Backstory

I made a prior-year contribution to my traditional IRA in January, thinking that contribution would be tax deductible. Unfortunately that was not the case. An issue came up as the non-deductible IRA contribution was already fully invested in my LendingClub IRA account. I ended up having to liquidate notes to execute a backdoor Roth IRA conversion.

Steps

- Liquidate notes on the LendingClub trading platform

- Move funds from the LendingClub Traditional IRA to the Self Directed IRA

- Close the LendingClub Traditional IRA

- Convert from a Traditional IRA to a Roth IRA

- Move funds from the Self Directed IRA to the LendingClub Roth IRA

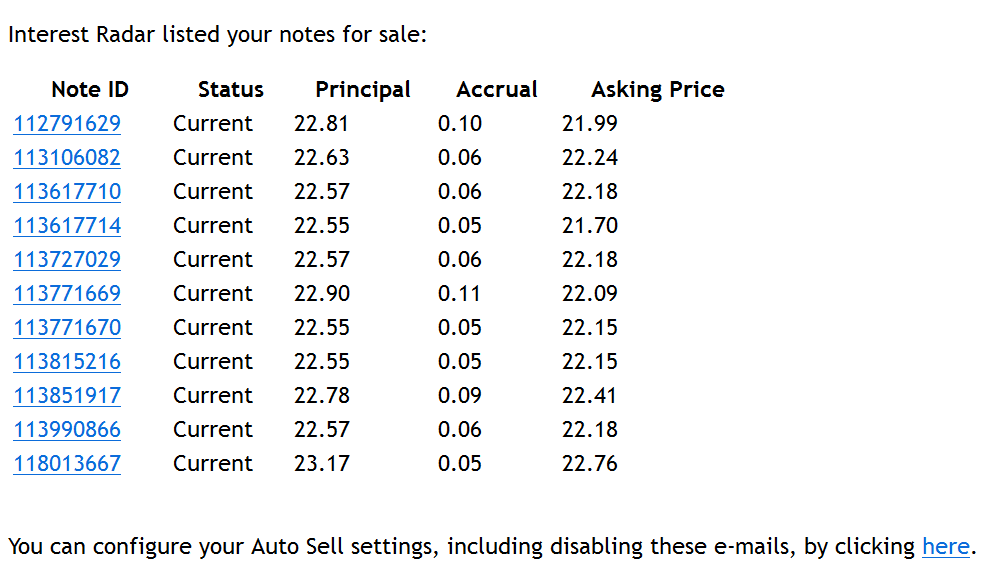

Step 1 – Sell Notes

Liquidate your holdings by listing notes on the secondary market. Issued and Current notes are easy to sell. You will have to lower the markup to liquidate faster.

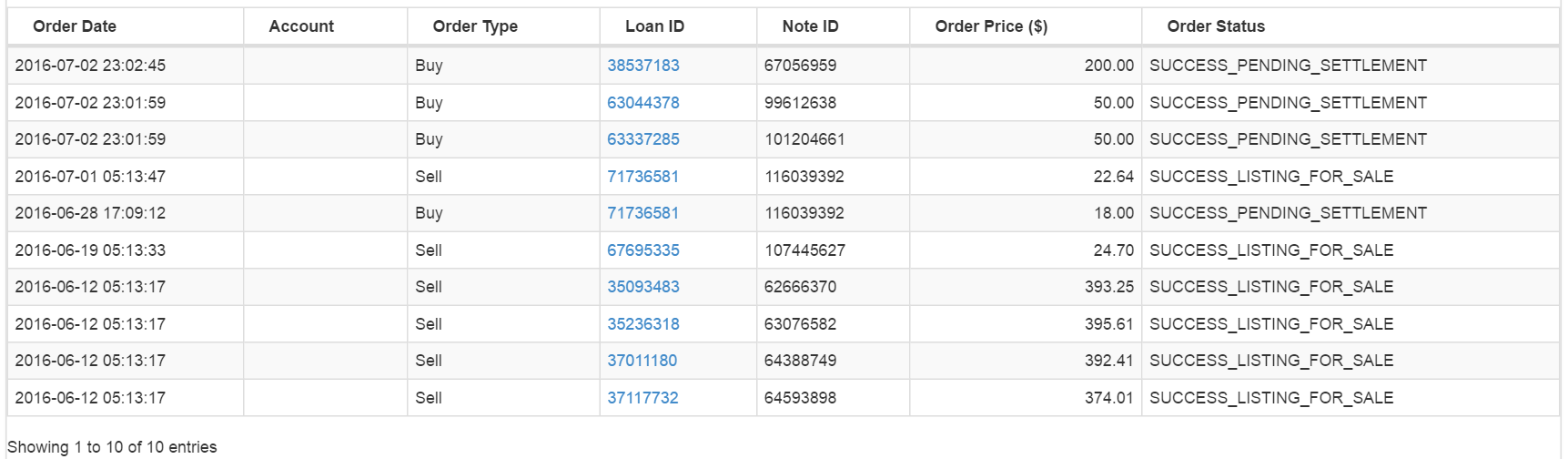

Step 2 – Transfer Unsold Notes

In Grace-Period and Late notes are hard to sell. If you have multiple accounts, transfer them to your other account. You can also use a third-party service such as PeerCube. Minimum Markup strategy is your friend.

