash from Credit Cards

The biggest barrier to credit card arbitrage is converting credit into cash. There are four primary methods:

- Direct Deposit — Electronic transfer to your bank account (fastest, most reliable)

- Balance Transfer Checks — Physical checks you write to yourself (traditional method)

- Credit Balance Refunds — Overpay, then request refund (complex, not recommended)

- Balance Carry Over — Use card for expenses, preserve cash for investing (simplest)

Method 1: Direct Deposit (Recommended)

The most efficient method when available. Request an electronic transfer from your credit card directly to your bank account, up to your available credit limit.

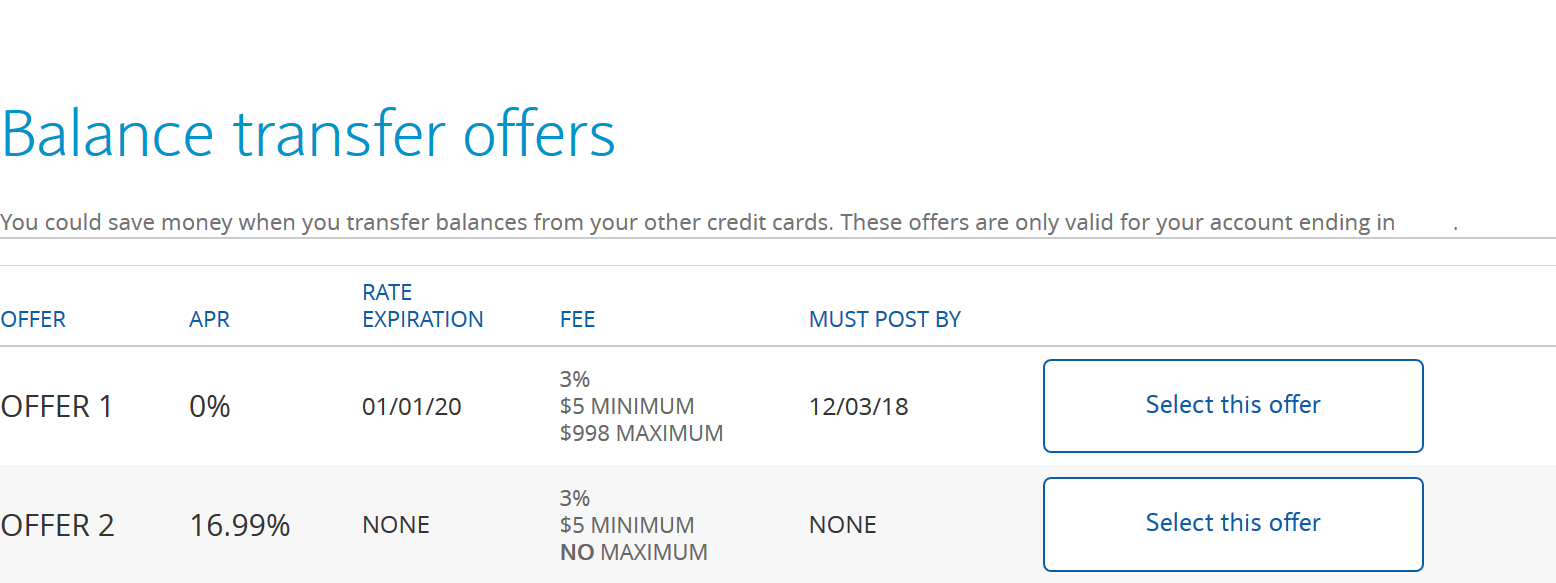

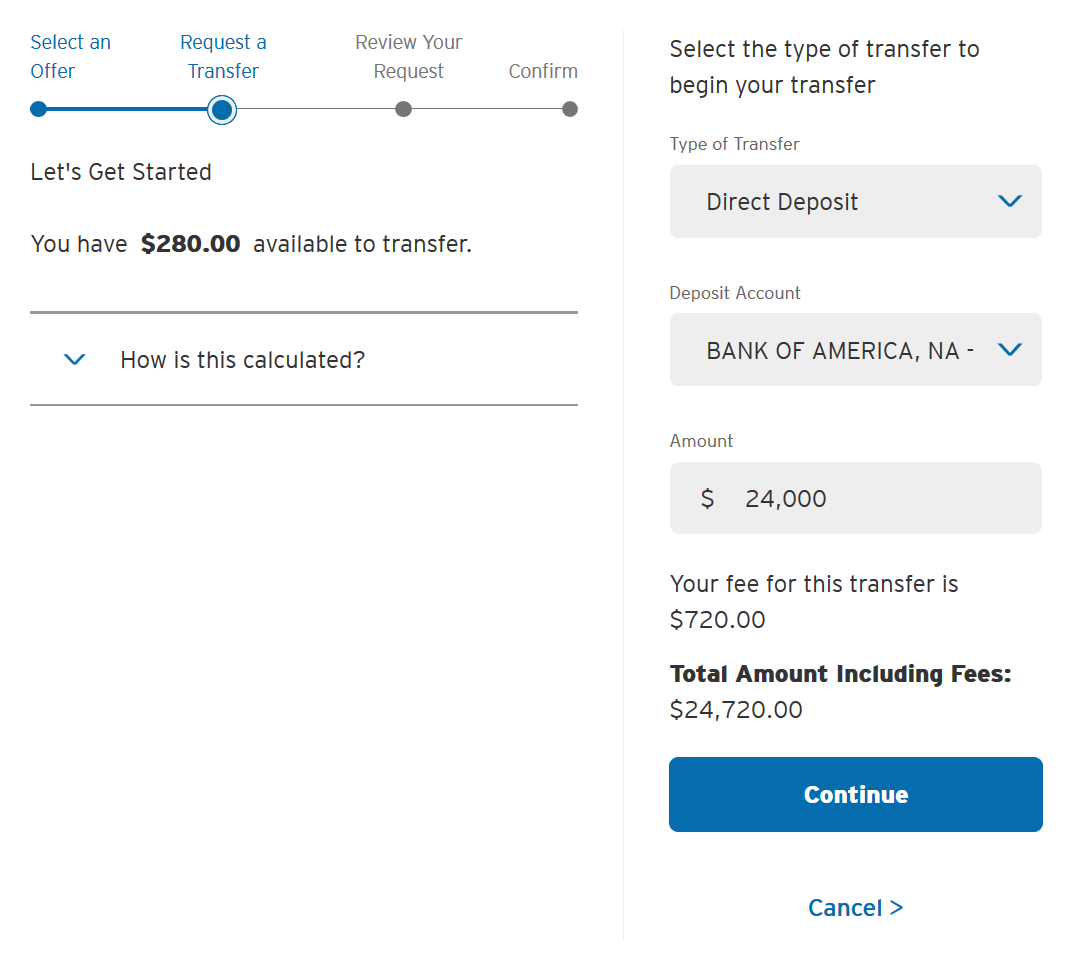

Barclaycard

Navigate to Services → Balance transfer offers → Select this offer

Under the Loan tab, enter your bank account information. You can direct deposit to any bank account—you’ll need your bank’s deposit mailing address (e.g., PO Box 105576, Atlanta, GA 30348-5576 for Bank of America).

Processing time: 7-8 business days

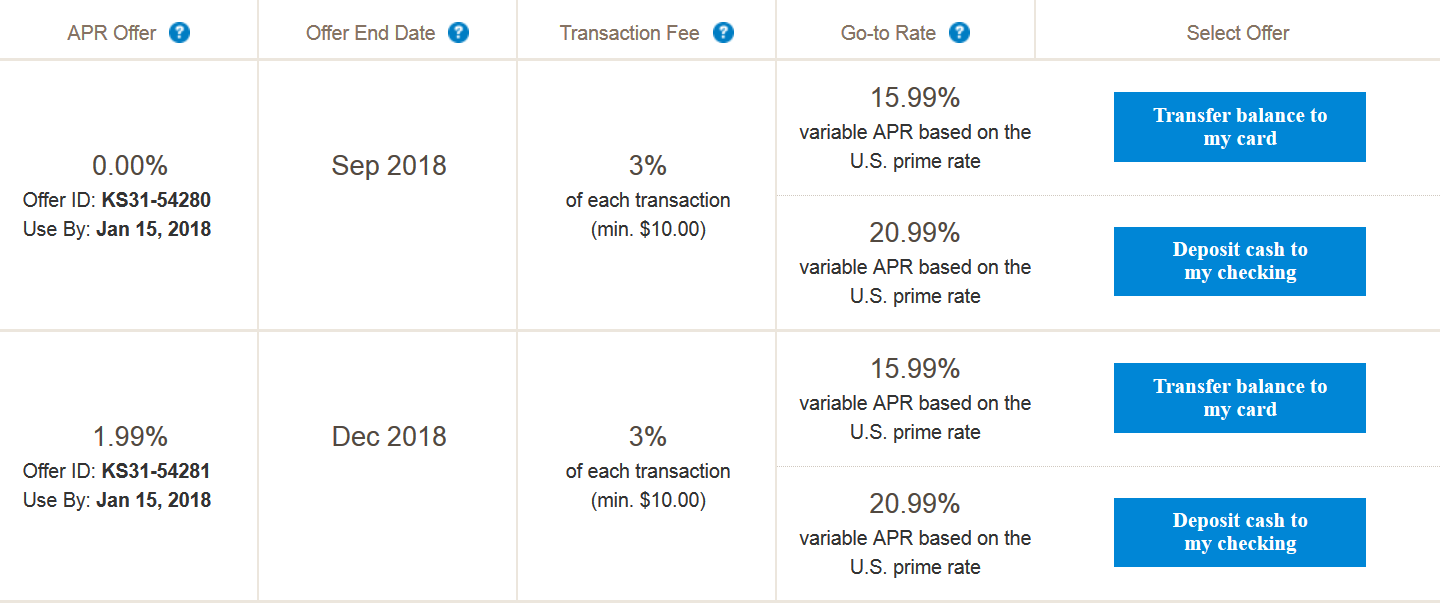

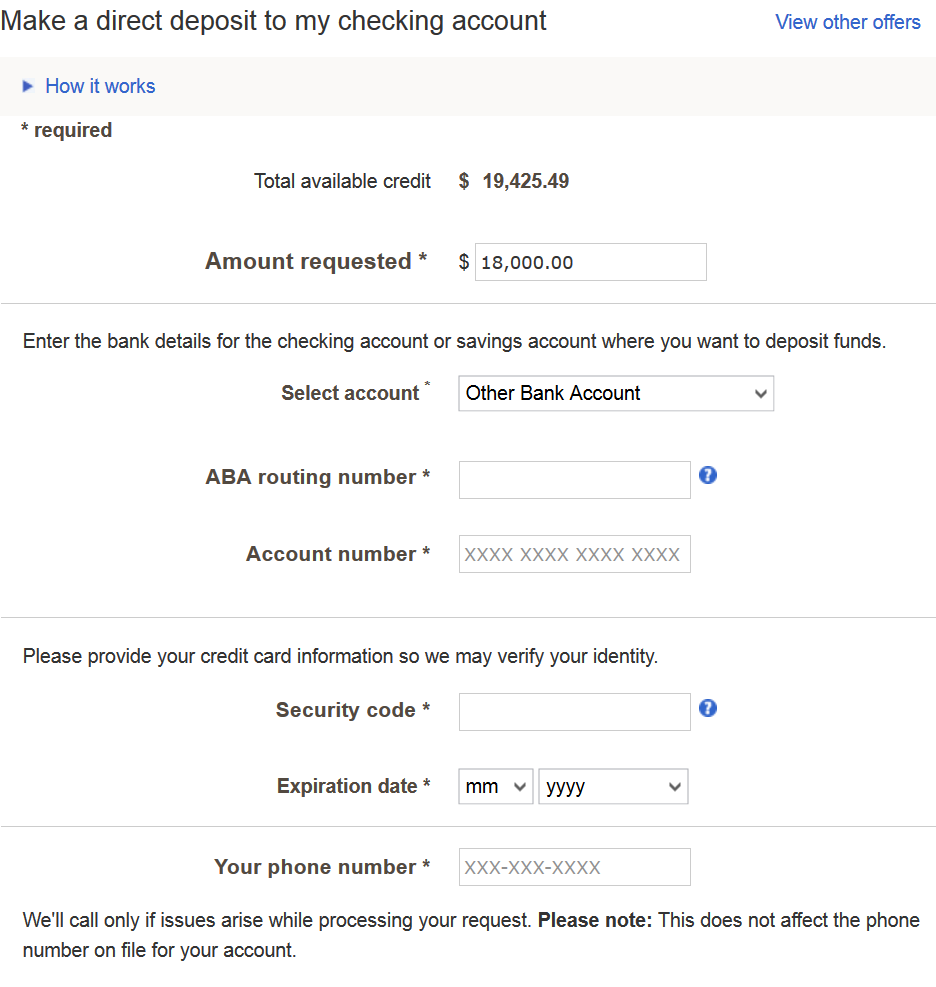

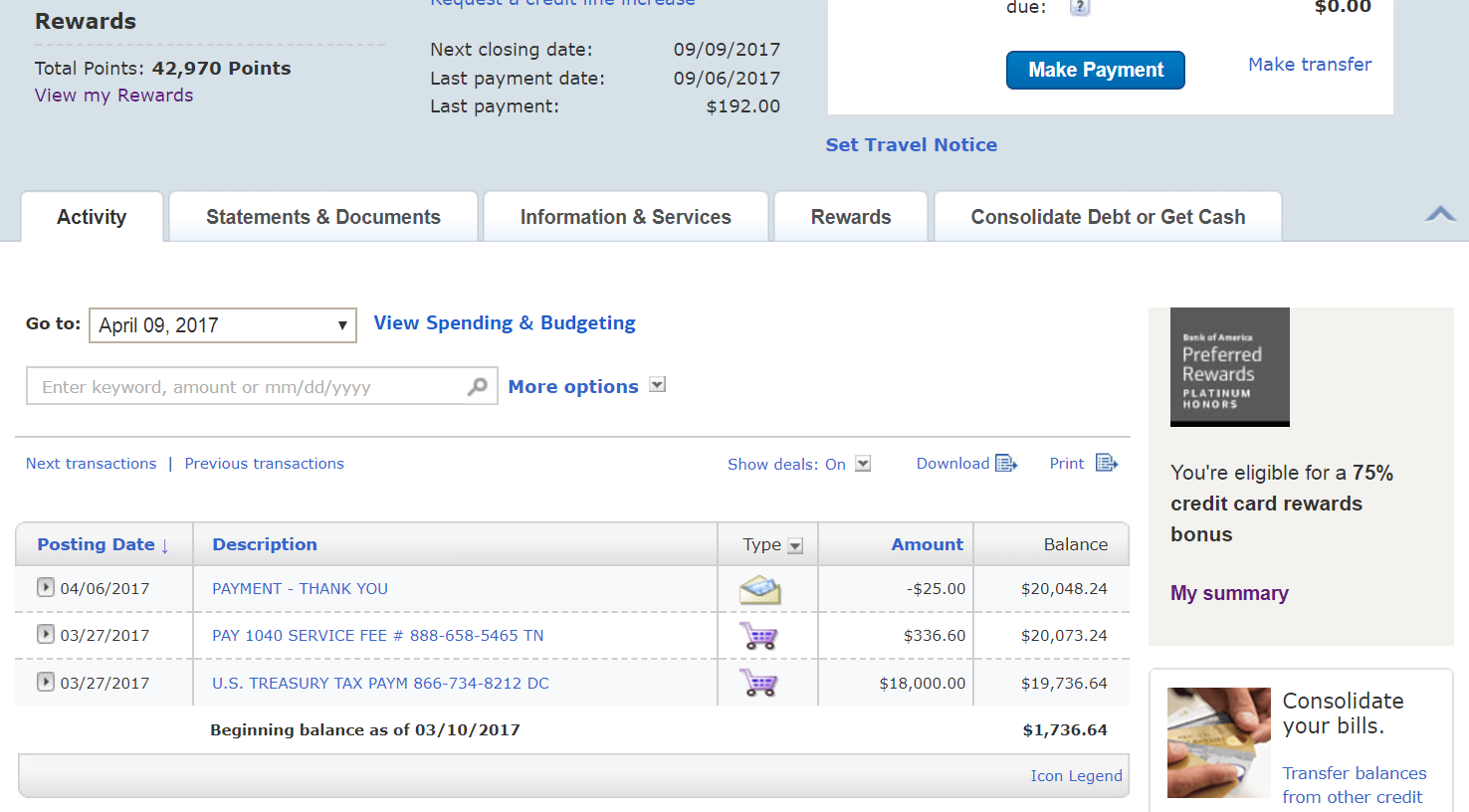

Bank of America

Navigate to Accounts → Select credit card → Consolidate Debt or Get Cash → Deposit cash to my checking

Select Other Bank Account to direct deposit to an external bank account.