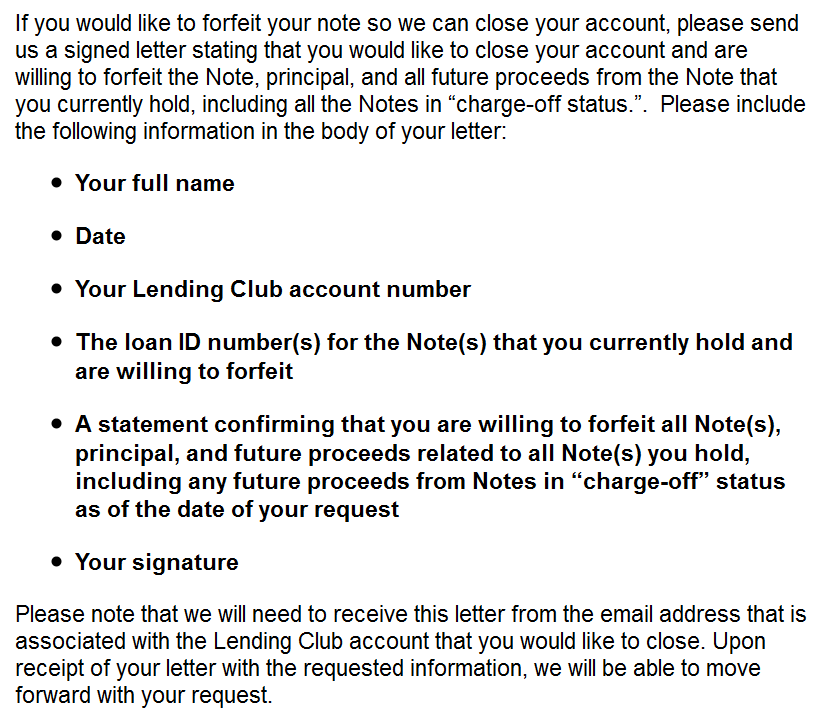

You can also submit a letter to forfeit all remaining notes in your account if you are unable to liquidate all notes. You need to send from the email address that is associated with the LendingClub account that you want to close.