Critical: Verify you’re selecting a promotional offer (0% APR), not the standard rate. The interface doesn’t always make this obvious.

Processing time: 1-2 business days

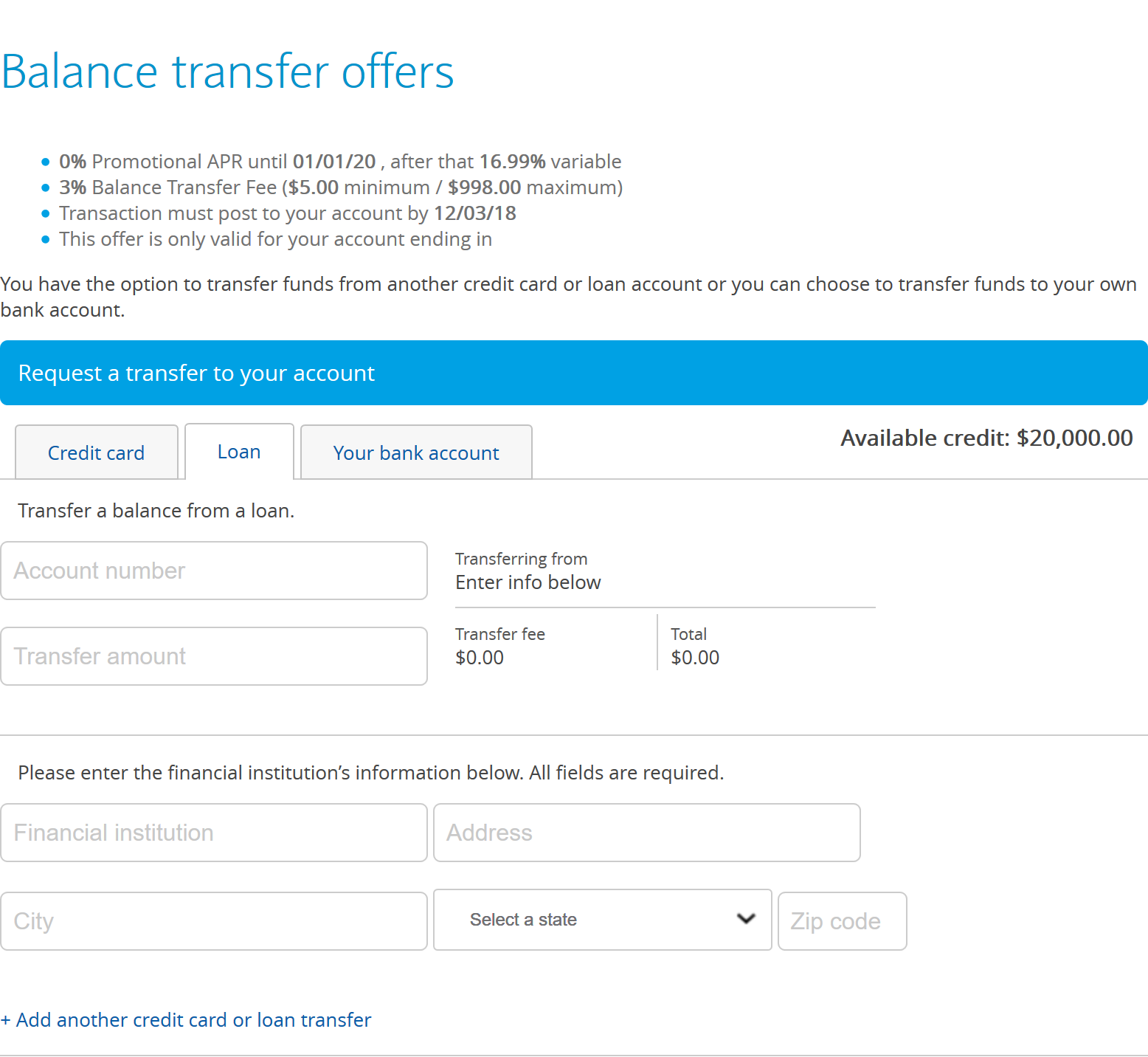

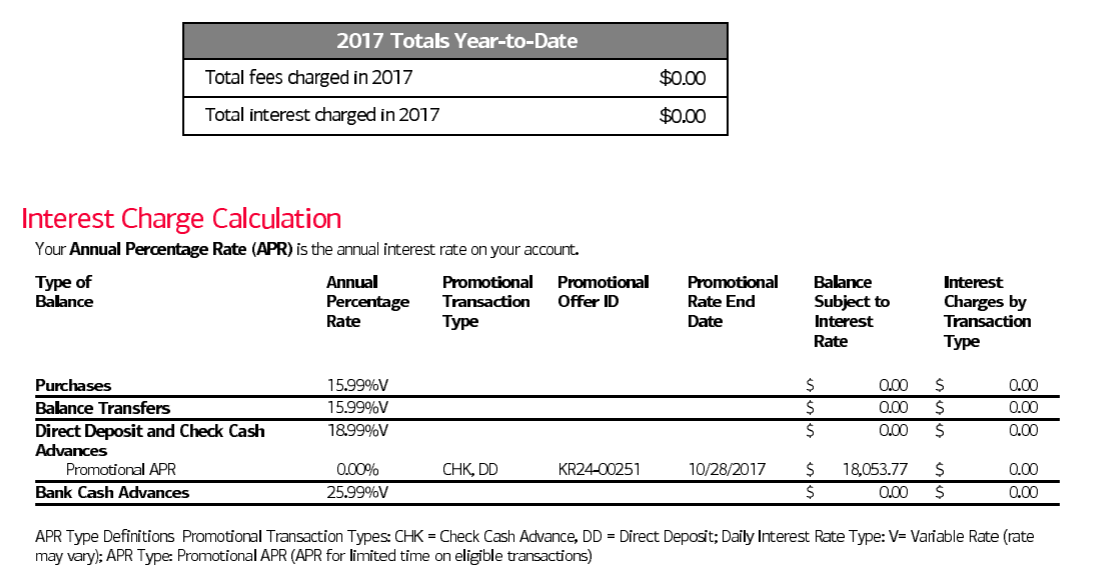

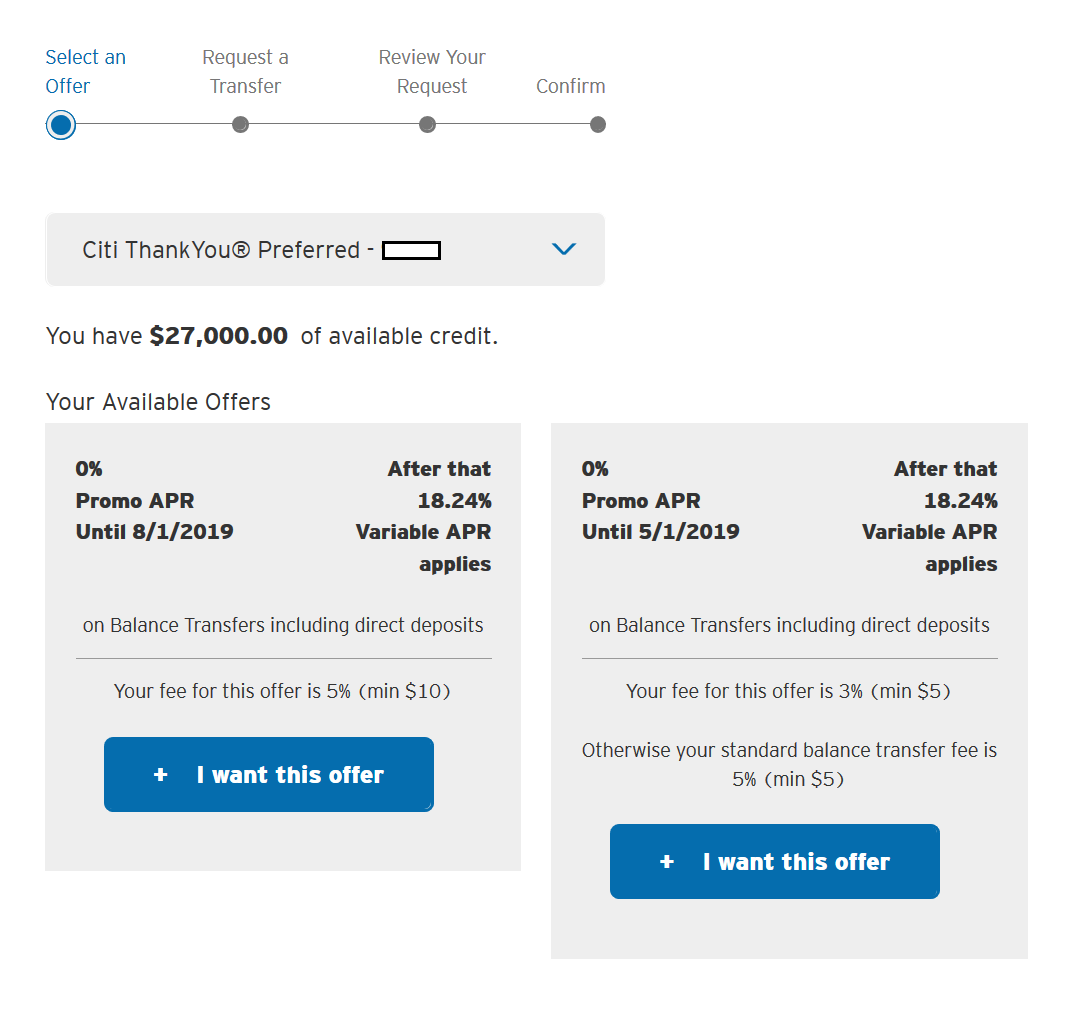

Citi

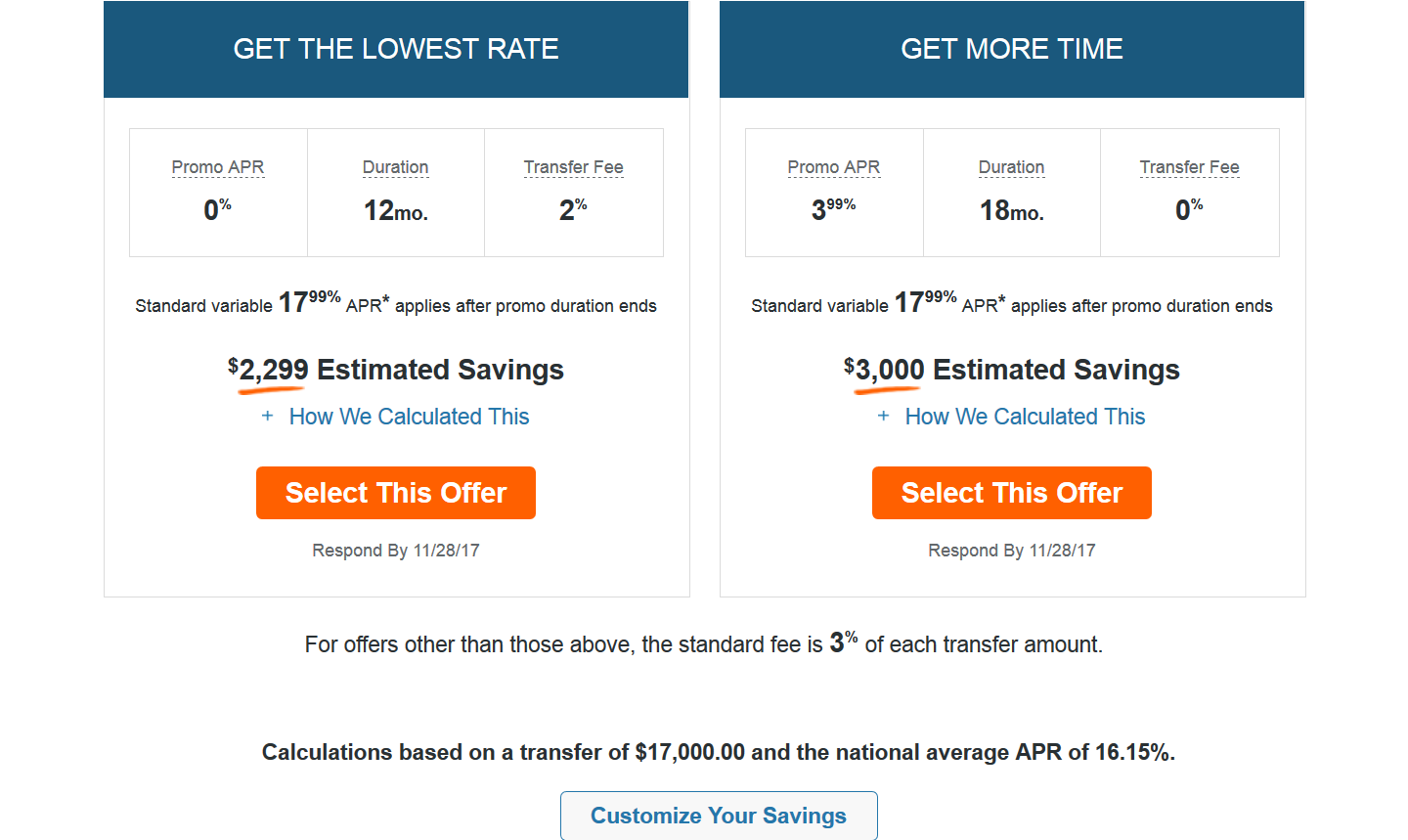

Navigate to Services → Credit Card Services → View Available Balance Transfer Offers. Select your desired offer and click Start your Transfer.

Choose Direct Deposit as the transfer option. You can only direct deposit to a bank account that’s set up for automatic payments on this card. Select Continue to finalize.

Processing time: 1-2 business days (may extend to 3-5 days if fraud alert is triggered on large amounts)

Discover

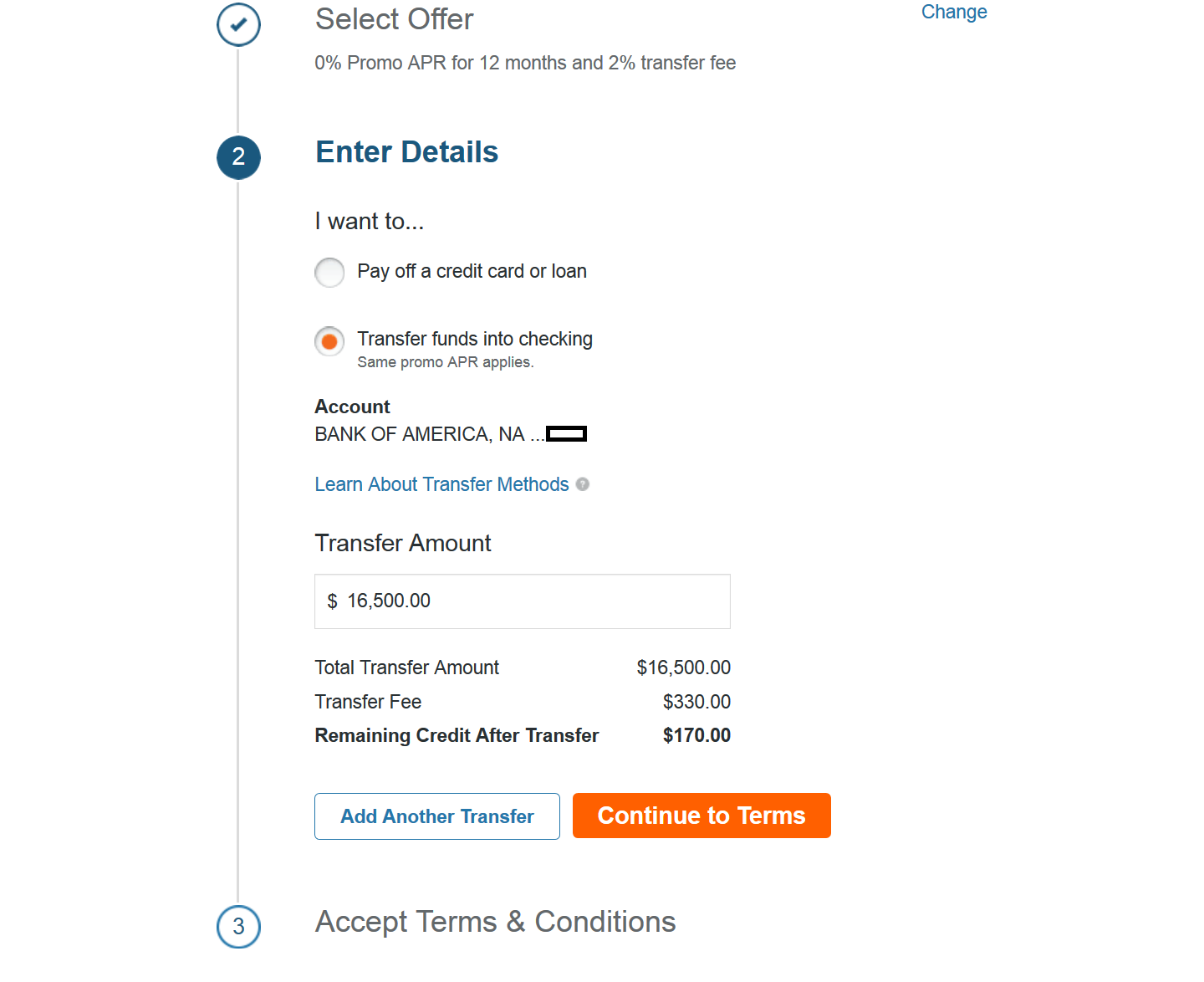

Navigate to Manage → Balance Transfer → Select This Offer

Select Transfer funds into checking. You can only direct deposit to a bank account that’s set up for automatic payments.