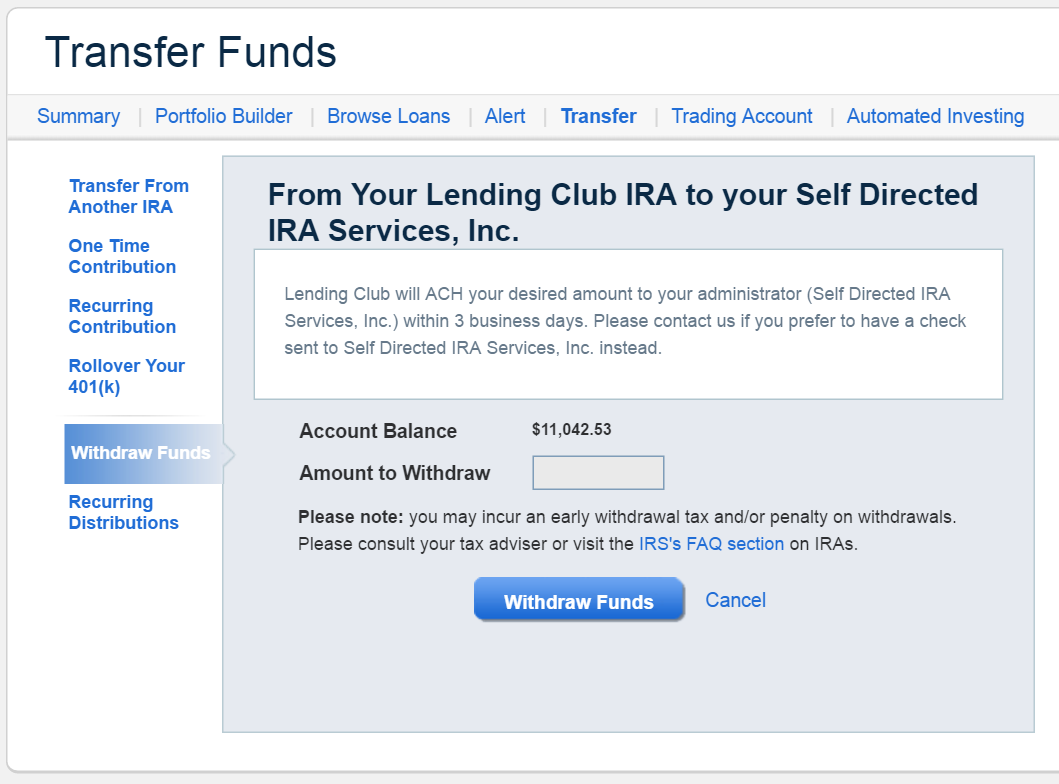

Step 3 – Withdraw Funds

After your account has been liquidated, transfer fund from your LendingClub IRA to your Self Directed IRA. It took 2 business days to withdraw.

Step 4 – Close a LendingClub Traditional IRA

Submit an account cancellation request to LendingClub. My account was closed the next business day.

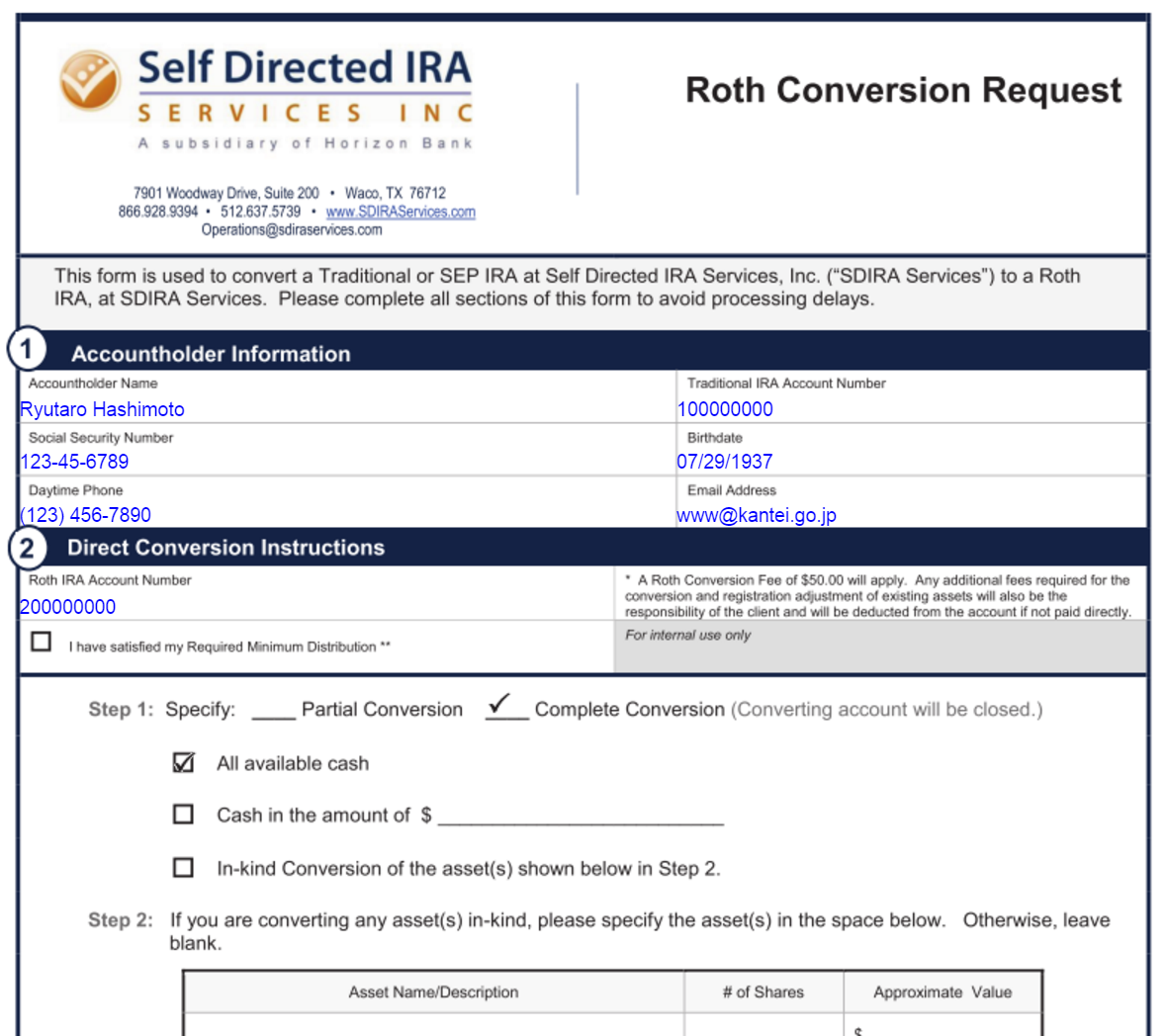

Step 5 – Backdoor Roth IRA Conversion

Submit a ROTH Conversion Request to Self Directed IRA to convert from a Traditional IRA to a Roth IRA. It took 5 business days to complete.