Processing time: 3-4 business days

Method 2: Balance Transfer Checks

Credit card companies regularly mail convenience checks that function as balance transfers. These checks can be written to yourself and deposited into your bank account.

Chase

Chase rarely sends balance transfer checks with promotional offers. When you receive one, save it—they’re valuable and infrequent.

U.S. Bank

U.S. Bank sends balance transfer checks frequently, often with competitive promotional rates. Keep all checks you receive for future campaigns.

Other Banks

Bank of America, Citi, and Discover also send balance transfer checks regularly. Since these banks offer direct deposit (which is faster), direct deposit is preferable for timing and tracking.

Method 3: Credit Balance Refunds (Not Recommended)

You can create a credit balance by overpaying your credit card using a balance transfer, then request a refund check for the overpayment amount.

Why this doesn’t work well: Large refund requests ($10,000+) often trigger fraud alerts. Banks may freeze your funds for investigation, refuse the refund, or take 3-4 weeks to process—creating costly cash drag that destroys your returns.

Alternative: Zero-Fee Balance Transfer Chain

A better approach if you have multiple cards: Create a credit balance on one card, then use a no-fee balance transfer from another card to “pay off” that balance via direct deposit to your bank account. This avoids triggering refund fraud alerts.

Example with Citi cards:

Example with Discover:

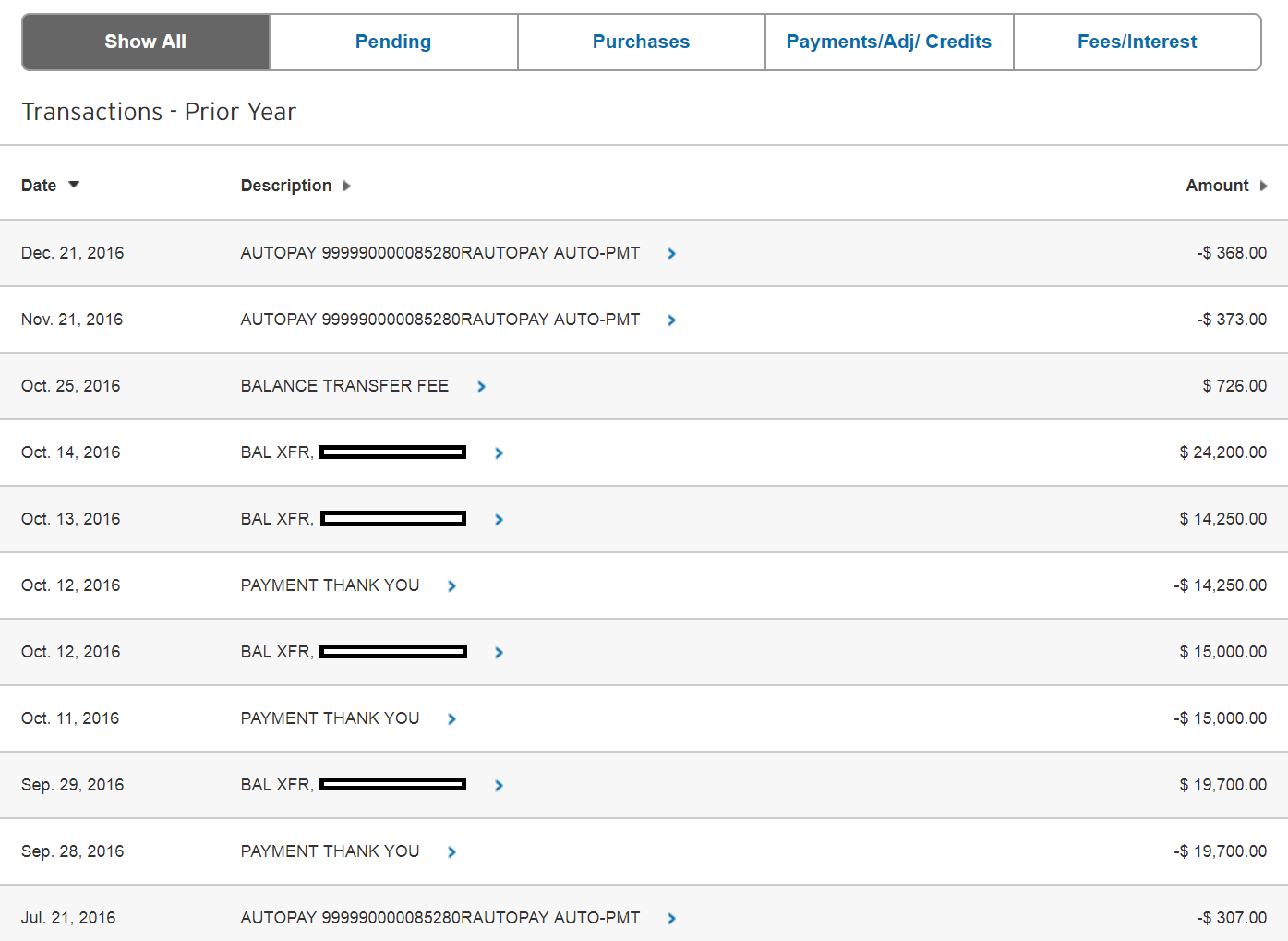

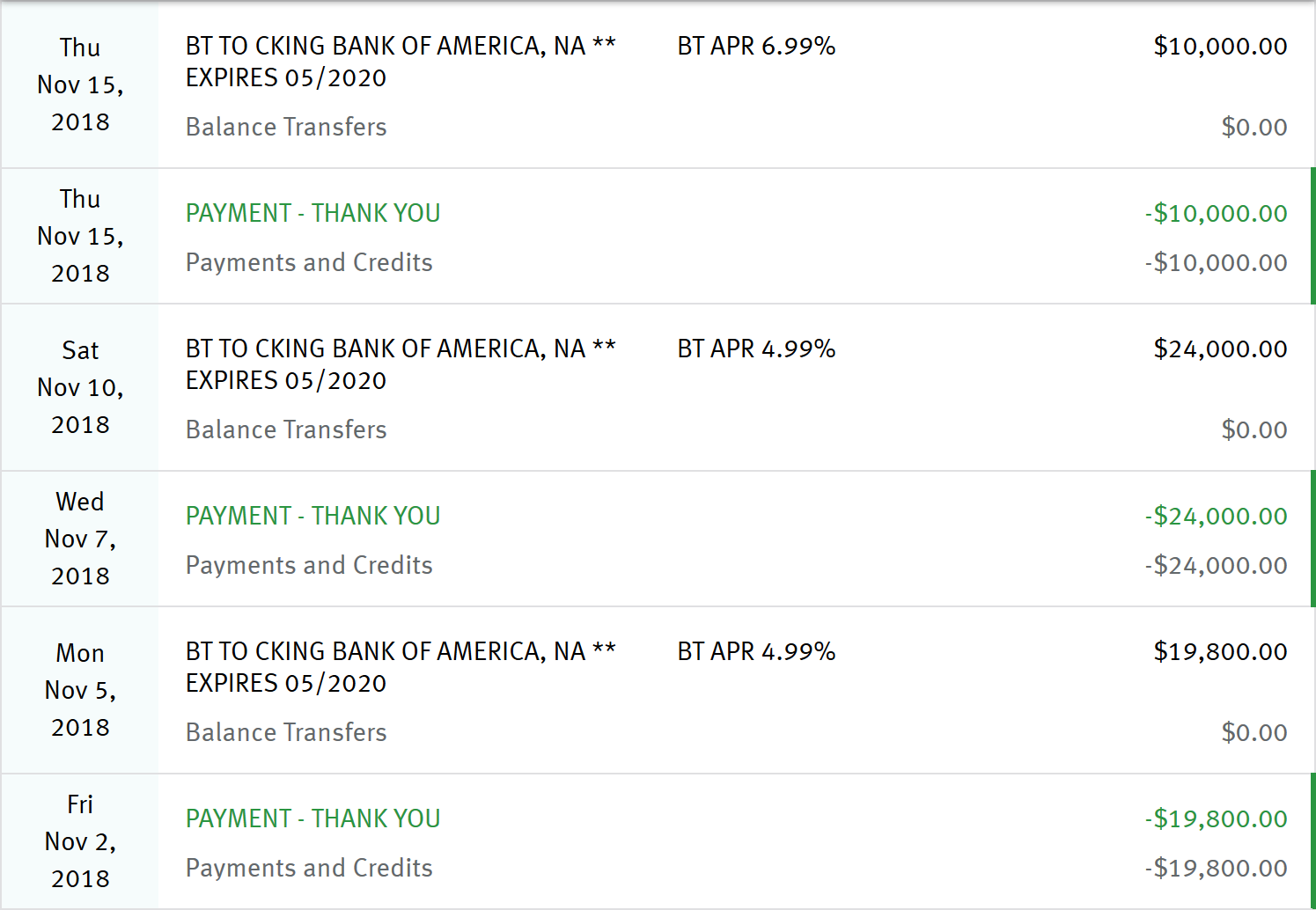

I successfully accessed over $100,000 using this zero-fee balance transfer chain method between 2016-2018.

Method 4: Balance Carry Over (Simplest)

Some cards don’t offer favorable balance transfer terms but do offer 0% APR on purchases. In these cases, use the card for regular expenses and carry the balance:

- Use the card for monthly expenses (rent, utilities, taxes, business expenses)

- Don’t pay off the balance—let it carry at 0% APR

- Invest the cash you would have spent on those expenses

- Repay before the promotional period ends

Best for: Cards with 0% APR on purchases but unfavorable balance transfer terms (e.g., American Express cards, BankAmericard Travel Rewards, Chase Ink Business Cash)

Bonus benefit: You often earn rewards points on purchases while carrying a 0% balance—effectively getting paid to borrow money.

Part 2: Advanced Technique — Cross-Account Balance Transfers

For households with multiple people willing to participate, cross-account balance transfers can dramatically expand borrowing capacity and extend promotional periods indefinitely.

How Cross-Account Transfers Work

Banks typically restrict balance transfers and direct deposits to accounts in your own name. However, most banks don’t rigorously verify account ownership during the transfer process—they primarily verify that the account exists and can receive deposits.

This creates an opportunity: you can balance transfer from your credit card to a family member’s account, and vice versa. This allows you to:

- Pool credit capacity: Access combined credit limits across household members

- Extend promotional periods: When Person A’s promotional period ends, transfer the balance to Person B’s new promotional offer

- Coordinate campaigns: Stagger applications and transfers for continuous 0% coverage

Important note: This technique worked consistently for me from 2016-2018. However, policies may have changed, and there’s always risk that a bank could flag transfers between different account holders. Start with small test amounts ($1,000-$2,000) before attempting large transfers.

Verified Cross-Account Transfer Results (2016-2018)

I successfully executed cross-account balance transfers totaling over $134,000 between family members. All transfers completed without issues:

| Source Card | Target Account | Amount | Method | Result |

|---|---|---|---|---|

| Bank of America (Person A) | Chase (Person B) | $1,000 | Balance Transfer | Success |

| Barclays (Person A) | Chase (Person B) | $1,500 | Balance Transfer | Success |

| Chase (Person B) | Citi (Person A) | $14,250 | Balance Transfer | Success |

| Chase (Person B) | Citi (Person A) | $15,000 | Balance Transfer | Success |

| Discover (Person C) | Bank of America (Person B) | $18,000 | Direct Deposit | Success |

| Chase (Person C) | Bank of America (Person A) | $11,400 | Balance Transfer | Success |

| U.S. Bank (Person A) | Bank of America (Person B) | $17,000 | Balance Transfer | Success |

| Alliant Credit Union (Person A) | Bank of America (Person B) | $16,000 | Balance Transfer | Success |

| U.S. Bank (Person C) | Alliant Credit Union (Person A) | $16,541 | Balance Transfer | Success |

| Discover (Person C) | Bank of America (Person B) | $23,700 | Direct Deposit | Success |

| Total | $134,391 | 100% success rate | ||

Person A, B, and C represent different family members. All transfers completed successfully with no rejections or fraud holds.

When Cross-Account Transfers Make Sense

This advanced technique is most valuable when:

- Multiple household members each have $100,000+ in available credit

- You’re investing in longer-term opportunities (2-5 years) like real estate debt or litigation finance

- You want to extend promotional periods indefinitely by rotating balances between participants

- You need to access more capital than any single person’s credit limit allows

Example scenario: Person A has $150K available at 0% for 15 months. Person B has $150K available at 0% for 18 months. By rotating balances between accounts as promotional periods expire, you can maintain continuous 0% coverage on $300K for years.

Part 3: Where to Invest for Double-Digit Returns

Once you’ve accessed capital from credit cards, the next challenge is deploying it profitably. The key principle: match investment duration to your promotional period. Never invest in illiquid assets that extend beyond your promotional window.

Investment Vehicles I Used (2015-2018)

Historical context: The following platforms and opportunities were available during my active arbitrage period (2015-2018). Some platforms have since changed, consolidated, or closed. Investment landscapes evolve—research current opportunities rather than assuming these remain available with the same terms.

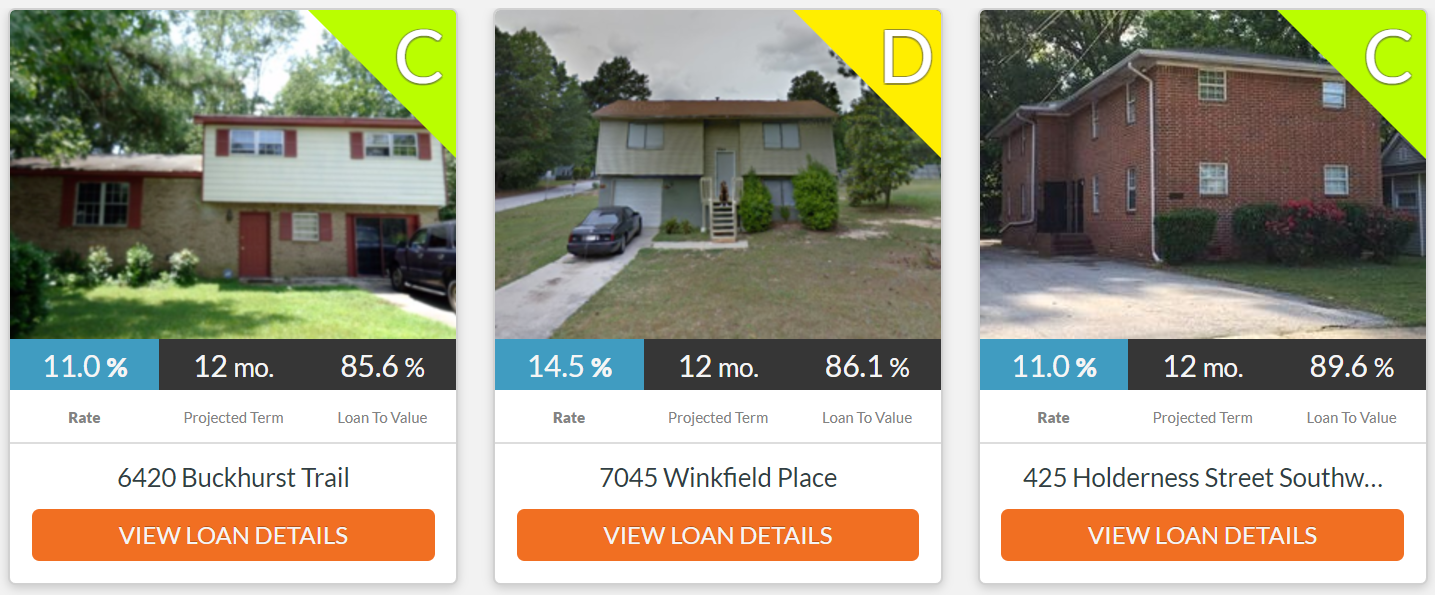

Groundfloor — Real Estate Fix-and-Flip Loans

Accreditation: Open to all investors

Minimum: $10 per loan

Terms: 6-12 months

Target Returns: 11-14.5% depending on risk grade

Groundfloor is a real estate lending marketplace for short-term fix-and-flip loans. I targeted Grade C (11%) or Grade D (14.5%) loans with terms under 12 months to align with promotional periods.