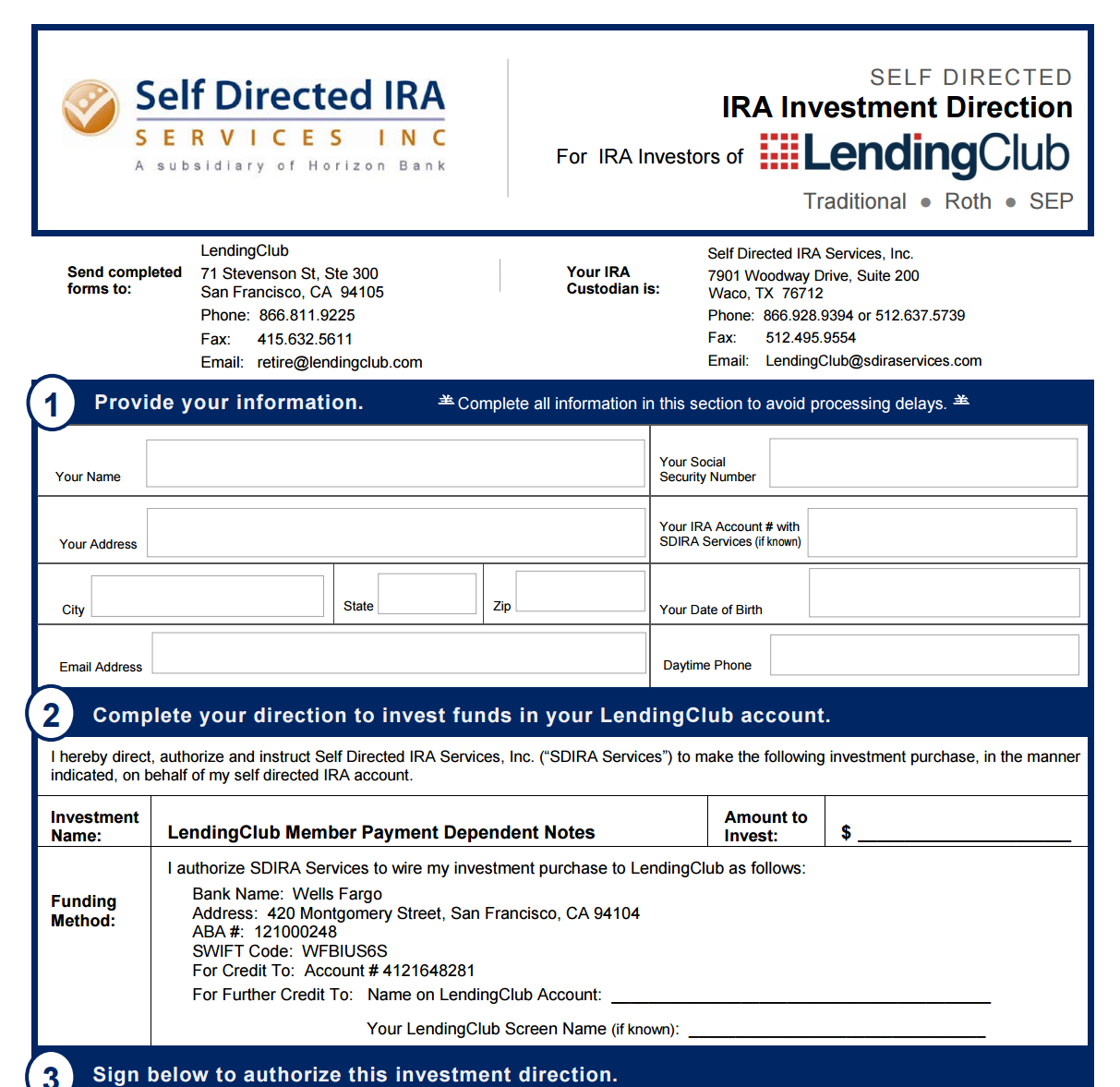

Step 6 – Transfer Funds to a LendingClub Roth IRA

Submit an IRA Investment Direction to Self Directed IRA to transfer funds to LendingClub Roth IRA. Your request will be processed same day if you scan and email the form directly to operations@sdiraservices.com.