My results: $40,270 invested across 13 loans, $39,940 returned, 3.58% IRR (2 defaults impacted returns)

Platform status: Still operating as of 2025

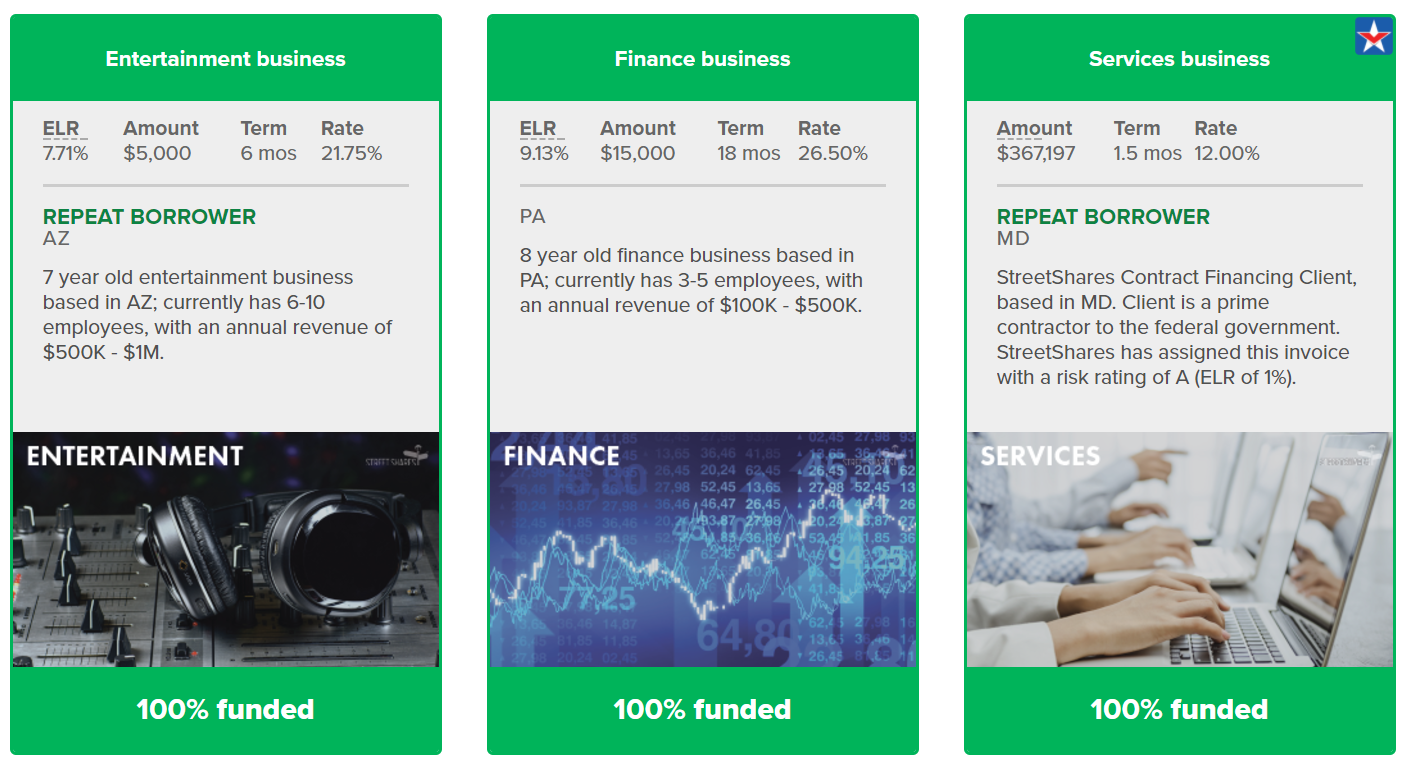

StreetShares — Veteran Small Business Loans

Accreditation: Investor self-certification (online attestation)

Minimum: $25 per loan

Terms: 3-12 months

Target Returns: 10-15%

StreetShares offered term loans and government contract financing to veteran-owned small businesses. The government contract financing product was particularly attractive: short-term, secured by federal contracts, and high-yield.

Platform status: StreetShares ceased operations in 2020

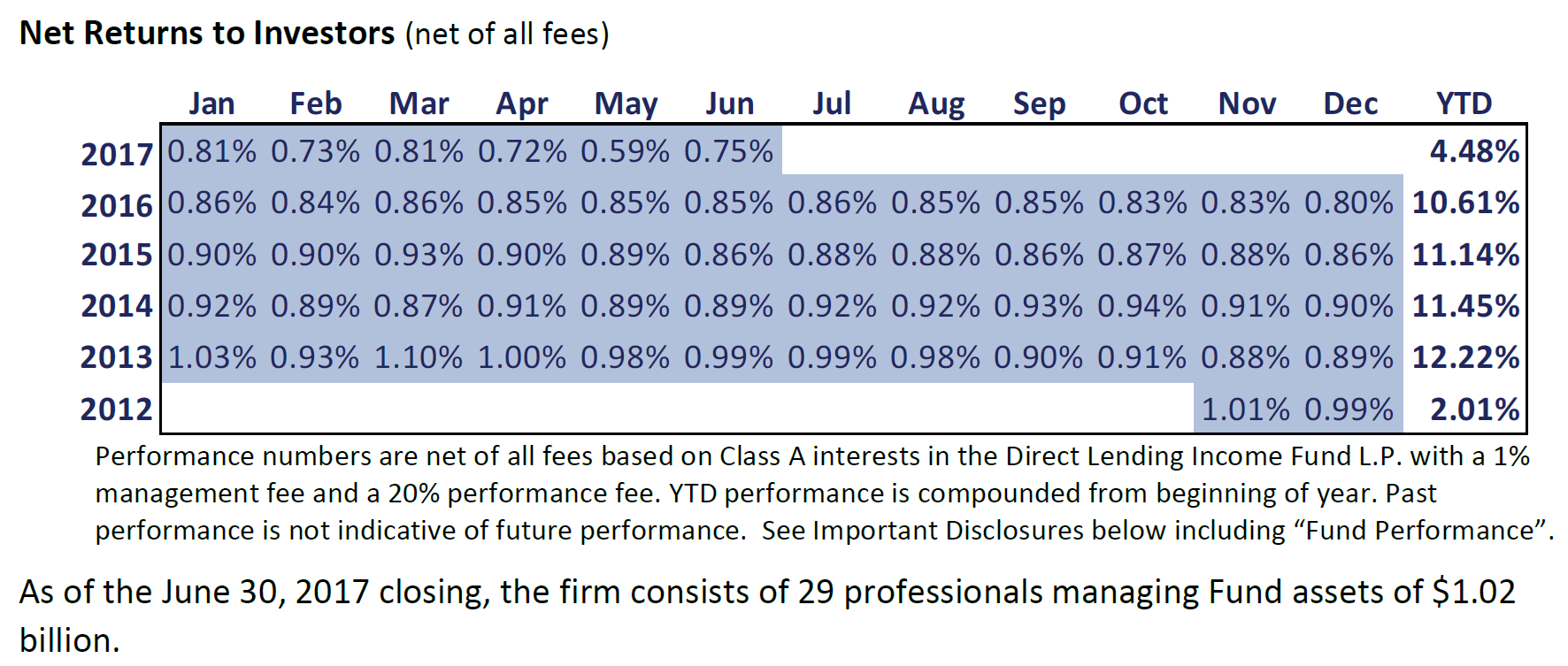

Direct Lending Income Fund (DLIF)

Accreditation: Accredited investors only

Minimum: $100,000

Terms: Open-ended with quarterly redemptions

Target Returns: 9-11%

This fund invested in diversified small business loans, functioning as a higher-yield alternative to savings accounts. Quarterly redemption windows provided acceptable liquidity for 15-18 month promotional periods.

My results: $710,000 invested, $835,501 returned, 10.03% IRR

Platform status: DLIF operations status unclear as of 2025

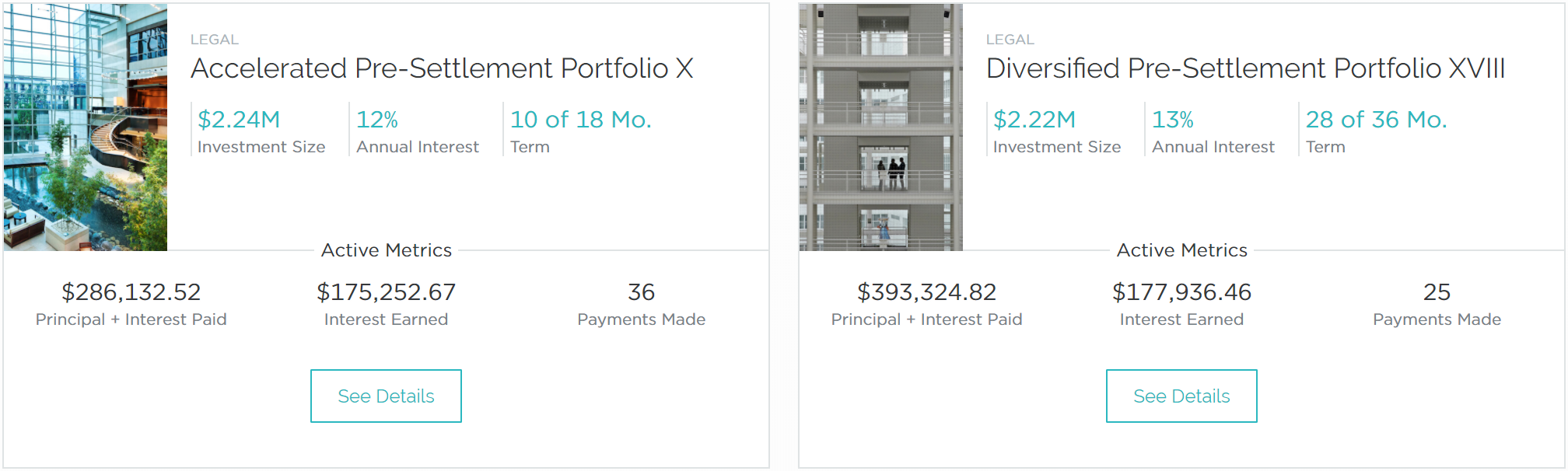

YieldStreet — Litigation Finance and Short-Term Debt

Accreditation: Accredited investors (self-certification available at the time)

Minimum: $5,000-$50,000 depending on offering

Terms: 12-48 months

Target Returns: 10-18%

YieldStreet offered short-term small business financing, litigation finance portfolios, and real estate debt. Multi-year litigation portfolios were ideal for extended promotional periods achieved through cross-account transfers.

My results: $320,000 invested across multiple offerings, $376,281 returned, mixed results (one significant default offset by several strong performers)

Platform status: YieldStreet rebranded to Willow Wealth in 2025. See my analysis: The $208M Rebrand: YieldStreet Becomes Willow Wealth

LendingClub — Peer-to-Peer Consumer Loans

Accreditation: Open to all investors

Minimum: $25 per loan

Terms: 36-60 months

Target Returns: 5-8%

LendingClub pioneered peer-to-peer lending for consumer loans. While returns were lower than other options, the platform offered easy diversification across hundreds of loans.

My results: $349,475 invested, $373,288 returned, 5.25% IRR

Platform status: LendingClub ceased peer-to-peer lending operations and converted to a traditional bank in 2020

Key Investment Principles

- Match duration to promotional period: Never invest in assets you can’t liquidate before 0% expires

- Diversify within the strategy: Spread funds across multiple loans/investments to mitigate individual defaults

- Maintain liquidity buffer: Keep 10-15% in liquid reserves for unexpected repayment needs

- Target 10%+ returns: Lower returns don’t justify the operational complexity and risk

- Avoid stock market exposure: Market volatility could force you to liquidate at a loss before promotional periods end

Modern Investment Options (2025)

The alternative investment landscape has changed significantly since 2018:

- Higher baseline savings rates: Online savings accounts now yield ~4% (vs. ~2% in 2018), making the spread more attractive if you can find no-fee offers

- Platform consolidation: Many marketplace lending platforms closed (LendingClub, StreetShares) or consolidated

- Evolved opportunities: New platforms emerged while others exited—research current options rather than relying on 2015-2018 recommendations

- Regulatory changes: Increased scrutiny on some alternative lending platforms has changed the risk-return profile

Bottom line: The fundamental arbitrage opportunity remains viable, but specific platforms and vehicles require current research. Focus on the principles (duration matching, diversification, 10%+ targets) rather than specific platforms from my 2015-2018 campaigns.

Part 4: Essential Tracking and Risk Management

The Critical Tracking Spreadsheet

Credit card arbitrage requires meticulous tracking. A single missed payment terminates your 0% APR and triggers penalty rates (25%+), instantly destroying months of profit. I maintained a detailed spreadsheet with these columns:

- Card name and last 4 digits

- Balance transfer amount and date

- Promotional APR and fee

- Promotional period end date

- Minimum payment amount and due date

- Investment vehicle and expected return

- Repayment deadline (60 days before promo ends)

- Current balance and interest charges (should always be $0)

Automated Payment Strategy

Set up automatic minimum payments for every card, without exception. Then manually make additional payments as needed. This two-layer approach ensures you never miss a payment even if you’re traveling, sick, or distracted.

Critical rule: Autopay is your insurance policy. Always maintain it, even when making manual payments.

Calendar Reminders

Set calendar alerts at multiple checkpoints:

- 90 days before promotional period ends: Begin monitoring investment liquidity and performance

- 60 days before: Begin liquidating investments if needed for repayment

- 30 days before: All funds should be liquid and ready to repay

- 15 days before: Execute repayment

Risk Management Rules

- Never invest in illiquid assets: If you can’t withdraw within 30 days, don’t use credit card funding

- Maintain emergency liquidity: Keep 10-15% buffer in liquid reserves separate from arbitrage capital

- Test small first: Start with $10,000-$25,000 to validate your systems before scaling to $100K+

- Account for all fees: Calculate effective borrowing cost including balance transfer fees

- Plan for defaults: In alternative investments, expect 5-10% default rates—diversify accordingly

- Build safety margins: Target 15%+ returns when borrowing costs are 3%, providing cushion for defaults

Summary: The Complete Process

-

Build Credit Infrastructure

Develop $100,000+ in available credit through strategic applications over 2-3 years. See credit building guide if starting from low limits. -

Secure Promotional Offers

Apply for 0% APR balance transfer offers with no fees (ideal) or 3% fees (acceptable). Use Doctor of Credit’s list to find current offers. -

Access Cash

Use direct deposit (1-8 days) or balance transfer checks to convert credit to liquid funds. Direct deposit is faster and easier to track. -

Deploy Capital Strategically

Invest in alternatives yielding 10%+ returns. Match investment duration to promotional period—never invest in assets you can’t liquidate before 0% expires. -

Track Meticulously

Monitor minimum payments, promotional end dates, and investment performance. Automate minimum payments and maintain detailed spreadsheets. One missed payment destroys all profit. -

Repay With Safety Buffer

Liquidate investments and repay balances 60 days before promotional period expires. This buffer protects against liquidity delays or unexpected complications.

Is It Worth It?

Credit card arbitrage can generate $20,000-$30,000+ annually with $200,000-$300,000 in credit capacity. However, it requires:

- 20-30 hours of setup per campaign

- Ongoing monthly tracking and payment management

- Strong organizational discipline and attention to detail

- Tolerance for credit score volatility (30-50 point temporary drops)

- Access to appropriate investment vehicles earning double-digit returns

My verdict: If you already have the credit infrastructure ($100K+ available) and investment knowledge, the strategy generates attractive risk-adjusted returns for the effort involved. If you’re building from scratch solely for this strategy, the complexity may not be worth it in 2025—especially with higher baseline savings rates (~4%) making simpler strategies more attractive.

For my personal results across four arbitrage campaigns generating $82,906 in profits, see Credit Card Arbitrage (summary) and the individual round breakdowns for detailed execution examples.

Last updated: February 2026

Wow, very helpful!! Thank you so much for taking the time and effort to explain some of the basics here. Obviously one must be EXTREMELY disciplined and ensure that you never miss one payment, as that will ruin your credit score, and eliminate your ability to keep building credit and getting more money. This is all very fascinating. Thank You!

Update: I have raised $55,000 in credit limits so far. I am however struggling with how to turn these credit limits into cash in my bank account. I don’t have a citi card yet, my application process has been delayed. I have: 3 BOA, 2 chase, 2 Barclaycard, 1 Discover, 1 Alliant, and 1 Capital One. BOA balance transfers seem easy to get into your checking account. Any suggestions for how to complete the rest? Thanks for any help!